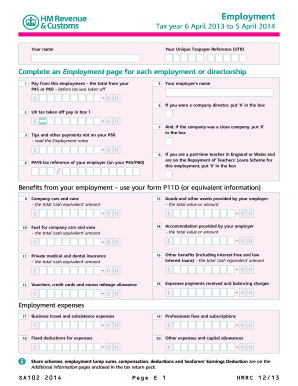

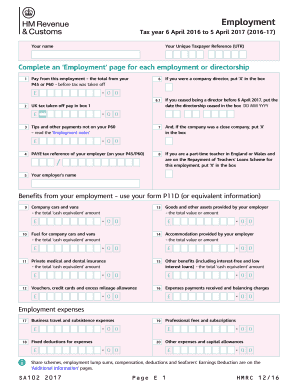

UK HMRC P87 2014 free printable template

Show details

Hmrc.gov.uk/online You must fill in a separate P87 for each employment for which you are claiming. For all claims make sure that you tell us the year of claim fill in section 1 and sign and date the declaration at section 10. Hmrc.gov.uk/flatexpenses Expenses claimed in section 2 P87 Page 1 HMRC 01/14 3 ehicles and expenses of using your own vehicle for work V You can request tax relief for expenses if you use your own car van or motorcycle for business mileage. Tax relief for expenses of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign p87 form hmrc

Edit your p87 claim form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your p87 form online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form p87 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit p87 hmrc login form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC P87 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hmrc p87 form

How to fill out UK HMRC P87

01

Gather all relevant information including employment details and expenses incurred.

02

Obtain the P87 form from the HMRC website or request a paper form.

03

Fill in personal information such as your name, address, National Insurance number, and tax reference number.

04

Provide details of your employment including the name of your employer and your job title.

05

List all allowable expenses related to your job, including travel costs, uniforms, and professional fees.

06

Calculate the total amount of expenses and subtract this from your total income to determine your tax relief.

07

Sign and date the form to confirm that the information is true and correct.

08

Submit the form to HMRC via post or online through your personal tax account.

Who needs UK HMRC P87?

01

Employees who incur work-related expenses that are not reimbursed by their employer.

02

Self-employed individuals claiming expenses related to their business.

03

Workers seeking to claim back tax deductions for allowable expenses.

Fill

p87

: Try Risk Free

What is p87 form?

If you're an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due. ... You must fill in a separate P87 for each employment for which you are claiming. If you have not paid any tax during the year no refund will be due.

People Also Ask about mileage form any

Can I get tax refund if I leave UK?

You can claim tax for the last six years even if you have been out of the country for part of that financial year. As long as you've completed a self-assessment tax return for the financial year, there's a chance that you could be owed a tax rebate.

Can I claim tax refund from previous years UK?

What are the time limits for claiming back tax? You have four years from the end of the tax year in which the overpayment arose to claim a refund, as shown below. If a claim is not made within the time limit you will lose out on any refund that may be due and the tax year becomes 'closed' to claims.

Can you reclaim NI?

If you overpay NIC or pay NIC incorrectly, you can claim a refund. You cannot claim a refund of NIC simply because you stop work or do not work for the whole tax year.

How to fill out a P87 tax form?

How to Use The P87 HMRC Form Your National Insurance Number. Your employee number (which you can find on your payslip) Your employer's PAYE number (this is also on your payslip) The receipts and records of your allowable expenses. Any records or receipts of your employer's contributions to your expenses.

How do I claim tax back from UK after leaving?

If you've already left the UK, fill in form P85 online. If you haven't already left the UK, download and fill in form P85 offline. Include Parts 2 and 3 of your P45 form - get these from your employer (or Jobcentre Plus if you've been claiming Jobseeker's Allowance).

Can I get my national insurance money back if I leave UK?

Can I get a refund of National Insurance contributions (NIC) paid in the UK? It is not usually possible to get a refund of NIC, but it might be possible to have them taken into account when determining eligibility for state benefits in another country.

How does tax relief work?

Claiming tax relief means you can either: reclaim tax in the form of a tax rebate from past tax years. pay less tax in the future by claiming tax relief on things you pay for to do your job.

How many years back can I claim mileage?

How far back can I make a claim? HMRC allow taxpayers to make claims for the last four tax years. If you don't claim within that timescale you will miss out on what you are owed.

How far back can you make a claim to HMRC?

You must claim within 4 years of the end of the tax year that you spent the money. If your claim is for the current tax year, HM Revenue and Customs ( HMRC ) will usually make any adjustments needed through your tax code.

Is UK National Insurance refundable?

National Insurance refunds You can claim back any overpaid National Insurance.

How far back can you claim P87?

You have four years from the end of the tax year to make a claim; so, for 2022/23, you must make a claim by 5 April 2027. As we are in 2022/23, you can make a claim going back to the 2018/19 tax year.

What is a P87 form for?

Claim Income Tax relief for your employment expenses (P87)

What does P87 mean?

A P87 is the code for the form 'Tax Relief for Expenses of Employment' and can be used to claim tax relief on work related expenses. The form should only be used by employed taxpayers under PAYE and not by the self employed who complete a tax return.

How many years can you go back to claim mileage?

How far back can I make a claim? HMRC allow taxpayers to make claims for the last four tax years. If you don't claim within that timescale you will miss out on what you are owed.

Who can claim P87 form?

You can only claim your tax rebates with a P87 if you're an employee. If you're self-employed, you tell HMRC about your expenses through the Self-Assessment system. You also have to use Self Assessment if you have work expenses of over £2,500 to claim for in one year.

How much tax can you claim back when leaving the UK?

It is common for people who are leaving the UK to only be due a repayment of income tax from the tax year in which they leave. In these circumstances you should be entitled to the difference between the tax you did pay in that tax year and the figure you would have paid if you worked for the full year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit p87 form download from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your form p87 guidance notes into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute form p87 download online?

With pdfFiller, you may easily complete and sign online form p87 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit p87 form hmrc download on an Android device?

With the pdfFiller Android app, you can edit, sign, and share hmrc p87 claim on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is UK HMRC P87?

UK HMRC P87 is a form used by employees to claim tax relief on expenses incurred in the course of their employment, such as work-related travel costs and other necessary expenses.

Who is required to file UK HMRC P87?

Employees who have incurred work-related expenses and wish to claim tax relief for those expenses are required to file UK HMRC P87.

How to fill out UK HMRC P87?

To fill out UK HMRC P87, individuals should provide personal details, details of their employment, information about the expenses they wish to claim, and any other supporting information required.

What is the purpose of UK HMRC P87?

The purpose of UK HMRC P87 is to allow employees to claim back tax relief on necessary expenses that are not reimbursed by their employer.

What information must be reported on UK HMRC P87?

The information that must be reported on UK HMRC P87 includes the employee's personal details, employment details, a breakdown of the expenses claimed, and any supporting documentation.

Fill out your p87 form 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

p87 Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to p87 form download pdf

Related to p87 hmrc pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.