Get the free city of philadelphia tax account number

Show details

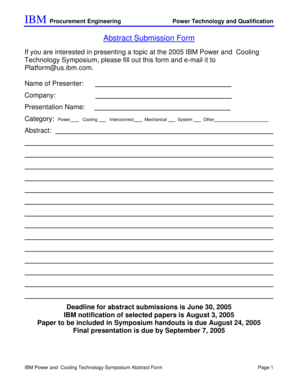

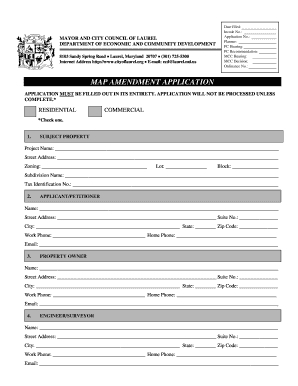

This document is an application form for obtaining an annual Philadelphia business tax account number, business privilege license, and wage tax withholding account.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign philadelphia tax id number form

Edit your philadelphia tax account number form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax account number philadelphia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing philadelphia tax id number lookup online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit philadelphia tax identification number form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out philadelphia tax account form

How to fill out philadelphia tax account number:

01

Obtain the Philadelphia tax account number application form from the official website of the City of Philadelphia.

02

Fill in your personal information accurately, including your name, address, and contact details.

03

Provide your social security number or federal tax identification number.

04

Specify the type of tax account you are applying for, such as Business Income and Receipts Tax (BIRT) or Net Profits Tax.

05

If you are applying for a business tax account, provide additional information about your business, such as its legal structure, industry, and date of establishment.

06

Ensure that all required fields are completed and any supporting documentation, if applicable, is provided.

07

Review the application form to verify that all information is correct and legible.

08

Sign and date the application form to certify its accuracy.

09

Submit the completed application form along with any required documents to the designated department or office as specified on the form.

Who needs philadelphia tax account number:

01

Individuals who are self-employed and earning income within the City of Philadelphia may need a tax account number for reporting and paying the Net Profits Tax.

02

Businesses operating within the City of Philadelphia, regardless of their legal structure (sole proprietorship, partnership, corporation, etc.), are required to have a tax account number for reporting and paying various taxes, such as the Business Income and Receipts Tax (BIRT) and the Use and Occupancy Tax.

03

Non-profit organizations that engage in taxable activities may also be required to obtain a tax account number. It is advisable to consult with the City of Philadelphia's Department of Revenue or a tax professional to determine if your organization needs a tax account number.

Fill

philadelphia tax id

: Try Risk Free

People Also Ask about

Do I have to file a tax return with the city of Philadelphia?

You must pay the Earnings Tax if you are a: Philadelphia resident with taxable income who doesn't have the City Wage Tax withheld from your paycheck. A non-resident who works in Philadelphia and doesn't have the City Wage Tax withheld from your paycheck.

What is Philadelphia Code 19 3800?

Complete this page if you are seeking status as a new business under Philadelphia Code 19-3800 which exempts the business from paying Business Income & Receipts Tax for the first two years of operation.

Who has to file a Philly tax return?

Tax requirements for anyone who is paid for work performed in Philadelphia, or for Philadelphia residents receiving unearned income.

Who must pay Philadelphia city tax?

All employed Philadelphia residents owe the Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

How do I get a PA state tax ID number?

The registration is done by filing form PA-100 with PDOR. You can get an EIN/TIN by mail, fax, or through the online application form on the IRS's website. It takes four days to get an EIN by fax, four weeks by mail, and around 15 minutes when done online.

How do I get a PA tax ID number?

The registration is done by filing form PA-100 with PDOR. You can get an EIN/TIN by mail, fax, or through the online application form on the IRS's website. It takes four days to get an EIN by fax, four weeks by mail, and around 15 minutes when done online.

How to apply for a tax ID number in Philadelphia?

You can obtain an EIN by Internet, phone, fax, or mail. The most efficient method is via Internet. The IRS provides a free online service that takes you through an interview-style application. Upon completion you will immediately receive your EIN.

Is a tax account number the same as an EIN?

Is an EIN the same as a tax ID? The IRS issues a tax ID for identifying individuals and businesses for the purpose of taxation. An EIN, or an employer identification number, is a type of tax ID issued to businesses as a separate tax entity from individuals.

Is the Philadelphia tax account number the same as a EIN?

For personal income taxes, such as Earnings and School Income Tax, the City uses your SSN as your tax ID. You cannot substitute your EIN (or FEIN) for your City Tax ID when filling out tax forms – here's why: The City ties your Philadelphia returns and payments to your City Tax ID.

How many digits is a PA tax ID number?

Eight-digit Sales Tax Account ID Number. Nine-digit Federal Employer Identification Number or Social Security number, or your 10-digit Revenue ID. Tax period end date. PA state gross sales, rentals and services.

What is a Philadelphia tax account number?

In order to pay City taxes, you need a Philadelphia Tax Identification Number (PHTIN). You also need a PHTIN to get a Commercial Activity License (CAL), which is required to do any business in Philadelphia. Nonprofits aren't liable for the Business Income and Receipts Tax (BIRT), but they may owe other taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send city of philadelphia tax for eSignature?

When you're ready to share your city of philadelphia tax, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in city of philadelphia tax without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your city of philadelphia tax, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete city of philadelphia tax on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your city of philadelphia tax. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is philadelphia tax account number?

The Philadelphia tax account number is a unique identifier assigned to businesses and individuals for the purpose of reporting and paying city taxes.

Who is required to file philadelphia tax account number?

All businesses operating within Philadelphia, as well as individuals earning income subject to Philadelphia tax, are required to file using their Philadelphia tax account number.

How to fill out philadelphia tax account number?

To fill out the Philadelphia tax account number, you need to include it on your tax forms, ensuring it is correctly entered to avoid processing delays.

What is the purpose of philadelphia tax account number?

The purpose of the Philadelphia tax account number is to facilitate the tracking and management of tax obligations and payments by the city for both businesses and individuals.

What information must be reported on philadelphia tax account number?

When filing with the Philadelphia tax account number, you must report income, deductions, tax credits, and any relevant business or personal tax information.

Fill out your city of philadelphia tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

City Of Philadelphia Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.