Get the free Roth IRA Adoption Agreement and Plan Document - First Republic ...

Show details

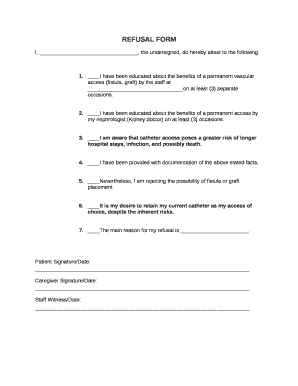

ROTH INDIVIDUAL RETIREMENT ACCOUNT (IRA) ADOPTION AGREEMENT AND PLAN DOCUMENT ROTH INDIVIDUAL RETIREMENT CUSTODIAL ACCOUNT Form 5305-RA (Revised March 2002) under Section 408A of the Internal Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira adoption agreement

Edit your roth ira adoption agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira adoption agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit roth ira adoption agreement online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit roth ira adoption agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira adoption agreement

How to fill out a Roth IRA adoption agreement:

01

Obtain the appropriate forms: The first step in filling out a Roth IRA adoption agreement is to obtain the necessary forms. These forms can typically be found on the website of the financial institution where you plan to open your Roth IRA.

02

Provide personal information: The next step is to fill in your personal information on the adoption agreement form. This may include your name, address, social security number, and birthdate. Make sure to double-check the accuracy of the information before submitting the form.

03

Designate beneficiaries: One crucial aspect of a Roth IRA adoption agreement is designating beneficiaries. This ensures that your assets are distributed according to your wishes after your passing. You will need to provide the name, relationship, and percentage of assets for each beneficiary.

04

Choose investment options: Roth IRAs allow you to invest your funds in various assets such as stocks, bonds, or mutual funds. Fill out the adoption agreement form by selecting your preferred investment options. Some financial institutions may offer guidance in choosing suitable investments based on your risk tolerance and investment goals.

05

Review and sign: Carefully review all the information you have filled out on the Roth IRA adoption agreement form. Ensure that it accurately reflects your intentions and goals. Once you are satisfied, sign the form and date it. Some forms may require a witness or notary signature, so make sure to fulfill any additional requirements.

Who needs a Roth IRA adoption agreement?

A Roth IRA adoption agreement is necessary for individuals who wish to establish a Roth IRA account. This can be anyone who meets the eligibility criteria set by the Internal Revenue Service (IRS). These criteria typically include having earned income and falling within certain income limits. It is essential to consult with a financial advisor or tax professional to determine if a Roth IRA is the right retirement savings option for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify roth ira adoption agreement without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including roth ira adoption agreement. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send roth ira adoption agreement for eSignature?

When your roth ira adoption agreement is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my roth ira adoption agreement in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your roth ira adoption agreement right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is roth ira adoption agreement?

The Roth IRA Adoption Agreement is a document that outlines the terms and conditions of opening and maintaining a Roth IRA account.

Who is required to file roth ira adoption agreement?

Individuals who wish to open a Roth IRA account are required to file the Roth IRA Adoption Agreement.

How to fill out roth ira adoption agreement?

To fill out the Roth IRA Adoption Agreement, individuals must provide personal information, beneficiary details, investment choices, and agree to the terms outlined in the document.

What is the purpose of roth ira adoption agreement?

The purpose of the Roth IRA Adoption Agreement is to establish and document the rights and obligations of both the account holder and the financial institution administering the account.

What information must be reported on roth ira adoption agreement?

The Roth IRA Adoption Agreement must include personal information of the account holder, beneficiary details, investment choices, and the agreement to the terms and conditions of the account.

Fill out your roth ira adoption agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Adoption Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.