Get the free MOTOR VEHICLE DEALER BOND - mvdb vipnet

Show details

Este formulario es utilizado por un solicitante de licencia de concesionario para vender vehículos de motor para verificar ante la Junta de Concesionarios de Vehículos Motorizados que ha obtenido

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor vehicle dealer bond

Edit your motor vehicle dealer bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor vehicle dealer bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing motor vehicle dealer bond online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit motor vehicle dealer bond. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor vehicle dealer bond

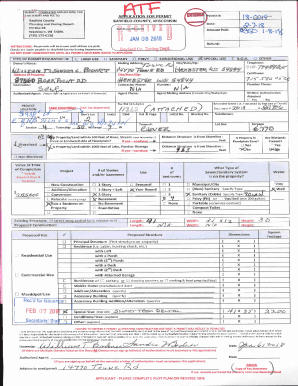

How to fill out MOTOR VEHICLE DEALER BOND

01

Obtain the appropriate bond form from a surety company or online.

02

Fill in your business name, address, and other required information on the bond form.

03

Specify the bond amount that meets your state’s regulations for motor vehicle dealers.

04

Provide any additional information or documentation that may be required by the surety company.

05

Sign the bond form in the designated area.

06

Submit the completed bond form along with the required premium payment to the surety company.

07

Receive your MOTOR VEHICLE DEALER BOND once the application is processed and approved.

Who needs MOTOR VEHICLE DEALER BOND?

01

Individuals or businesses looking to operate as motor vehicle dealers.

02

Dealers who are required to be licensed in their respective states.

03

Those seeking to protect consumers against dealership fraud or misconduct.

Fill

form

: Try Risk Free

People Also Ask about

What is the auto dealer bond in Texas?

The Texas Department of Motor Vehicles (TxDMV) requires a $50,000 auto dealer bond for independent dealerships. This bond ensures motor vehicle dealers follow state laws and ethical business practices. Without it, a dealership can't get or keep a state license. Texas dealers must secure this bond for legal operation.

What is the $25,000 dealer bond in Florida?

The $25,000 Florida Motor Vehicle Dealer Bond is a licensing requirement for auto dealers operating in the state. The Florida Department of Highway Safety and Motor Vehicles (FLHSMV) utilizes the bond as a financial safeguard for the consumers' benefit from damages arising from misleading or criminal dealer activities.

What is a vehicle surety bond Texas?

A Texas bonded title is a vehicle title backed by a surety bond which is a type of insurance you're sometimes required to purchase as proof you're the legal owner of a vehicle. A bonded title is required when the original vehicle title is filled out incorrectly, damaged and illegible, or the original title is missing.

How do I get a motor vehicle bond in California?

Follow this step-by-step process to get a California car title bond and become the legal owner of your vehicle. Fill out an application with the California DMV. Fill out a Statement of Facts form. A DMV representative must inspect your vehicle. Get your vehicle appraised.

What is a Texas auto dealer bond?

The bond is used to provide financial protection for consumers should businesses (including independent motor vehicle, motorcycle, wholesale, and independent mobility dealers) fail to abide by licensing requirements, such as transferring a clean title.

How much is a dealer surety bond in Texas?

Most dealers are required to obtain a $50,000 motor vehicle dealer surety bond, which is like an insurance policy for the dealer's customers and is the only acceptable form of security.

How much is a $50,000 surety bond in Texas?

Frequently Asked Questions about Surety Bonds in Texas For a $50,000 bond, you could expect to pay between $500 and $5,000 as the premium. In the case of bail bonds, this fee is generally around 10%, which means you'd likely pay $5,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MOTOR VEHICLE DEALER BOND?

A Motor Vehicle Dealer Bond is a type of surety bond that is required for individuals or businesses that deal in the sale of motor vehicles. It serves as a financial guarantee that the dealer will comply with state laws and regulations.

Who is required to file MOTOR VEHICLE DEALER BOND?

Individuals or businesses applying for a motor vehicle dealer license are typically required to file a Motor Vehicle Dealer Bond as part of the licensing process.

How to fill out MOTOR VEHICLE DEALER BOND?

To fill out a Motor Vehicle Dealer Bond, the dealer must provide information about their business, including the business name, address, and the specifics of the bond such as the bond amount and duration. Proper signatures from the dealer and the surety company are also required.

What is the purpose of MOTOR VEHICLE DEALER BOND?

The purpose of a Motor Vehicle Dealer Bond is to protect consumers and the state by ensuring that dealers adhere to regulations, conduct business ethically, and fulfill their financial obligations.

What information must be reported on MOTOR VEHICLE DEALER BOND?

The information typically reported on a Motor Vehicle Dealer Bond includes the bond number, the principal's name (dealer), the surety company's details, the bond amount, and the terms of the bond including the effective date and expiration.

Fill out your motor vehicle dealer bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Vehicle Dealer Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.