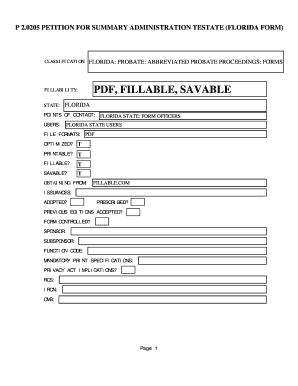

Get the free form fl et30

Show details

Justin US Law US Codes and Statutes Florida Statutes 2014 Florida Statutes TITLE CLII ESTATES AND TRUSTS Chapter 735 PROBATE CODE: SMALL...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form fl et30

Edit your form fl et30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form fl et30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form fl et30 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form fl et30. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form fl et30

How to Fill Out Form FL ET30:

01

Start by carefully reading the instructions provided on the form. Make sure you understand the purpose and requirements of Form FL ET30 before proceeding.

02

Begin by entering the necessary personal information in the designated fields. This may include your name, address, contact details, and any other information specifically requested on the form.

03

Pay close attention to any sections that require you to provide specific dates or numerical figures. Double-check your entries to ensure accuracy and completeness.

04

If the form requires you to provide information about a specific event or transaction, provide all the relevant details. Be thorough and provide any supporting documentation if required.

05

Make sure to sign and date the form where indicated. Failure to do so may result in the form being deemed incomplete or invalid.

06

Review the completed form before submitting it. Ensure all sections have been filled out correctly and that no errors or omissions are present. If necessary, make any necessary corrections or revisions.

Who Needs Form FL ET30:

01

Form FL ET30 is typically required by individuals or businesses who need to report and remit taxes on certain transactions, such as the sale of tobacco products or electronic cigarettes.

02

Retailers and distributors involved in the sale of tobacco products may be required to fill out Form FL ET30 to report and pay the appropriate taxes to the relevant tax authorities.

03

Form FL ET30 may also be required by wholesalers or manufacturers who engage in the sale or distribution of tobacco products.

Remember, it's important to consult with the relevant tax authorities or seek professional advice if you are unsure about the specific circumstances under which Form FL ET30 needs to be filled out.

Fill

form

: Try Risk Free

People Also Ask about

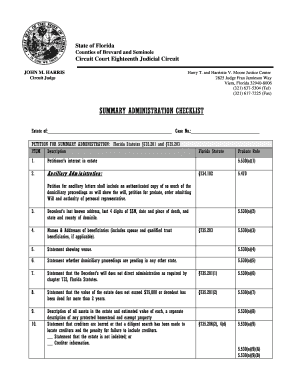

How much does a summary administration cost in Florida?

Most attorneys will charge a flat fee for summary administration, which can range from $1,500 to $3,500 depending on the nature of the assets within the estate, outstanding creditor claims, and the number of beneficiaries listed.

Who can file a Petition for summary administration in Florida?

The petition for summary administration may be filed by any beneficiary or by a person nominated as a personal representative by the decedent's will, but must be signed and verified by the surviving spouse (if any).

What is a summary administration form for probate in Florida?

The Petition for Summary Administration is a document used for Summary Administration. This is a more “expedited” version of probate. Summary administration is only available if the estate is valued at less than $75,000 worth of assets or in cases where the decedent has been deceased for more than two years.

What is a formal probate in Florida?

As its name suggests, formal administration is the type of probate required in most cases when a Florida resident passes away. In essence, formal administration is required when the decedent's assets are worth more than $75,000 or the decedent has been dead for less than two years.

What is a petition for formal administration in Florida probate?

A Petition for Formal Administration is the standard document used to open a probate case in Florida. Formal Administration refers to the “standard” probate process used for most estates in the State of Florida after someone passes away.

What is a Petition for formal probate in Florida?

The Petition for Administration is the document filed in a Florida probate court seeking to open the estate of a deceased person. The Petition seeks a couple of things. First, it seeks to have a Will–if there is one–admitted to probate. If there is no Will, then it seeks to open an intestate estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form fl et30?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form fl et30. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the form fl et30 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your form fl et30.

How do I edit form fl et30 on an iOS device?

Create, modify, and share form fl et30 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is form fl et30?

Form FL ET30 is a tax form that is used for reporting certain tax-related information in the state of Florida.

Who is required to file form fl et30?

Generally, businesses operating in Florida that meet specific criteria and have certain tax obligations are required to file Form FL ET30.

How to fill out form fl et30?

To fill out Form FL ET30, businesses must provide accurate information as requested on the form, including their tax identification number, financial details, and any other pertinent information as specified.

What is the purpose of form fl et30?

The purpose of Form FL ET30 is to ensure compliance with state tax laws and to report relevant financial information to the Florida Department of Revenue.

What information must be reported on form fl et30?

The information that must be reported on Form FL ET30 includes the business's tax identification number, income, expenses, tax obligations, and any other details as required by the Florida Department of Revenue.

Fill out your form fl et30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Fl et30 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.