Get the free 2307

Show details

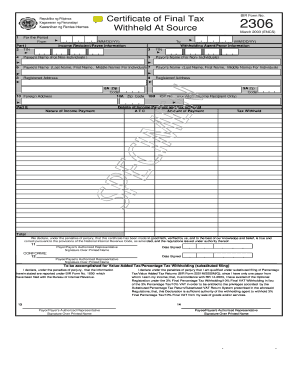

(To be filled up by the BIR) DAN: SIC: Republican NG Filipinas Catamaran NG Pananalapi Hawaiian NG Rental Internal Return of Percentage Tax Payable Under Special Laws BIR Form No. 2553 July 1999 (ENDS)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 2307 sample

Edit your sample filled up bir form 2307 excel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2307 sample filled up form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2307 sample online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2307 bir form excel. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2307 bir form sample

01

Prepare all necessary documents and information.

1.1

Gather your personal information such as full name, address, and contact details.

1.2

Prepare your TIN (Tax Identification Number) and other relevant identification documents.

02

Determine the appropriate BIR form to use.

2.1

Identify the specific BIR form that corresponds to the purpose of your filing.

2.2

The BIR website or local BIR office can provide assistance in selecting the correct form.

03

Fill out the required details in the BIR form.

3.1

Carefully read the instructions provided on the form.

3.2

Complete all necessary fields, including your personal information, income details, and deductions, if applicable.

04

Provide accurate and detailed information.

4.1

Ensure that all the information you provide is accurate, complete, and up to date.

4.2

Double-check your entries to avoid any errors or discrepancies.

05

Attach supporting documents, if required.

5.1

Depending on the type of form being filled out, certain supporting documents may be required.

5.2

These may include receipts, invoices, or any other relevant documents that validate the information provided in the form.

06

Review and verify the filled-out form.

6.1

Take the time to review the completed form before submitting.

6.2

Verify that all the information is correct and that nothing has been omitted.

07

Submit the filled-out form to the appropriate BIR office.

7.1

Locate the nearest BIR office where your form should be submitted.

7.2

Ensure that you have all the necessary copies of the form and supporting documents.

Who needs a sample filled-up BIR?

01

Individuals who are new to the process of filling out and submitting BIR forms may find a sample filled-up BIR helpful.

02

People who want to ensure that they are providing accurate information and properly completing the required fields on the BIR form.

03

Individuals who are unfamiliar with specific terms or sections of the BIR form and would benefit from observing a correctly filled-out sample.

Video instructions and help with filling out and completing 2307

Instructions and Help about how to fill up bir form 2307 sample

Fill

sample 2307 for rentals form

: Try Risk Free

People Also Ask about bir form 2307 sample

How to fill out 2307?

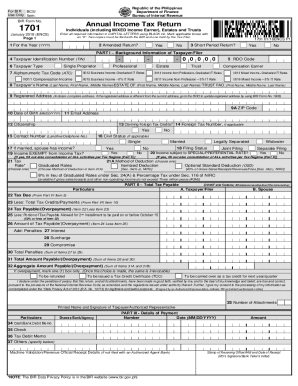

How to fill out the BIR form 2307 Download the Excel or PDF file from the BIR website. Fill out the following information: Part 1 – Payee Information. Part 2 – Payer Information. Details of Monthly Income Payments and Taxes Withheld. Printed Name of the Payor/Authorized Representative.

Is form 2307 an EWT or CWT?

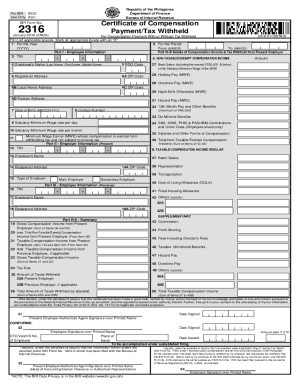

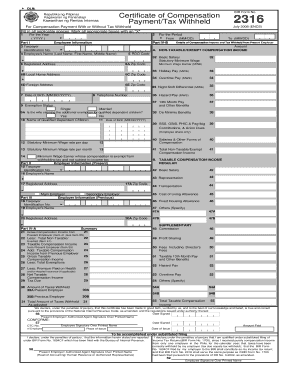

The BIR Form 2307 is more commonly referred to as the Certificate of Creditable Tax Withheld at Source. This certificate exhibits the income that is subjugated to Expanded Withholding Tax (EWT) that is paid by a withholding agent.

What is certificate of creditable tax withheld at source BIR Form 2307?

What is this form? BIR Form 2307, or Certificate of Creditable Tax Withheld at Source is a tax certificate which needs to be accomplished by the withholding agent which shows the recipient of any income subject to expanded withholding tax.

How to generate BIR Form 2307?

How to Generate BIR Form 2307 | Form 2306 Click the excel icon to choose the excel template to be used. Click BIR Form 2307 to download the template. Open the template and take time to analyze the sample data. Again, DO NOT edit Row1 and DO NOT work directly in the template.

What is certificate of creditable tax withheld at source form 2307?

The BIR Form 2307 is also known as the Certificate of Credible Tax Withheld at Source. This is used to present the income of an individual or business entity that is subject to Expanded Withholding Tax (EWT) paid by the withholding agent. The form lies under assets in the accounting books.

How to generate BIR form 2307?

How to Generate BIR Form 2307 | Form 2306 Click the excel icon to choose the excel template to be used. Click BIR Form 2307 to download the template. Open the template and take time to analyze the sample data. Again, DO NOT edit Row1 and DO NOT work directly in the template.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2307 bir form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific sample of 2307 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make edits in form 2307 bir sample without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 2307 form sample, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete sample 2307 for goods on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your sample of filled out bir form 2307 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is sample filled up bir?

A sample filled up BIR (Bureau of Internal Revenue) form is a version of the official tax form that has been completed with example data to show how it should be filled out accurately.

Who is required to file sample filled up bir?

Individuals and businesses that are subject to taxation and need to report their income or business transactions to the BIR are required to file a filled up BIR form.

How to fill out sample filled up bir?

To fill out a sample filled up BIR, one must follow the instructions on the form, provide accurate personal or business details, report income, deductions, and other relevant information, and ensure all sections are completed as required.

What is the purpose of sample filled up bir?

The purpose of a sample filled up BIR form is to serve as a reference or guideline for taxpayers on how to correctly complete their own tax forms, ensuring compliance with BIR regulations.

What information must be reported on sample filled up bir?

Information that must be reported includes taxpayer identification details, income earned, deductions claimed, tax due, and other relevant financial information pertaining to the tax period.

Fill out your 2307 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample 2307 is not the form you're looking for?Search for another form here.

Keywords relevant to 2307 rental sample

Related to bir 2307 form download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.