Get the free performance bond example

Show details

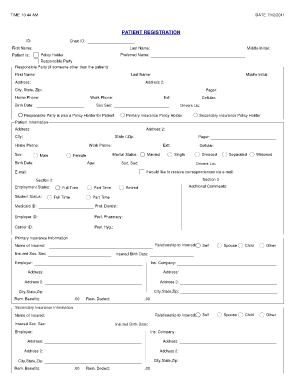

EXAMPLE PERFORMANCE BOND Landscaping and Irrigation Bond No: Project Name: Land use Permit No: Building Permit No: WHEREAS, (Name of entity posting the bond, ex. Union Hill Development, LLC, hereinafter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign example of performance bond

Edit your performance bond sample pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your performance bond template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing performance bond sample online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit performance bond คือ. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out performance bond example

How to fill out performance bond example?

01

Gather all necessary information and documentation such as project details, contractor information, and bonding requirements.

02

Complete the performance bond form by filling in the required fields accurately and thoroughly. This may include providing details on the project scope, start and end dates, contract amount, and specific terms and conditions.

03

Ensure that the form is signed by both the contractor and the bonding company, or any other required parties.

04

Attach any supporting documents or additional information that may be requested, such as financial statements, resumes, or project plans.

05

Review the completed form and all attached documents for any errors or missing information, and make any necessary corrections or additions.

06

Submit the filled out performance bond form and any other required documents to the appropriate party or authority.

Who needs performance bond example?

A performance bond example is beneficial for various parties involved in construction projects, including:

01

Contractors: Contractors need performance bond examples to understand the required information and format when filling out and submitting the actual performance bond form. It helps them ensure compliance with the bonding requirements stated in their contracts.

02

Project Owners: Project owners may require contractors to provide a performance bond as a safeguard against potential non-performance or breach of contract. Having access to a performance bond example helps them understand the contents and the necessary information to include in the bond form.

03

Bonding Companies: Bonding companies issue performance bonds and assess the risk associated with the specific project. Having access to performance bond examples helps bonding companies ensure that contractors provide accurate and comprehensive information when applying for a bond.

04

Construction Managers: Construction managers oversee various construction projects and may need to review and approve performance bond forms. Performance bond examples assist them in assessing the completeness and accuracy of the provided information.

Having access to a performance bond example can be beneficial for all parties involved in the construction process as it provides a clear understanding of the requirements and expectations when filling out the actual performance bond form.

Fill

form

: Try Risk Free

People Also Ask about

What are the 2 types of performance bond?

There are two types of performance bond: "On Demand" and "Conditional". On Demand Bonds are rarely used in the UK construction industry, but they are a standard requirement in many international contracts, as well as in the petroleum and power industries within the UK.

What is a performance bond?

A performance bond, also known as a contract bond, is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. The term is also used to denote a collateral deposit of good faith money, intended to secure a futures contract, commonly known as margin.

How does performance bond work?

Performance bonds are refundable, but it depends on the situation. Generally speaking, when you purchase a bond it is considered “fully earned” for its first term.

How Long Does a Performance Bond Last?

A performance bond is a financial guarantee to one party in a contract against the failure of the other party to meet its obligations. It is also referred to as a contract bond. A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

What is a performance bond and how does it work?

A performance bond is a type of contract construction bond that guarantees a contractor will complete a project ing to the terms outlined in a contract by the project owner, also called the obligee. The obligee can be a city, state, or local government, as well as the federal government or a private developer.

Who benefits from a performance bond?

Disadvantages of Performance Bonds A surety may accuse an owner of not complying with a bond agreement to avoid paying the owner. Another disadvantage is underestimating losses which means getting less money from a surety to complete the project. A surety may also try to settle for the least expensive solution.

What is a typical performance bond rate?

What is the Average Performance Bond Rate? The typical rates and costs can range from 1% – 5%. This is only a general estimate, while an expert contractor may get lower bond rates than someone with poor credit issues or financial deficiencies.

How Much Does a Performance Bond Cost?

Performance bonds, which are secured by a contractor before the beginning of a project, provide a guarantee to the project owner that contract obligations will be fulfilled. If the contractor fails to complete work ing to the contract terms, the property owner may be financially compensated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out performance bond example using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign performance bond example and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out performance bond example on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your performance bond example. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit performance bond example on an Android device?

You can make any changes to PDF files, like performance bond example, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is performance bond example?

A performance bond example is a guarantee provided by a surety company that a contractor will fulfill their contractual obligations. For instance, a contractor awarded a state construction project may provide a performance bond that ensures the project will be completed according to the contract specifications.

Who is required to file performance bond example?

Typically, contractors involved in government contracts or large construction projects are required to file a performance bond. This ensures that the project owner is protected in case the contractor fails to meet their obligations.

How to fill out performance bond example?

To fill out a performance bond, you need to provide details such as the names and addresses of the principal (contractor), the surety company, and the obligee (project owner), along with the project description, bond amount, and relevant dates. It's important to ensure that all parties sign the document.

What is the purpose of performance bond example?

The purpose of a performance bond is to protect the project owner against financial loss if the contractor fails to complete the project or meet the agreed-upon specifications. It assures that the contractor will fulfill their duties as outlined in the contract.

What information must be reported on performance bond example?

The information that must be reported on a performance bond includes the names and contact details of the contractor and surety company, the name and address of the project owner, the bond amount, project description, and terms of the bond, including any conditions or penalties for non-compliance.

Fill out your performance bond example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Performance Bond Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.