Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Forms are structured documents that are used to collect and organize data or information. They are commonly used in various settings, such as business, government, education, and healthcare, to gather information from individuals or entities. Forms typically include fields or sections where users can input or select their responses, such as filling out personal details, providing feedback, answering questions, or submitting requests. Forms can be physical copies printed on paper or digital versions created and completed online through websites or applications.

Filling out forms generally requires attention to detail and accuracy. Here are steps to help you fill out forms effectively:

1. Read the instructions: Start by reading the instructions provided with the form. Understanding the purpose and requirements of the form will help you complete it correctly.

2. Gather necessary information: Collect all the information you need to fill out the form. This may include personal details, contact information, identification numbers, or supporting documents. Have them readily available to avoid any delays.

3. Use a black or blue pen: Most forms require filling out with a black or blue pen, so make sure you have one before starting. Avoid using pencil or other colored inks that may not be acceptable.

4. Follow the format: Pay attention to the layout and format of the form. Different sections may require specific formats, such as dates, phone numbers, or addresses. Fill in the information as required by the form.

5. Be accurate and consistent: Double-check the information you provide to ensure accuracy. Write legibly and use capital letters, if necessary. Keep names, addresses, and other details consistent across the form to avoid confusion.

6. Skip irrelevant sections: If there are sections on the form that don't apply to you, you can often leave them blank or mark with "N/A" (not applicable) if allowed. Do not make up information or provide false details.

7. Seek assistance if needed: If you encounter any difficulties or encounter unfamiliar terms or questions, seek guidance from someone knowledgeable about the form or contact the organization responsible for it. It's better to clarify doubts than to make mistakes.

8. Review, review, review: Before submitting the form, carefully review all the information you entered. Ensure it is complete, accurate, and meets the requirements. Make corrections if necessary.

9. Sign and date the form: If required, sign and date the form in the designated areas. Use your usual signature, and if the form needs a witness, ensure they also sign and provide their information.

10. Make copies: Make copies of the completed form for your records before submitting it. This allows you to have a reference in case of any future need.

Remember, different forms may have specific requirements or additional steps, so it's essential to carefully read the instructions provided with each individual form.

What is the purpose of forms?

The purpose of forms is to collect information from users or site visitors in a structured manner. They are commonly used on websites and in various applications to capture and process data such as user feedback, inquiries, registrations, orders, surveys, and more. Forms allow businesses, organizations, and individuals to gather specific details or complete specific transactions efficiently and accurately. The collected information can then be utilized for various purposes such as analysis, customer service, record-keeping, personalization, and decision-making.

What information must be reported on forms?

The specific information that must be reported on forms can vary depending on the type of form and the purpose for which it is being filled out. However, some common types of information that are typically required on forms include:

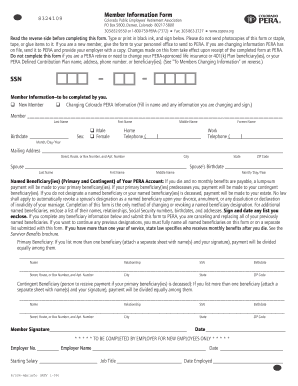

1. Personal information: This may include the person's full name, address, contact details, date of birth, Social Security number, and other identifying information.

2. Employment details: Forms often require information about the person's current or past employment, including the name and address of the employer, job title, duration of employment, and salary details.

3. Educational background: Some forms may ask for information about the person's educational qualifications, such as the name and address of the school or university attended, degree or diploma obtained, and graduation date.

4. Financial information: Certain forms may require details about an individual's financial situation, including income, assets, and liabilities. This can be relevant for tax forms, loan applications, or financial aid applications.

5. Medical history: In healthcare-related forms, individuals may need to provide information about their medical history, current medications, allergies, and other relevant health details.

6. Legal information: Legal forms often require individuals to disclose any previous criminal convictions, pending legal cases, or other legal matters that may be relevant.

7. Consent or authorization: Forms may also require individuals to provide their consent or authorization for specific activities, such as consent to receive marketing communications, authorization to release information, or permission to conduct a background check.

It is important to note that the specific information required on forms can vary vastly depending on the purpose and jurisdiction. Therefore, it is recommended to carefully review the instructions and requirements provided with each specific form.

When is the deadline to file forms in 2023?

The specific deadline to file forms in 2023 will vary depending on the country and the type of form you are referring to. Can you please provide more information about the specific form you are asking about or specify the country?

What is the penalty for the late filing of forms?

The penalty for late filing of forms can vary depending on the specific form and the rules and regulations of the governing authority. In different contexts, the penalty may include late fees, fines, interest charges, or other consequences.

For example, in the context of tax filing in the United States, the penalty for late filing of tax returns is generally a percentage of the amount owed. The penalty rate can range from 5% to 25% of the unpaid tax, depending on the number of days the return is late.

Similarly, in the case of business filings, such as annual reports or financial statements, the penalty for late filing can vary by jurisdiction. It may involve late fees or the loss of certain privileges, such as suspension of business operations or the inability to conduct certain transactions.

It is important to consult the specific regulations and guidelines provided by the relevant authorities to determine the accurate penalty for the late filing of forms in a particular situation.

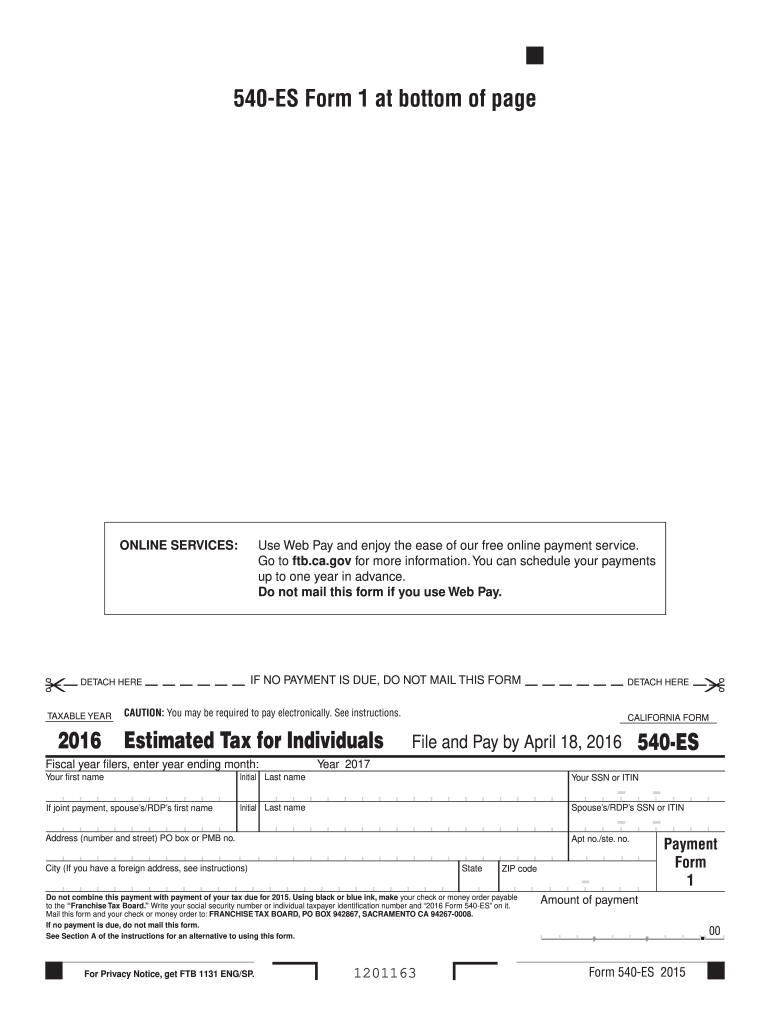

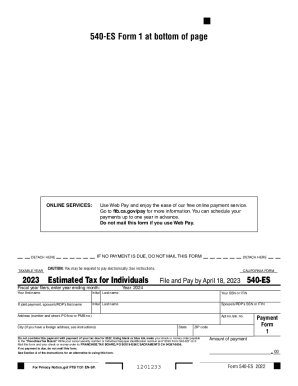

How can I modify 2016 forms - ftb without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 2016 forms - ftb, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I fill out 2016 forms - ftb using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2016 forms - ftb and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out 2016 forms - ftb on an Android device?

Use the pdfFiller Android app to finish your 2016 forms - ftb and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.