Get the free pdffiller

Show details

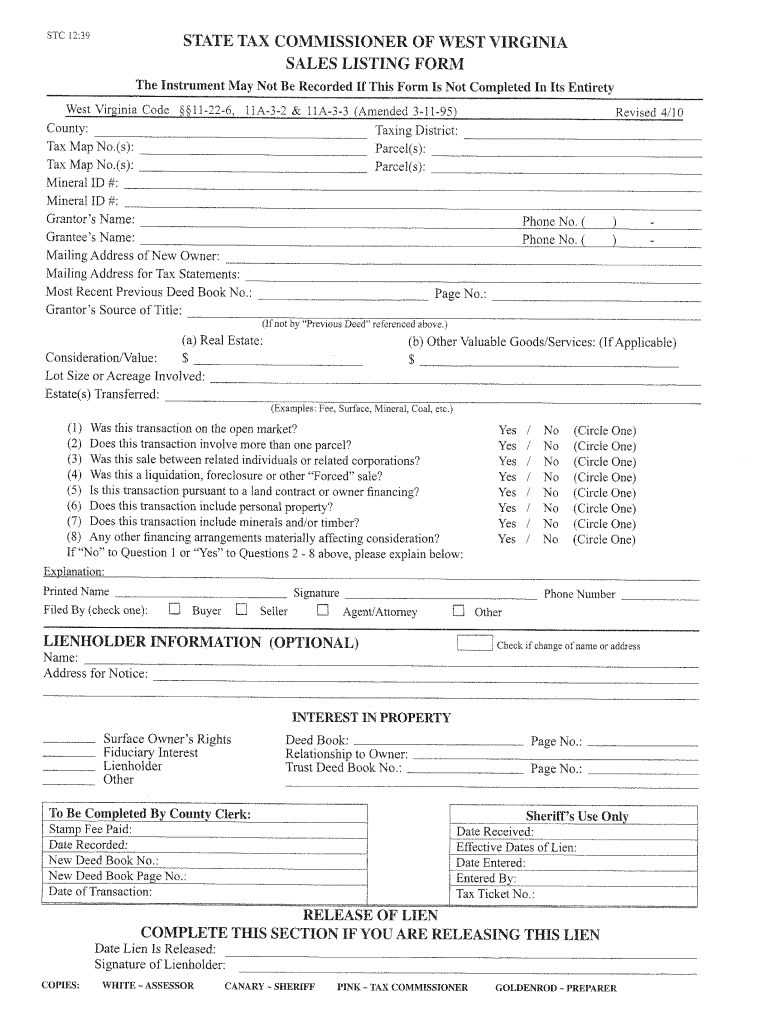

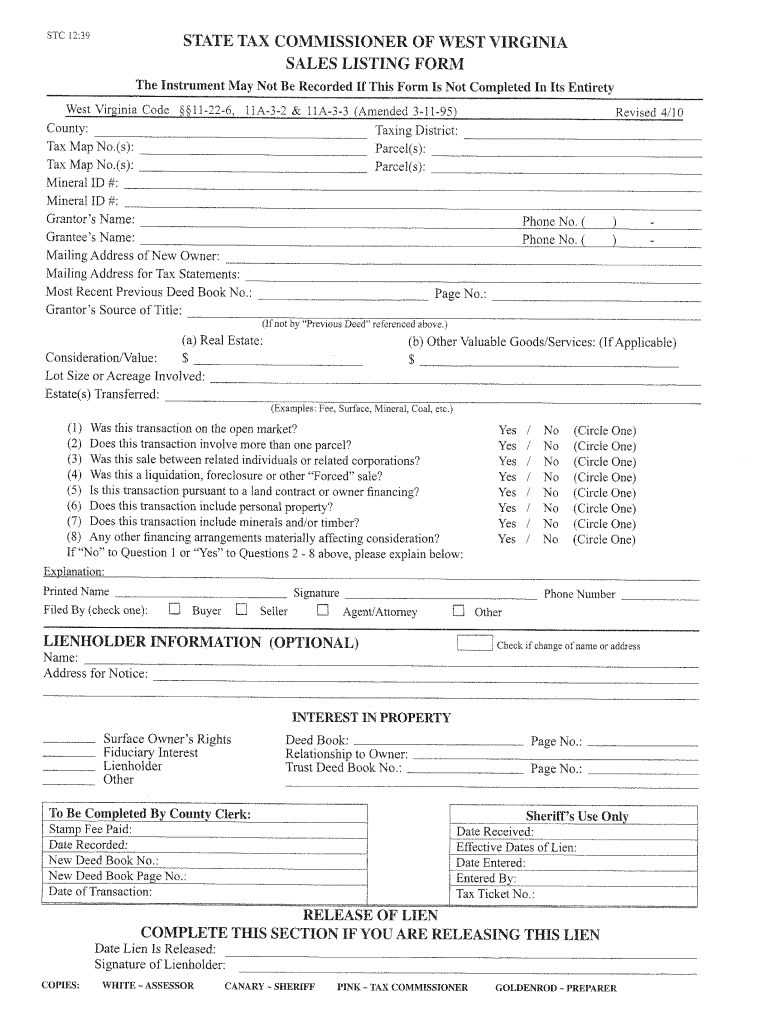

STC 12' STATE TAX COMMISSIONER OF WEST VIRGINIA. SALES LISTING FORM. The Instrument May Not Be Recorded If This Form Is Not Completed In Its ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wv sales listing form

Edit your sales listing form wv form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your west virginia sales listing form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sales listing form online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wv sales tax form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wv sales and use tax form pdf

How to fill out the WV sales listing form:

01

Start by gathering all the necessary information for the form, such as the property details, sales price, and any relevant disclosures.

02

Begin filling out the form by providing the basic information about the property, including the address, legal description, and parcel identification number.

03

Move on to the section where you will disclose any known defects or issues with the property. Be sure to include all relevant information and be as specific as possible.

04

Next, input the sales price and terms of the sale, including the closing date and any specific contingencies that may apply.

05

If applicable, include information about any financing or mortgage involved in the sale.

06

In the next section, accurately state the commission or fee to be paid to the listing broker.

07

Provide your contact information as the person completing the form.

08

Review the completed form for any errors or omissions before submitting it.

Who needs the WV sales listing form:

01

Individuals or real estate agents who are listing a property for sale in West Virginia.

02

Sellers who want to ensure all necessary information about the property, including any known defects, is disclosed to potential buyers.

03

Buyers who want to verify the accuracy of the listing information provided for a property they are interested in purchasing.

Fill

wv 1

: Try Risk Free

People Also Ask about west virginia sales tax form

What is West Virginia Code of Laws 11 22 6?

§11-22-6. Duties of clerk; declaration of consideration or value; filing of sales listing form for Tax Commissioner; disposition and use of proceeds. §11-22-7. Failure to affix stamps.

What is the declaration of consideration or value in West Virginia?

Declaration of Consideration of Value (This is the monetary amount for which the property is sold. If the property is being transferred without monetary value, it must state in the declaration paragraph 'why' it is exempt from transfer tax.)

What is the estate tax rate on capital gains?

Trusts and estates pay capital gains taxes at a rate of 15% for gains between $2,600 and $13,150, and 20% on capital gains above $13,150.00. It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or estate administration.

How is capital gains calculated on sale of property?

Determine your realized amount. This is the sale price minus any commissions or fees paid. Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.

How do I avoid capital gains tax on the sale of my home?

How to avoid capital gains tax on real estate Live in the house for at least two years. The two years don't need to be consecutive, but house-flippers should beware. See whether you qualify for an exception. Keep the receipts for your home improvements.

What is Schedule D in WV sales tax?

Schedule D is used when deductions have been taken that reduce the gross amount of sales or purchases that are subject to tax, or when either of two specific tax credits are taken that reduce the overall liability due.

What is the capital gains tax on $200 000?

= $ Single TaxpayerMarried Filing JointlyCapital Gain Tax Rate$0 – $44,625$0 – $89,2500%$44,626 – $200,000$89,251 – $250,00015%$200,001 – $492,300$250,001 – $553,85015%$492,301+$553,851+20% Jan 11, 2023

How much is capital gains tax on real estate in WV?

6.5% of the estimated capital gain derived from the sale or exchange. The amount of tax withheld must be paid to the real estate reporting person before the deed or other instrument transferring title to the realty is presented for recordation or filing in the county clerk's office.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pdffiller form directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your pdffiller form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit pdffiller form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your pdffiller form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the pdffiller form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign pdffiller form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is wv sales listing form?

The WV sales listing form is a document used in West Virginia to report the sale of real estate properties for tax assessment purposes.

Who is required to file wv sales listing form?

Property owners or any individual or entity that sells a property in West Virginia is required to file the WV sales listing form.

How to fill out wv sales listing form?

To fill out the WV sales listing form, indviduals should provide details such as the property's address, sale price, date of sale, buyer and seller information, and other relevant details as required by the form.

What is the purpose of wv sales listing form?

The purpose of the WV sales listing form is to provide accurate sales data to local tax assessors, ensuring properties are assessed fairly for property taxation.

What information must be reported on wv sales listing form?

The information that must be reported on the WV sales listing form includes the property location, sales price, date of sale, names of the buyer and seller, and any additional details required by the local assessor.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.