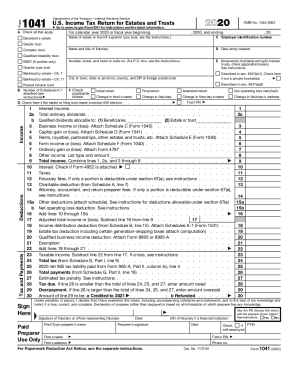

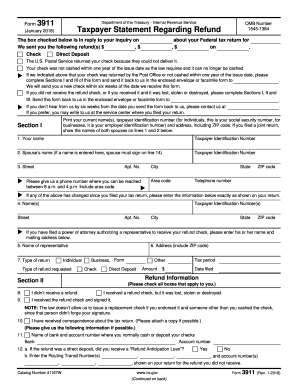

IRS Instruction 1041 2017 free printable template

Get, Create, Make and Sign IRS Instruction 1041

How to edit IRS Instruction 1041 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instruction 1041 Form Versions

How to fill out IRS Instruction 1041

How to fill out IRS Instruction 1041

Who needs IRS Instruction 1041?

Instructions and Help about IRS Instruction 1041

Okay for this video I wanted to go over a very simple example as to how to complete a form 1041 trust tax return for a revocable non-grantor trust now trust returns these can get incredibly complicated, so I'm going to just use a very, very simple example a little of income and expenses one beneficiary and then just show you how the fact pattern kind of works with the return and what some basic uh sections of the return you need to complete um and moving on to the k1s as well, so I've got the sample 1041 in front of us we'll go through all the relevant fields here, and then I also have a sample fact pattern here that we're going to review and this is the information we're going to use to populate the 1041 tax return so um what's the fat pattern we've got here well we're going with Jane smith she's the U.S. taxpayer a granter, and she wants to form an irrevocable non-grantor trust for the benefit of her only daughter her daughter is daughter smith now Jane has a lawyer draft up a trust agreement and that agreement...

People Also Ask about

Does an estate have to file Form 1041 A?

Do I have to file a 1041 as a beneficiary?

Do you have to file a 1041 if there is no income?

Who is required to file Form 1041 A?

How do I know if I need to file a 1041?

When Should Form 1041 be filed?

Do I have to file a 1041 for a trust with no income?

Do I need to file a tax return if I didn't have any income?

Does a surviving spouse have to file a 1041?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my IRS Instruction 1041 in Gmail?

How can I edit IRS Instruction 1041 on a smartphone?

How do I fill out IRS Instruction 1041 using my mobile device?

What is IRS Instruction 1041?

Who is required to file IRS Instruction 1041?

How to fill out IRS Instruction 1041?

What is the purpose of IRS Instruction 1041?

What information must be reported on IRS Instruction 1041?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.