CA SB-13100 2014-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

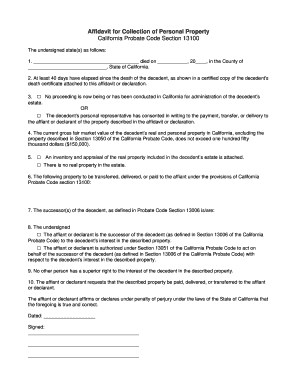

Edit and sign in one place

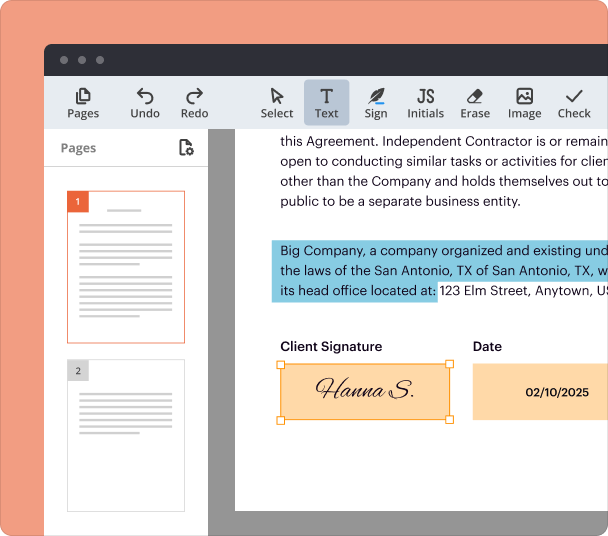

Create professional forms

Simplify data collection

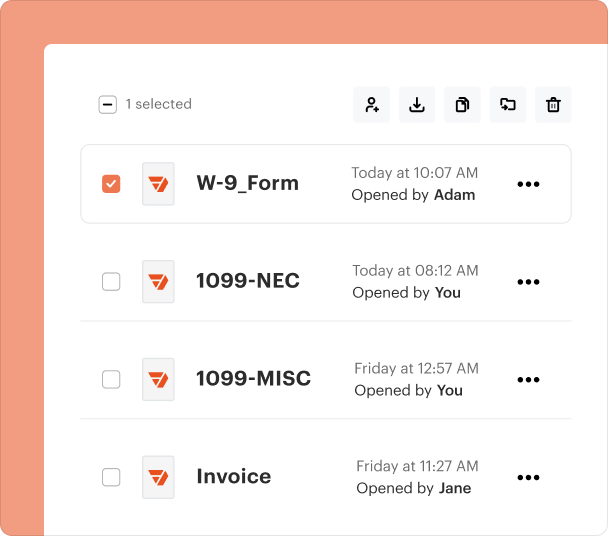

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

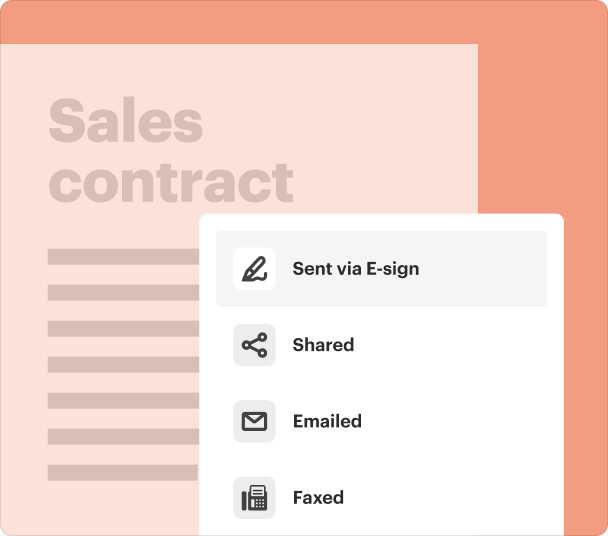

Comprehensive Guide to Completing the CA SB-13100 Form

What is the CA SB-13100 form?

The CA SB-13100 form serves as a personal property transfer affidavit, crucial for ensuring the proper transfer of assets in compliance with California’s Probate Code. Individuals are required to use this form when they need to manage a decedent's estate, particularly when there is no will present. Understanding its importance can streamline the probate process, making it essential for heirs.

What are the key components of the CA SB-13100 form?

-

Including full name, date of death, and residency to verify the validation of the claim.

-

A certified copy of the death certificate is necessary to substantiate the affidavit.

-

Clarifies the absence of a will and the appropriate handling of estate matters.

-

The estimated current value of the property ensures transparency in the transfer process.

How do you complete the CA SB-13100 form step-by-step?

Filling out the CA SB-13100 form accurately is essential to avoid delays. Start by entering the decedent's personal details clearly to avoid ambiguity. Describe the property to be transferred with precision, ensuring that it is easily understood. It is also important to declare your relationship to the decedent correctly and to sign and date the affidavit, acknowledging that all provided information is true under penalty of perjury.

How can pdfFiller help manage your CA SB-13100 form?

-

pdfFiller provides intuitive tools that help streamline the process of editing the form, enabling easy corrections and adjustments.

-

Use pdfFiller to electronically sign your CA SB-13100, making it simple to share documents securely with relevant parties.

-

Teams can work together effectively on probate cases, sharing the form and facilitating real-time updates.

What are common pitfalls and important considerations regarding the CA SB-13100 form?

Understanding common mistakes can significantly ease the filing process. Many individuals overlook the accuracy needed when filling in the decedent's information, which can lead to denials. It's crucial to ask questions during the filing process to clarify any requirements, especially relating to property rights and potential disputes.

What legal considerations should you keep in mind?

-

The CA SB-13100 form operates under specific guidelines outlined in the California Probate Code, ensuring compliance with state laws.

-

Incorrect filings may lead to significant legal issues, including the potential for the estate to face scrutiny from the courts.

-

Carefully reviewing all filing requirements helps prevent mistakes that could result in legal penalties.

Where can you find resources for further assistance?

Accessing reliable resources can simplify the management of probate matters. California state resources offer a wealth of information, while legal aid organizations can provide direct assistance. Additionally, pdfFiller supports document management with various tools that can enhance your experience with the CA SB-13100 form.

Frequently Asked Questions about small estate affidavit california form

What happens if I do not file the CA SB-13100 form?

Failure to file the CA SB-13100 form when required can lead to delays in transferring property and potentially result in legal complications. Courts may not recognize the transfer of assets without this affidavit, impacting the rights of heirs.

Can I fill out the CA SB-13100 form online?

Yes, you can fill out the CA SB-13100 form online using platforms like pdfFiller. These tools streamline the completion process and allow for easy editing and electronic signing.

Are there fees associated with filing the CA SB-13100 form?

There may be a nominal fee depending on the county in California where you submit the form. It's essential to check with local regulations to understand any costs involved.

How do I obtain a certified copy of the death certificate?

You can obtain a certified copy of a death certificate from the county clerk's office where the death was recorded. This can often be done online or through a mail request.

Who can assist me in filling out the CA SB-13100 form?

Professional legal aid providers or online services such as pdfFiller can provide guidance in filling out the CA SB-13100 form to ensure accuracy and compliance with regulations.

pdfFiller scores top ratings on review platforms