Get the free MOTOR VEHICLE FUEL TAX REPORT - nd

Show details

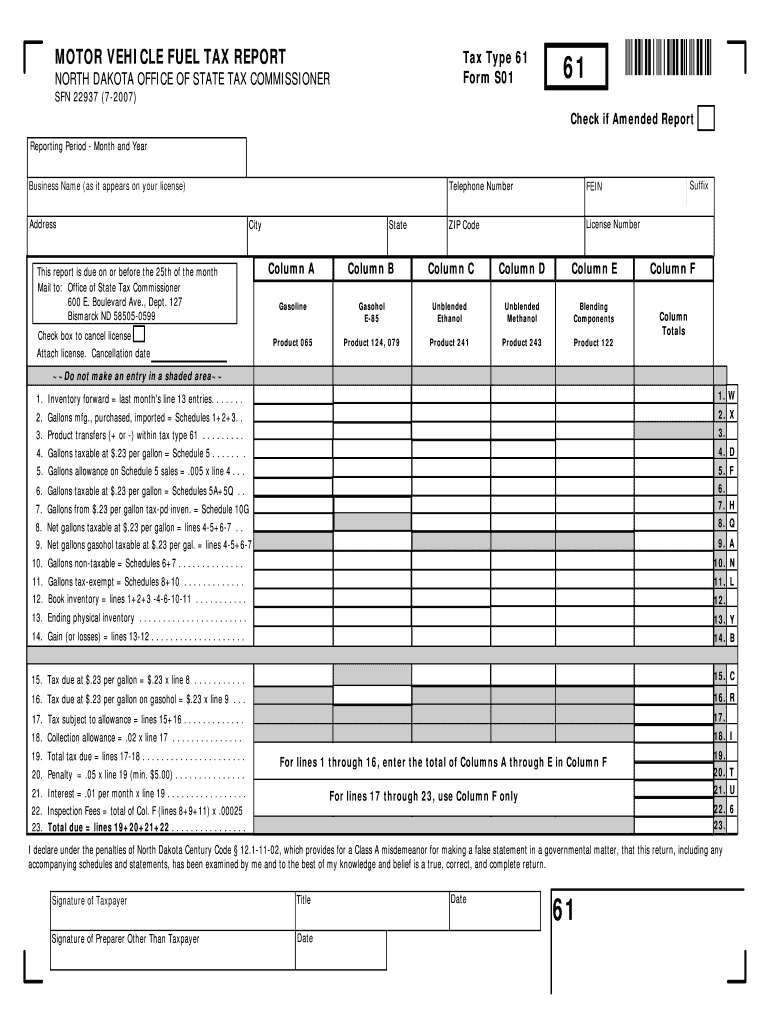

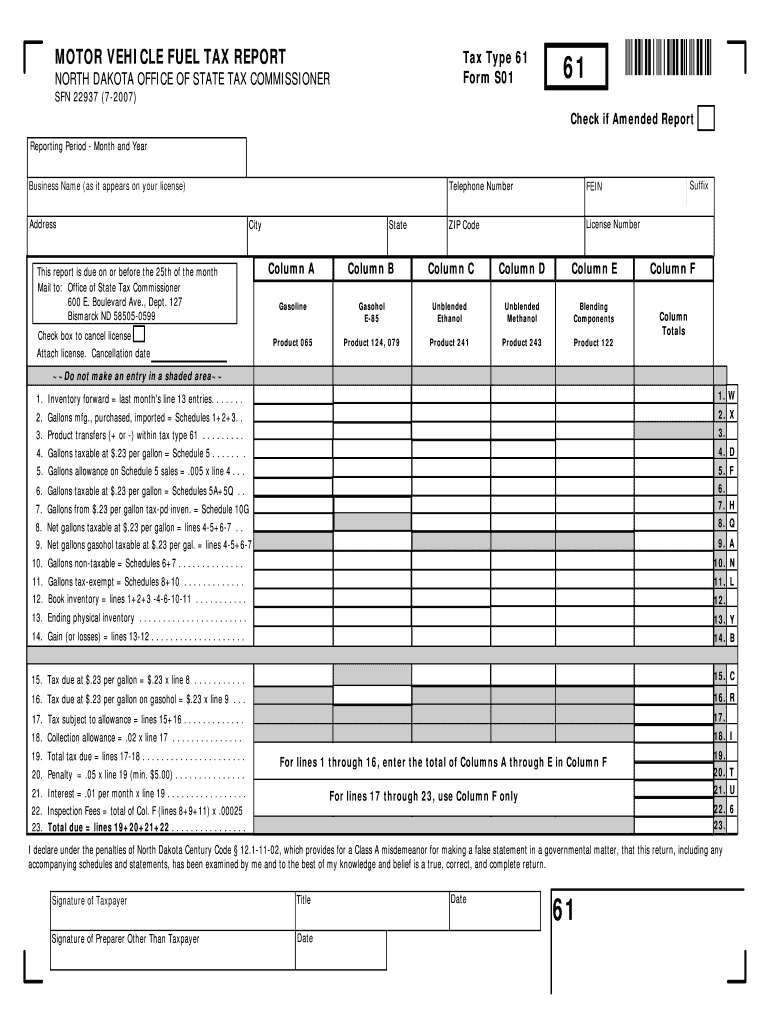

This report is used to detail and calculate the total fuel tax due based on gasoline and other fuel types for businesses in North Dakota, including the inventory and sales data for these products.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor vehicle fuel tax

Edit your motor vehicle fuel tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor vehicle fuel tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor vehicle fuel tax online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit motor vehicle fuel tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor vehicle fuel tax

How to fill out MOTOR VEHICLE FUEL TAX REPORT

01

Gather all relevant fuel purchase receipts and documentation.

02

Determine the reporting period for the fuel tax.

03

Fill in the business name and address at the top of the report.

04

Enter the total gallons of fuel purchased during the reporting period.

05

Calculate the taxable gallons based on state regulations.

06

Include any fuel used for tax-exempt purposes, if applicable.

07

Calculate the total motor vehicle fuel tax due by applying the tax rate.

08

Review the report for accuracy and completeness.

09

Sign and date the report.

10

Submit the report to the appropriate tax agency by the deadline.

Who needs MOTOR VEHICLE FUEL TAX REPORT?

01

Businesses that operate motor vehicles and purchase fuel for business purposes.

02

Companies transporting goods or providing services requiring fuel.

03

Certain governmental entities that manage fleets of vehicles.

04

Individuals or entities eligible for fuel tax refunds or credits.

Fill

form

: Try Risk Free

People Also Ask about

What is required for IFTA reporting?

What the Report Includes. The exact form may differ slightly by state. However, all reports require a significant amount of fuel and mileage data broken down for each jurisdiction traveled. You must document total IFTA miles, non-IFTA miles, taxable miles, miles per gallon (MPG) for indicated fuel types.

How do I claim my motor fuel tax refund in Illinois?

You may file a claim for refund by completing and submitting Form RMFT-11-A. If you already have a Motor Fuel Refund account with the Illinois Department of Revenue, you may also submit your claim electronically using MyTax Illinois.

What is a fuel tax report?

At the end of the quarter a fuel tax report is completed that shows miles traveled and gallons of fuel for each region. IFTA assists in calculating the amount of tax due or tax credit for each state, to determine the tax liability for each and to oversee the distribution of funds ingly.

Who qualifies for fuel tax credit?

The credit is available only for nontaxable uses of gasoline, aviation gasoline, undyed diesel and undyed kerosene. Nontaxable uses are purposes where fuel isn't used for regular driving purposes, such as: On a farm for farming purposes.

How do I claim gas on my tax return?

The Form SCGR-1 and all related schedules must be completed and submitted to our office within three (3) years from the date of gasoline purchase before a refund can be considered. Schedules A and B/C are required with all claims for refund. Schedule D is required for claims utilizing the inventory method.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MOTOR VEHICLE FUEL TAX REPORT?

The Motor Vehicle Fuel Tax Report is a document that assesses the fuel taxes owed by motor vehicle operators and companies. It details the amount of fuel consumed and the tax liability based on that consumption.

Who is required to file MOTOR VEHICLE FUEL TAX REPORT?

Companies and individuals who purchase, produce, or sell motor vehicle fuels are typically required to file the Motor Vehicle Fuel Tax Report. This includes fuel distributors, retailers, and fleet operators.

How to fill out MOTOR VEHICLE FUEL TAX REPORT?

To fill out the Motor Vehicle Fuel Tax Report, follow the guidelines provided by your local tax authority. Gather data on fuel purchases, sales, and any exemptions. Complete the form with the required information, ensuring accuracy before submission.

What is the purpose of MOTOR VEHICLE FUEL TAX REPORT?

The purpose of the Motor Vehicle Fuel Tax Report is to ensure compliance with fuel tax regulations, facilitate the collection of taxes owed on fuel sales, and enable governments to allocate funding for transportation infrastructure.

What information must be reported on MOTOR VEHICLE FUEL TAX REPORT?

The information that must be reported on the Motor Vehicle Fuel Tax Report includes the total gallons of fuel sold, the type of fuel, applicable tax rates, exemptions claimed, and any other relevant details as specified by the tax authority.

Fill out your motor vehicle fuel tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Vehicle Fuel Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.