SSA SSA-L9790-SM 2015-2025 free printable template

Show details

Social Security Administration Retirement, Survivors and Disability Insurance Important Information 9790R0000025 T0001 JERRY L RITZ 1079 STARTED ROAD PUNXSUTAWNEY, PA 157674230 DFTFDTTDTATDAATTAFFTTFTFFTTFFTFTTATTAADAFATFFATFADDADAFDADFTTTFTA

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ssal9790sm download printable form

Edit your 2015 ssa ssal9790sm form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ssal9790sm download fill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ssal9790sm file printable online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ssal9790sm download pdffiller form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA SSA-L9790-SM Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ssa l9790 sm

How to fill out SSA SSA-L9790-SM

01

Gather necessary personal information, including your Social Security number and contact information.

02

Read the instructions carefully before starting to fill out the form.

03

Complete Section 1 by providing information about the individual whose claim you are submitting.

04

In Section 2, indicate your relationship to the individual and your contact details.

05

Fill out Section 3 with any additional medical, social, or financial information that may support the claim.

06

Review all the information for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the form via mail or in person to the appropriate Social Security Administration office.

Who needs SSA SSA-L9790-SM?

01

Individuals who are applying for Social Security benefits, or their representatives who are assisting with the application process.

Fill

ssa l9790 sm instructions

: Try Risk Free

People Also Ask about

How do I get the $16728 Social Security bonus?

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

Can I see my Social Security statement online?

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

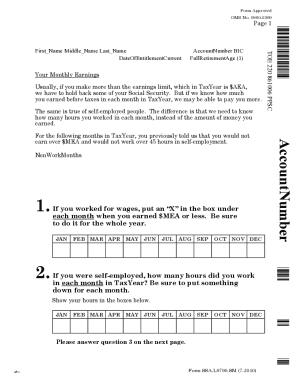

What is form SSA L9790 SM?

Beneficiary completes Form SSA-L9790. The beneficiary completes the SSA-L9790 to provide the months he or she earned less than the monthly exempt amount, the number of hours he or she was engaged in self-employment, and whether he or she stopped working during the year(s) in question.

What is the purpose of SSA form?

An SSA-1099 is a tax form we mail each year in January to people who receive Social Security benefits. It shows the total amount of benefits you received from us in the previous year so you know how much Social Security income to report to the Internal Revenue Service on your tax return.

Is SSA-1099 income taxable?

The taxable portion of Social Security benefits is never more than 85% of the net benefits the taxpayer received. In many cases, the taxable portion is less than 50%. If the taxpayer files a joint return, enter the amounts from each Form SSA-1099 and the software will compute the portion that is taxable, if any.

What is Form SSA L9781 SM?

Form SSA-L9781 Retirement, Survivors and Disability Insurance: Earnings.

How do I get my lifetime earnings statement from Social Security?

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SSA SSA-L9790-SM from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including SSA SSA-L9790-SM, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for signing my SSA SSA-L9790-SM in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your SSA SSA-L9790-SM right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out SSA SSA-L9790-SM on an Android device?

Complete your SSA SSA-L9790-SM and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is SSA SSA-L9790-SM?

SSA SSA-L9790-SM is a form used by the Social Security Administration for specific reporting purposes related to Social Security benefits.

Who is required to file SSA SSA-L9790-SM?

Individuals or organizations involved in managing or reporting Social Security benefits may be required to file SSA SSA-L9790-SM.

How to fill out SSA SSA-L9790-SM?

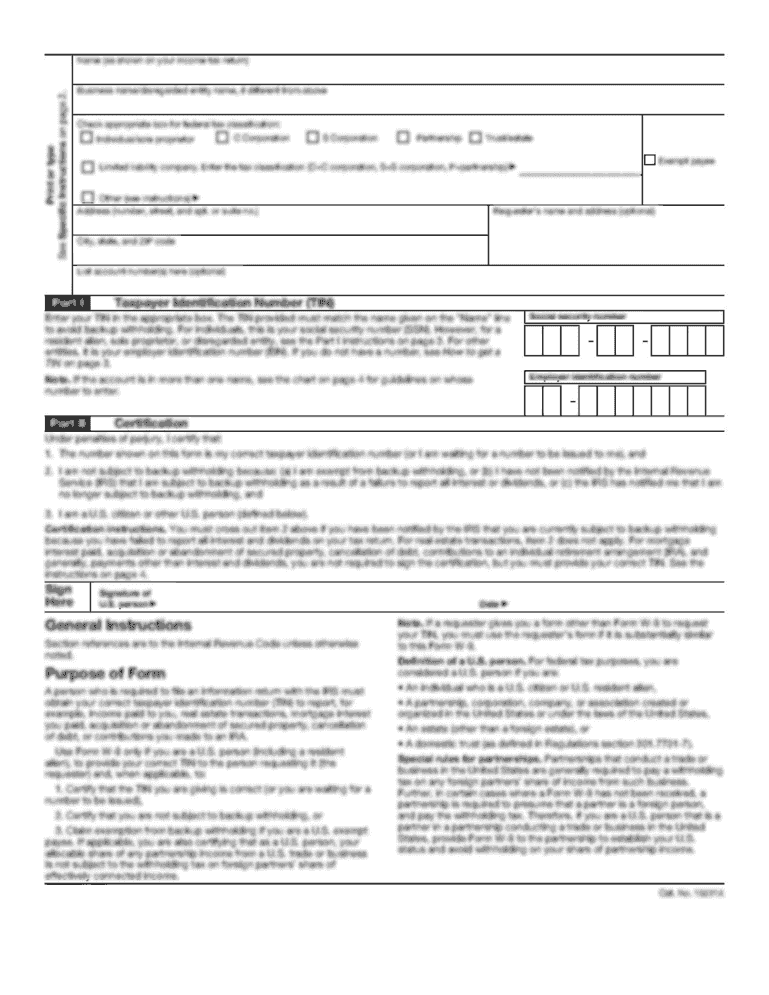

To fill out SSA SSA-L9790-SM, you need to provide personal information, details about the individual receiving benefits, and any relevant income or eligibility information as instructed in the form guidelines.

What is the purpose of SSA SSA-L9790-SM?

The purpose of SSA SSA-L9790-SM is to collect necessary data to assess eligibility, benefits, and any changes in circumstances that affect Social Security benefits.

What information must be reported on SSA SSA-L9790-SM?

Information that must be reported on SSA SSA-L9790-SM includes personal details of the applicant, information regarding any dependents, income details, and circumstances affecting eligibility for benefits.

Fill out your SSA SSA-L9790-SM online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA SSA-l9790-SM is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.