CA Revocable Transfer on Death (TOD) Deed 2015 free printable template

Show details

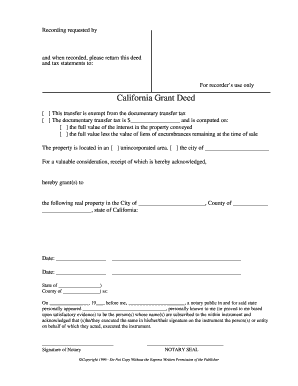

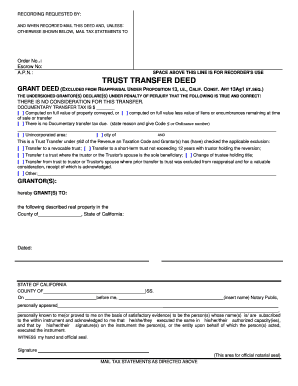

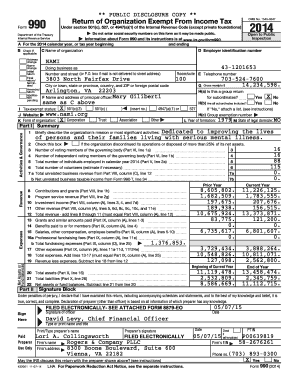

If the transfer document is not RECORDED before your death the TOD deed will take effect. I AM BEING PRESSURED TO COMPLETE THIS FORM. SPACE ABOVE THIS LINE FOR RECORDER S USE ONLY ESCROW NO. SIMPLE REVOCABLE TRANSFER ON DEATH TOD DEED California Probate Code Section 5642 ASSESSOR S PARCEL NUMBER This document is exempt from documentary transfer tax under Revenue Taxation Code 11930. IS PROPERTY TRANSFERRED BY THE TOD DEED SUBJECT TO MY DEBTS Yes. DOES THE TOD DEED HELP ME TO AVOID GIFT AND...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Revocable Transfer on Death TOD Deed

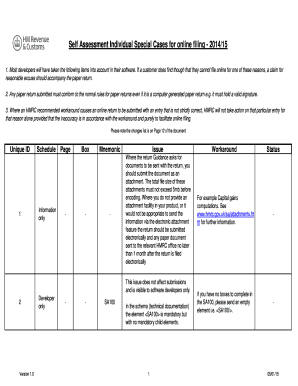

Edit your CA Revocable Transfer on Death TOD Deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Revocable Transfer on Death TOD Deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Revocable Transfer on Death TOD Deed online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA Revocable Transfer on Death TOD Deed. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Revocable Transfer on Death (TOD) Deed Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Revocable Transfer on Death TOD Deed

How to fill out CA Revocable Transfer on Death (TOD) Deed

01

Obtain the CA Revocable Transfer on Death (TOD) Deed form from your local county recorder's office or online.

02

Fill in the name and address of the property owner(s) in the designated section.

03

Provide the legal description of the property being transferred, including the parcel number.

04

Name the designated beneficiary or beneficiaries who will receive the property upon the owner's death.

05

Include any specific conditions or restrictions on the transfer if desired.

06

Sign and date the deed in the presence of a notary public.

07

File the completed TOD deed with the county recorder's office in the county where the property is located.

Who needs CA Revocable Transfer on Death (TOD) Deed?

01

Individuals who own real estate in California and want to ensure a smooth transfer of property to beneficiaries without going through probate.

02

People looking to retain control over their property during their lifetime while designating who will receive the property after their death.

Fill

form

: Try Risk Free

People Also Ask about

What is the disadvantage of TOD?

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

What does Tod stand for in banking?

Transfer on Death Designations: Advantages and Disadvantages.

What is the difference between transfer on death and beneficiary?

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

What is difference between pod and TOD?

There are various components to titling; one is using a transfer on death (TOD), generally used for investment accounts, or payable on death (POD) designation, used for bank accounts, which acts as a beneficiary designation to whom the account assets are to pass when the owner dies.

Does a transfer on death deed supersede a will in Texas?

A Transfer on Death Deed trumps a will. A will has no effect on a Transfer on Death Deed. For example, suppose that you make a Transfer on Death Deed naming your child as beneficiary and file it in the deed records. Later, you make a will leaving the same property to your spouse.

What's the difference between payable on death and transfer on death?

“Payable on death” usually refers to bank accounts, and nearly any kind of bank account can be payable on death. “Transfer on Death” is a term that more properly applies to stocks, bonds, and brokerage accounts. Establishing an account as POD or TOD is generally simple.

Does transfer on death supercede will Ohio?

That transfer on death shall supersede any attempted testate or intestate transfer of that real property or interest in real property.

How do I revoke a transfer on death deed in Texas?

How Do I Revoke A Texas Transfer On Death Deed? By signing a new Transfer on Death Deed that expressly revokes the prior one or specifies that the property should pass to someone else. By signing a separate document that expressly revokes the prior Transfer on Death Deed.

Is transfer on death the same as a beneficiary designation?

There are various components to titling; one is using a transfer on death (TOD), generally used for investment accounts, or payable on death (POD) designation, used for bank accounts, which acts as a beneficiary designation to whom the account assets are to pass when the owner dies.

Which is better TOD or beneficiary?

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Can a transfer on death deed be contested in Texas?

Whether you have a Transfer on Death Deed, Deed with Reservation of Life Estate or a Ladybird Deed, such deed could be voided by a court if the property owner lacks sufficient mental capacity at the time the deed was signed or if the deed was procured by fraud, undue influence or duress.

What is the advantage of transfer on death?

The primary advantage of a transfer on death deed is to avoid the probate process. If a property owner has executed a transfer on death deed, then as soon as the property owner dies, that property passes to the person named. The beneficiary does not have to go to court.

Is TOD better than beneficiary?

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

How do you avoid probate after death in Ohio?

Living Trusts In Ohio, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

How do I get a TOD deed in Ohio?

How to create a Transfer on Death for your home Choose your recipients. You can choose one or more people to become owner of any home or land that you own. Find a copy of your deed. Complete the TOD for real estate form. Take the form to a notary . Submit the form at your County Recorder's Office.

Does Ohio have a transfer on death deed?

More than 25 states, including Ohio, now allow the use of Transfer-On-Death deeds. You don't have to actually live in a state that allows TOD deeds to be able to use one, but the property must be located in such a state.

Are TOD accounts a good idea?

The most important benefit of a TOD account is simplicity. Estate planning can help minimize the legal mess left after you die. Without it, the probate system can take over the distribution of your assets. It can also name an executor of your estate and pay off your remaining debts with your assets.

What are the disadvantages of a TOD deed?

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

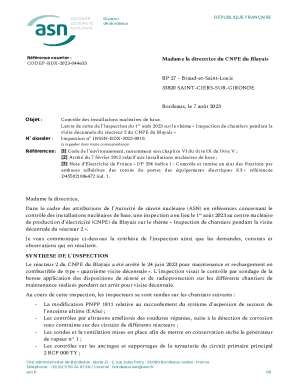

How can I modify CA Revocable Transfer on Death TOD Deed without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including CA Revocable Transfer on Death TOD Deed, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit CA Revocable Transfer on Death TOD Deed in Chrome?

Install the pdfFiller Google Chrome Extension to edit CA Revocable Transfer on Death TOD Deed and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out CA Revocable Transfer on Death TOD Deed on an Android device?

Use the pdfFiller mobile app and complete your CA Revocable Transfer on Death TOD Deed and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CA Revocable Transfer on Death (TOD) Deed?

A California Revocable Transfer on Death (TOD) Deed is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate.

Who is required to file CA Revocable Transfer on Death (TOD) Deed?

Any individual who owns real property in California and wishes to designate one or more beneficiaries to receive their property upon death can file a CA Revocable Transfer on Death Deed.

How to fill out CA Revocable Transfer on Death (TOD) Deed?

To fill out the CA Revocable Transfer on Death Deed, the property owner must provide details such as the property's legal description, the names of the beneficiaries, and the property owner's signature. It is also recommended to have the document notarized.

What is the purpose of CA Revocable Transfer on Death (TOD) Deed?

The purpose of the CA Revocable Transfer on Death Deed is to simplify the transfer of real estate to beneficiaries, allowing them to inherit the property directly and avoid the complexities and costs associated with probate.

What information must be reported on CA Revocable Transfer on Death (TOD) Deed?

The CA Revocable Transfer on Death Deed must include the property owner's name, the legal description of the property, the names and addresses of the beneficiaries, and the property owner's signature.

Fill out your CA Revocable Transfer on Death TOD Deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Revocable Transfer On Death TOD Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.