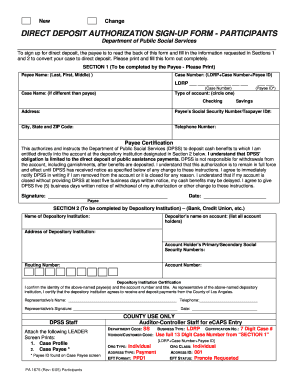

Who Needs a QR-7 Report Form?

General Relief Quarterly Report Form (QR-7 Report Form) is used by people who require a Cash Aid and Food Stamps.

What is a QR-7 Report Form Used for?

This is NOT a Form for applying for Cash Aid and Food Stamps! A QR-7 Report Form is used to confirm the circumstances giving the right to receive Cash Aid and Food Stamps. Each quarter this form is filled out and filed to prove that applicant still requires and aid. This form is also used to request to stop benefits.

Is a QR-7 Report Form Accompanied by Other Forms?

Whenever you give a positive answers you should attach the proofs. If nothing has changed from the last report the QR-7 Report Form is not accompanied by other forms.

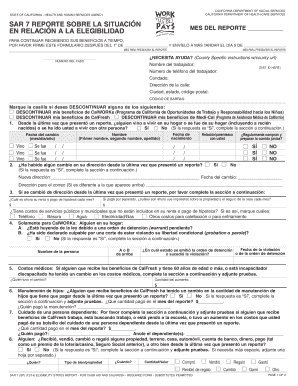

What Information Should Be Provided in QR-7 Report Form?

First you should mention to submit month. There is also a field for your address, so you can get the submitted form back. Whether you are applying to stop the benefits you should give the reason for this action. In Part 2 you should give an information about your habitation. There are other fields to be filled in concerning changes happened to anyone in your home including family change, disability, work, address change etc. A QR-7 Report Form should be signed by the applicant of the bottom of the last page

When is QR-7 Report Form due?

A QR-7 Report Form is filled and filed once every three month (quarter). The Country will tell you when you are supposed to turn in your completed QR-7. It is signed after the 1st and returned after the 5th days of the submit month. QR-7 should be received before the 11th of the submit month to be considered not late.

Where do I send a QR-7 Report Form?

This Form is filed to the Department of public social services in your country.