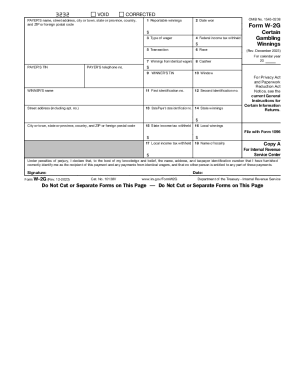

IRS W-2G 2015 free printable template

Instructions and Help about IRS W-2G

How to edit IRS W-2G

How to fill out IRS W-2G

About IRS W-2G 2015 previous version

What is IRS W-2G?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

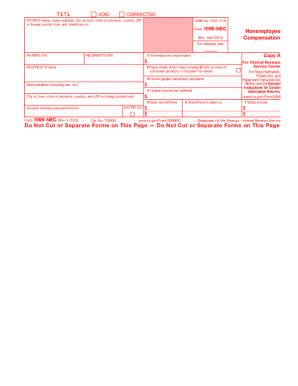

Is the form accompanied by other forms?

FAQ about IRS W-2G

What should I do if I made a mistake on my IRS W-2G?

If you discover an error after submitting your IRS W-2G, you can submit a corrected version. Ensure that you clearly indicate it as a correction and provide the correct information. It's important to keep records of both the original and corrected filings for your future reference.

How can I verify the status of my IRS W-2G submission?

To check the status of your IRS W-2G submission, you can access the IRS's online tracking tools. This will allow you to confirm whether your form has been successfully processed. Pay attention to common e-file rejection codes that might indicate issues that need addressing.

Are there special considerations for foreign payees when issuing an IRS W-2G?

When issuing an IRS W-2G to a foreign payee, be mindful of specific tax obligations and information reporting requirements that may differ from domestic cases. It’s advisable to consult a tax professional familiar with international tax matters to ensure compliance.

What should I do if I receive a notice about my IRS W-2G?

If you receive a notice regarding your IRS W-2G, it is crucial to read it carefully and respond accordingly. Gather relevant documentation to support your case, and ensure that any necessary corrections are made promptly. Communicating with the IRS in a timely manner is key to resolving any issues.

See what our users say