Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

CT forms refer to the state-specific forms used in Connecticut, United States. These forms are typically provided by government agencies, departments, and other organizations to collect information, process applications, and facilitate various transactions related to taxes, business registrations, real estate, motor vehicles, licenses, and more. The specific content and purpose of CT forms can vary widely based on the topic or process they are associated with.

Who is required to file ct forms?

The specific individuals and businesses required to file CT forms may vary depending on the jurisdiction. However, in a general sense, the following entities are commonly required to file CT forms:

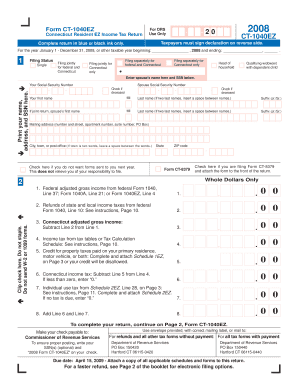

1. Individuals: Individuals who earn income above a certain threshold, typically determined by the tax laws of their country or state, are required to file CT forms. This includes income from wages, investments, self-employment, rental income, etc.

2. Sole Proprietors: Individuals operating a business as sole proprietors are generally required to file CT forms to report their business income and expenses.

3. Partnerships: Partnerships, which are legal entities formed by two or more individuals or businesses, are required to file CT forms to report their income, expenses, and distribute profits and losses to partners.

4. Limited Liability Companies (LLCs): LLCs, depending on their structure, may need to file CT forms at both the entity level and the individual level. For example, a single-member LLC would generally file a Schedule C as part of their personal tax return, while multi-member LLCs may need to file separate CT forms for the business.

5. Corporations: Corporations, including both C corporations and S corporations, are generally required to file CT forms to report their taxable income, deductions, and credits.

It's important to note that tax laws can be complex and vary by jurisdiction, so it is advisable to consult with a tax professional or refer to the specific tax regulations of the relevant jurisdiction for accurate and up-to-date information on who is required to file CT forms.

How to fill out ct forms?

To fill out CT forms, you can follow these steps:

1. Read the instructions: Start by carefully reading the instructions provided with the form. Make sure you understand what information is required and any specific guidelines for filling out the form correctly.

2. Gather necessary documents: Collect all the documents and information needed to complete the form. This may include personal identification, financial records, or other supporting documents. Ensure you have all the required information before you begin filling out the form.

3. Use clear and legible handwriting: If the form is to be filled out by hand, use clear and legible handwriting to ensure that the information is easily readable.

4. Provide accurate and complete information: Fill in all the necessary fields accurately and completely. Double-check your information to avoid any mistakes, as errors may cause delays or complications.

5. Follow the formatting requirements: Pay attention to the formatting requirements specified in the form instructions. This might include using specific date formats, capitalization, or other formatting guidelines. Adhering to these requirements will help ensure your form is processed smoothly.

6. Seek assistance if needed: If you have difficulty understanding any portion of the form or have questions about specific sections, seek assistance from the appropriate authority or consult a lawyer, if necessary. Properly completing the form is crucial, so don't hesitate to ask for help when needed.

7. Review and sign the form: Before submitting the form, review all the information you have entered to make sure it is accurate and complete. If required, sign and date the form in the designated areas.

8. Make copies for your records: Once you have filled out the form completely and accurately, make copies of the form and any supporting documents for your records. It is essential to keep copies as proof of your filing.

9. Submit the form: Submit the completed form and any required documents to the appropriate recipient. This may involve mailing the form, submitting it in person, or electronically filing, depending on the specific requirements and procedures outlined in the form instructions.

Remember to keep a copy of the submitted form and any related correspondence for future reference. It is always recommended to consult with the relevant authorities or professionals if you have any doubts or need specific guidance while filling out CT forms.

What is the purpose of ct forms?

CT forms, also known as Certificate of Tax Forms, serve the purpose of documenting and verifying the income, business activities, and tax liabilities of an individual or entity. These forms are often used for tax filing and compliance purposes. They provide a summary of income, deductions, credits, and other relevant information necessary for calculating and reporting taxes accurately. CT forms can vary depending on the jurisdiction and specific tax requirements.

What information must be reported on ct forms?

The exact information that must be reported on CT forms can vary depending on the specific form and the jurisdiction in which it is being filed. However, generally, CT forms require the following information to be reported:

1. Business name and legal structure: The name of the business or entity being formed or registered in the jurisdiction, along with its legal structure (e.g., corporation, limited liability company, partnership).

2. Registered agent: The name and address of the registered agent, who is the person or entity designated to receive legal and official documents on behalf of the business.

3. Principal place of business: The address of the main office or principal place of business for the entity.

4. Mailing address: A mailing address where official correspondence and notices can be sent.

5. Ownership and management: Information about the owners or shareholders of the business, including their names, addresses, and ownership percentages. Additionally, information about the management structure, such as the names and addresses of directors or managers, may be required.

6. Purpose of the business: A brief description of the purposes or activities for which the entity is being formed.

7. Capitalization and shares: Information about the capital structure, including the number and types of shares, authorized and issued, and the par value of shares, if applicable.

8. Filing fee: Most CT forms require payment of a filing fee, which typically varies based on the type of entity and the jurisdiction.

It is important to note that this information is a general guideline, and specific reporting requirements can vary from state to state or country to country. It is advisable to consult the relevant jurisdiction's laws and regulations or seek legal advice to ensure accurate and complete reporting on CT forms.

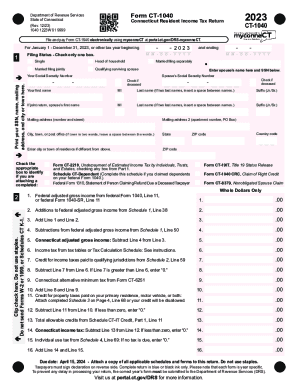

When is the deadline to file ct forms in 2023?

The deadline to file CT forms, specifically the Connecticut income tax return, for the year 2023 is April 17th, 2024. However, please note that tax filing deadlines can occasionally change or be subject to extensions, so it is always recommended to verify the exact deadline with the Connecticut Department of Revenue Services or consult a tax professional.

What is the penalty for the late filing of ct forms?

The penalty for the late filing of CT forms, which may vary depending on the jurisdiction, can include fines, interest charges, and potential legal action. It is best to consult with the relevant authorities or seek professional advice to determine the specific penalty in a particular jurisdiction.

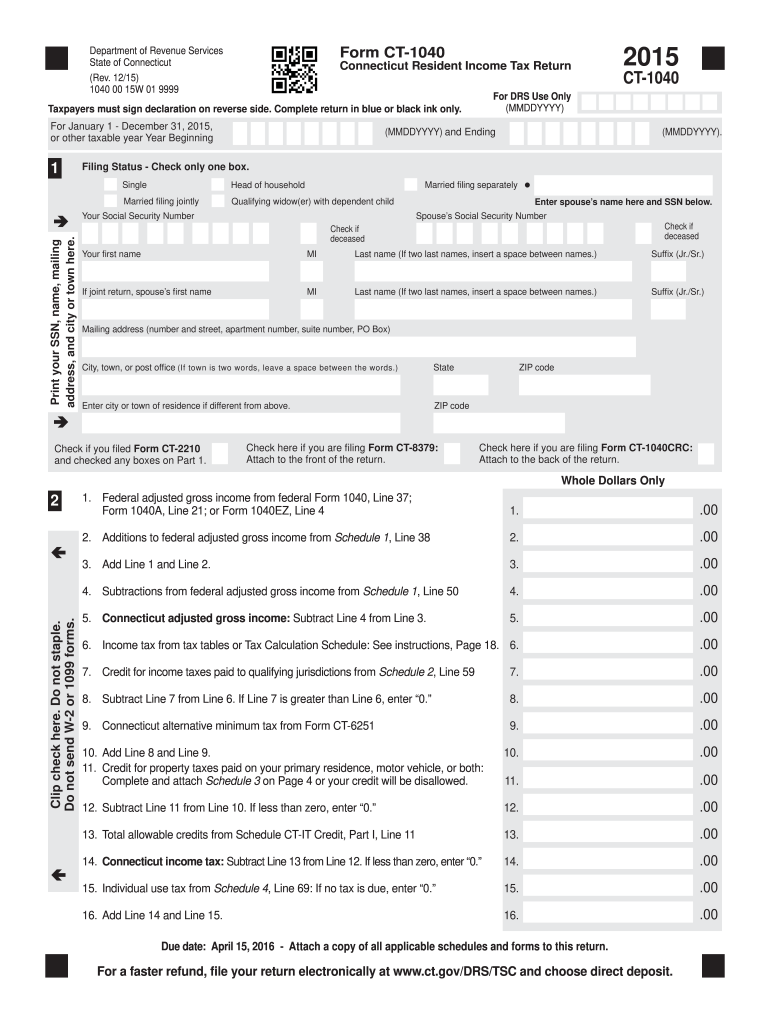

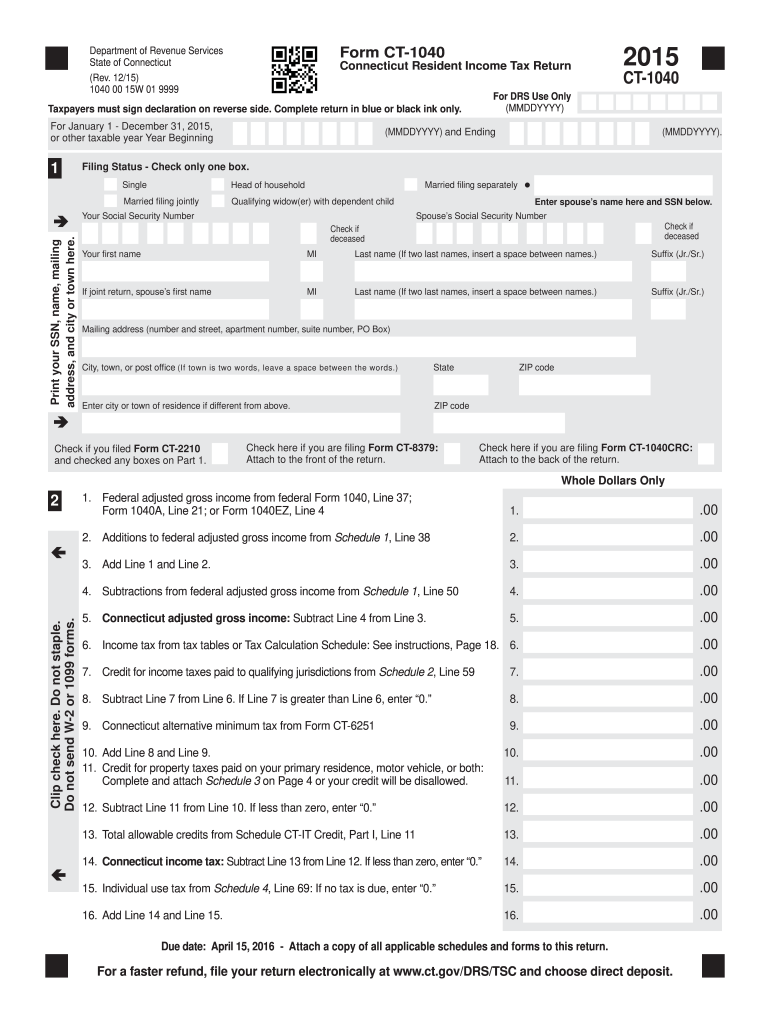

How can I manage my ct forms 2015 directly from Gmail?

ct forms 2015 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find ct forms 2015?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ct forms 2015 and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the ct forms 2015 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your ct forms 2015 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.