Get the free ca form 593 2017

Show details

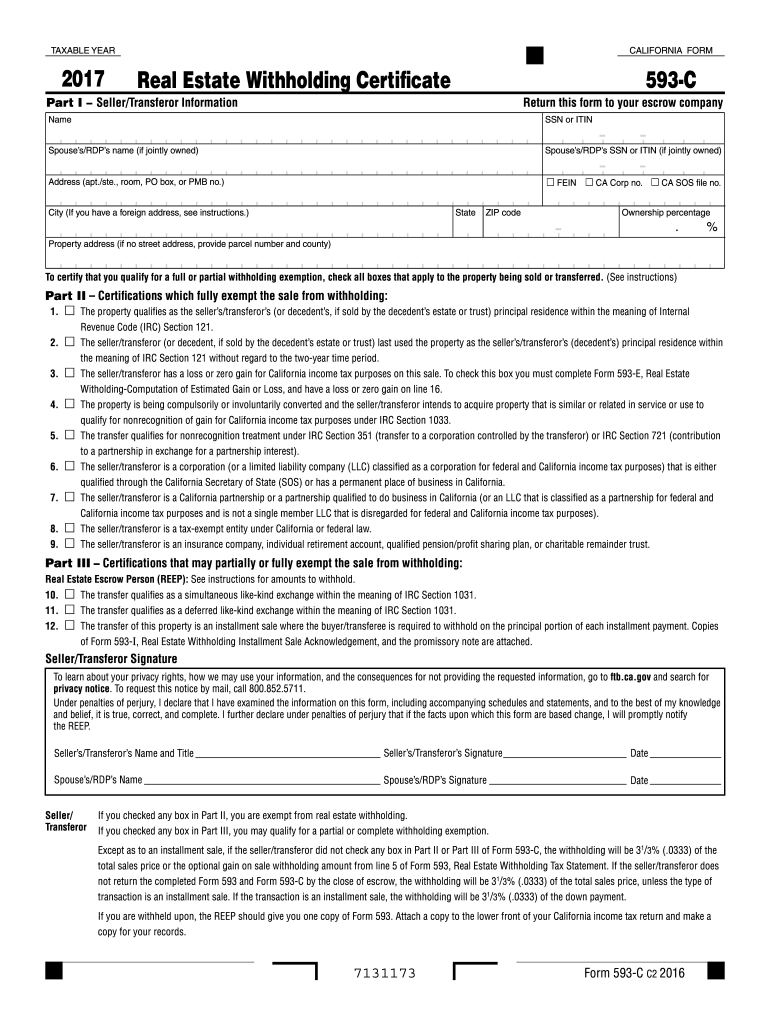

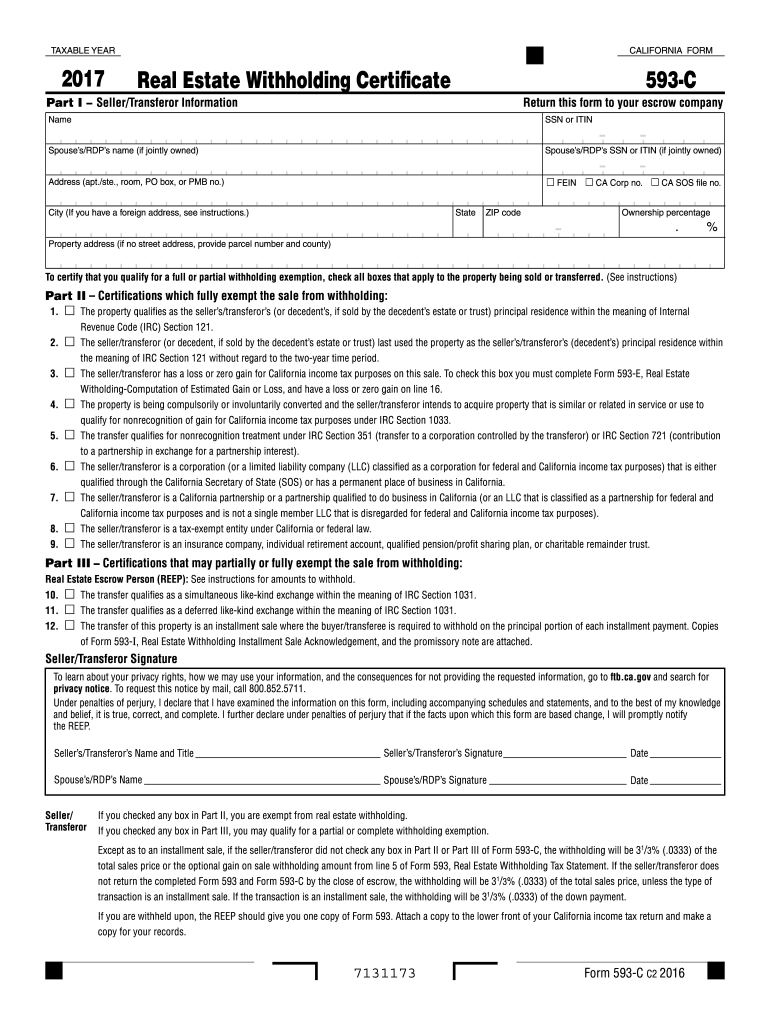

TAXABLE YEAR CALIFORNIA FORM 593-C Real Estate Withholding Certificate Part I Seller/Transferor Information Return this form to your escrow company Name SSN or ITIN Spouse s/RDP s name if jointly owned Spouse s/RDP s SSN or ITIN if jointly owned Address apt. /ste. room PO box or PMB no. FEIN CA Corp no. CA SOS file no. City If you have a foreign address see instructions. 7131173 Form 593-C C2 2016 2017 Instructions for Form 593-C References in these instructions are to the Internal Revenue...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ca form 593 2017

Edit your ca form 593 2017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca form 593 2017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ca form 593 2017 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ca form 593 2017. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ca form 593 2017

How to fill out CA FTB 593-C

01

Obtain a copy of the CA FTB 593-C form from the California Franchise Tax Board website.

02

Fill out the top section with your name, address, and Social Security Number or Employer Identification Number.

03

Indicate your role in the transaction such as buyer or seller.

04

Provide the property address and the date of the sale.

05

Record the total selling price of the property.

06

Complete the specific sections regarding tax withheld as required.

07

Review the form for any errors or omissions.

08

Sign and date the form before submission.

Who needs CA FTB 593-C?

01

Any individual or entity that has sold real property in California that is subject to withholding requirements must file CA FTB 593-C.

02

The form is typically needed by sellers or their representatives to report the transaction to the California Franchise Tax Board.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 593 used for?

The grantor reports the real estate sale and claims the withholding on their tax return. Unless the grantor qualifies for an exemption, complete Form 593 using the grantor's information.

Where do I enter Form 593?

To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return, Withholding (Form 592-B and/or 593). Attach one copy of Form(s) 593, to the lower front of your California tax return. Make a copy for your records.

Who needs to file Form 593?

Who Must File. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file Form 593. Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.

Who is required to withhold tax on the California real estate sale?

Real estate withholding is required on the sale of CA real property held by a trust unless the trust can qualify for an exemption on Form 593. There are two types of trusts; a grantor and a nongrantor trust.

Under which circumstance may withholding be required?

within the same escrow agreement constitute one transaction for purposes of determining the withholding requirements. Withholding is required when the combined sales price of all parcels exceeds $100,000, even though the sales price of each separate parcel in the same escrow transaction is under $100,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ca form 593 2017?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific ca form 593 2017 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in ca form 593 2017 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your ca form 593 2017, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit ca form 593 2017 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing ca form 593 2017, you need to install and log in to the app.

What is CA FTB 593-C?

CA FTB 593-C is a form used by the California Franchise Tax Board (FTB) for reporting the sale of California real property and the withholding on that sale.

Who is required to file CA FTB 593-C?

The seller of California real property is required to file CA FTB 593-C if they are a non-resident of California or if withholding is required under California tax law.

How to fill out CA FTB 593-C?

To fill out CA FTB 593-C, you need to provide information about the buyer and seller, the sale price, the calculated withholding amount, and any exemptions that may apply.

What is the purpose of CA FTB 593-C?

The purpose of CA FTB 593-C is to ensure that California collects withholding tax from the sale of real property by non-residents, helping to ensure tax compliance.

What information must be reported on CA FTB 593-C?

The information that must be reported on CA FTB 593-C includes the names and addresses of the buyer and seller, the sale price of the property, the amount of withheld tax, and any applicable exemptions.

Fill out your ca form 593 2017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ca Form 593 2017 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.