Canada T2201 E 2015 free printable template

Show details

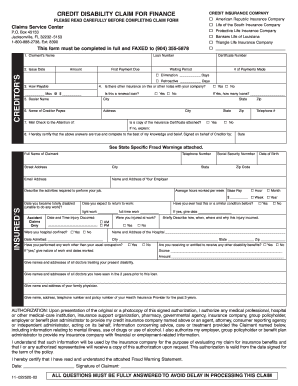

T2201 E 15 Vous pouvez obtenir ce formulaire en fran ais www. arc.gc.ca/formulaires ou en composant le 1-800-959-7383. Clear Data Help Protected B when completed Disability Tax Credit Certificate Use this form to apply for the disability tax credit DTC. Being eligible for this credit may reduce your income tax and open the door to other programs. For more information go to www. cra*gc*ca/dtc* Step 1 Complete only the sections of Part A that apply to you. Remember to sign this form* Step 2 Ask...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T2201 E

Edit your Canada T2201 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2201 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T2201 E online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada T2201 E. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2201 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2201 E

How to fill out Canada T2201 E

01

Obtain the Canada T2201 E form from the Canada Revenue Agency website or a local tax office.

02

Fill out Part A: "General Information" including your personal details like name, address, and contact information.

03

Complete Part B: "Certification" where you will need to provide information about your condition and how it affects your daily life.

04

Ensure that your doctor provides their details and signs the form in the appropriate section to certify your condition.

05

Review the form to ensure that all sections are completed accurately and legibly.

06

Submit the completed T2201 E form to the Canada Revenue Agency either by mail or electronically if possible.

Who needs Canada T2201 E?

01

Individuals with disabilities who are applying for the Disability Tax Credit in Canada.

02

Caregivers of individuals with disabilities who may benefit from tax credits associated with their care.

03

Anyone who has a medical condition that significantly impairs their ability to perform daily activities.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for the Disability Tax Credit Canada?

You may be eligible for the DTC if a medical practitioner certifies that you have a severe and prolonged impairment in 1 of the categories, significant limitations in 2 or more categories, or receive therapy to support a vital function.

How do I get the Canadian disability tax credit?

You may be eligible for the DTC if a medical practitioner certifies that you have a severe and prolonged impairment in 1 of the categories, significant limitations in 2 or more categories, or receive therapy to support a vital function.

Is the Canadian disability tax credit retroactive?

The Disability tax credit can be paid in a few ways: Adult retroactive payments: the CRA will reassess taxes paid during the period of eligibility and send you a one-time payment for all retroactive years.

How does Canada disability tax credit work?

The disability tax credit (DTC) is a non-refundable tax credit that helps people with impairments, or their supporting family member, reduce the amount of income tax they may have to pay. If you have a severe and prolonged impairment, you may apply for the credit.

How do I get a T2201 form?

The Disability Tax Credit Certificate T2201 is available to download on the CRA's website. On this page you will find two versions of the T2201 form: The first is a simple PDF version (t2201-21e. pdf), which can be printed and taken to your medical practitioner.

Where do I get a T2201 form?

The Disability Tax Credit Certificate T2201 is available to download on the CRA's website. On this page you will find two versions of the T2201 form: The first is a simple PDF version (t2201-21e. pdf), which can be printed and taken to your medical practitioner.

How much refund will I get for disability tax credit?

How much can you claim for the disability tax credit? For 2022, the federal non-refundable disability amount is: $8,870 for an adult. up to $5,174 for an additional supplement,* if the person with the disability is a child under 18.

How much do you get back for disability tax credit Canada?

If you were eligible for the DTC in past years but did not claim the disability amount, you may be able to claim it going back up to 10 years.Amounts you may claim for the past 10 years. YearDisability amountSupplement for children (17 and younger)2020$8,576$5,0032019$8,416$4,9092018$8,235$4,8048 more rows

How far back will CRA pay disability tax credit?

The DTC eligibility can go unlimited years in the past but the CRA can only reassess up to 10 years retroactively.

How is DTC refund calculated?

HOW IS THE DTC CALCULATED? Each government allows taxpayers to reduce their taxes payable by a percentage of their non-refundable tax credits. The federal government rate is 15%. The federal DTC is calculated by multiplying by the base amount by 15%.

What is CRA Form T2201?

T2201 Disability Tax Credit Certificate.

How long does it take CRA to process disability tax credit?

The CRA aims to process your application and mail you a notice of determination within 8 weeks of receiving it. It may take longer if information is missing. If you send your application with your tax return, the CRA will review your application before assessing your income tax return.

What is a T2201 form?

Medical practitioners may complete Part B of Form T2201, Disability Tax Credit Certificate using the DTC digital application. The digital application was updated to reflect expanded eligibility criteria for mental functions and life-sustaining therapy.

Does the disability tax credit give you money back?

The disability tax credit (DTC) is a non-refundable tax credit that helps people with impairments, or their supporting family member, reduce the amount of income tax they may have to pay.

How much do you get back for disability tax credit Canada?

Claiming for past years YearDisability amountSupplement for children (17 and younger)2020$8,576$5,0032019$8,416$4,9092018$8,235$4,8042017$8,113$4,7337 more rows

Is there a tax credit for type 2 diabetes?

The DTC is a non-refundable tax credit that helps people with disabilities or requiring a life-sustaining therapy, or caregivers reduce their income taxes. People who have diabetes and use insulin typically apply for the DTC under the category of life-sustaining therapy.

Does Type 2 diabetes qualify for disability tax credit in Canada?

The DTC is available to individuals with diabetes using insulin whose doctor certifies that they spend at least 14 hours per week on specific activities related to determining and administering insulin. You can access the DTC form T2201 here.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada T2201 E to be eSigned by others?

When you're ready to share your Canada T2201 E, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get Canada T2201 E?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific Canada T2201 E and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete Canada T2201 E on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your Canada T2201 E. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is Canada T2201 E?

Canada T2201 E is a form used to apply for the Disability Tax Credit (DTC) in Canada, which assists individuals with disabilities by reducing their taxable income.

Who is required to file Canada T2201 E?

Individuals who have a severe and prolonged impairment in physical or mental functions and wish to claim the Disability Tax Credit are required to file Canada T2201 E.

How to fill out Canada T2201 E?

To fill out Canada T2201 E, individuals must provide personal information, details about the disability, and have a qualified healthcare professional complete the certification section confirming the impairment.

What is the purpose of Canada T2201 E?

The purpose of Canada T2201 E is to certify an individual's eligibility for the Disability Tax Credit, which helps reduce income tax for those living with disabilities.

What information must be reported on Canada T2201 E?

The form requires personal details of the applicant, specific information about the disability, a description of how it impacts daily life, and a certification from a qualified medical practitioner.

Fill out your Canada T2201 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2201 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.