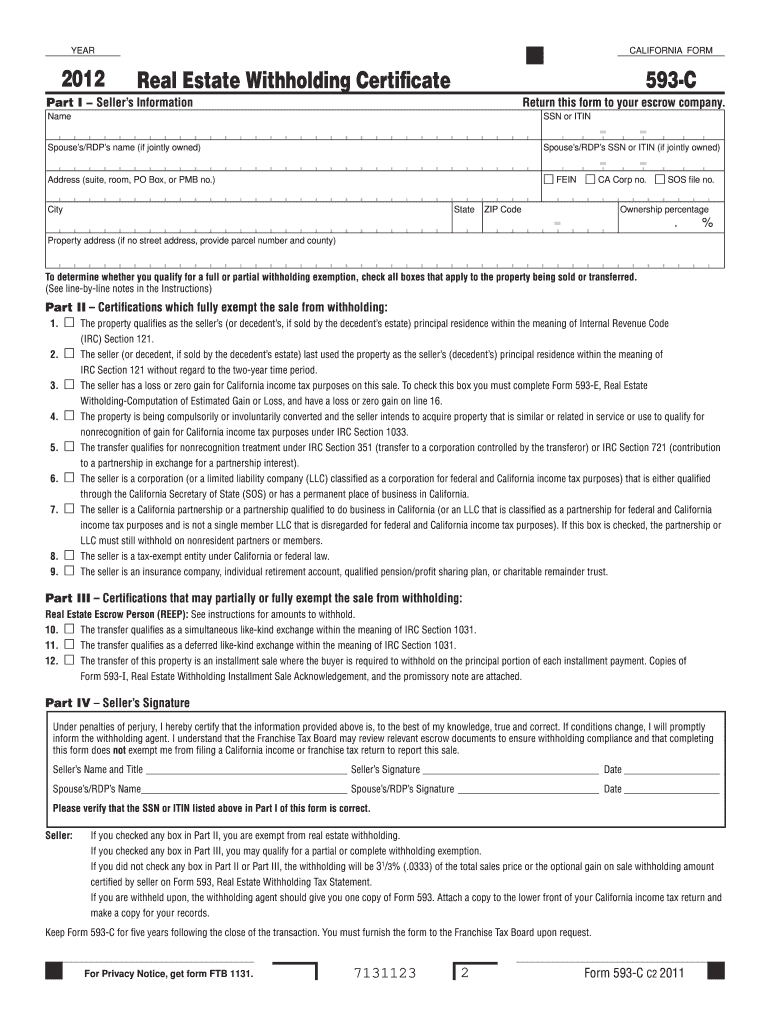

Who needs form 593-C?

Form 593-C is also known as the Real Estate Withholding Certificate. It is requested by the California Franchise Tax Board (FT) from local taxpayers who have already transferred or sold real property over the past year. It doesn’t exempt the filer from filing a California Income Tax Return, even if the tax withholding is approved.

What is form 593-C for?

If your application for tax exemption was approved, you need to return a completed form 593-C to the escrow company and inform another party of the fact that this sale or transfer of real property is fully or partially exempt from tax withholding. You can also use this form to determine if you qualify for full or partial exemption.

Is it accompanied by other forms?

There are no specific requirements. However, this form contains detailed instructions with a list of forms you can use to claim your withholding on, such as forms 540, 540NR, 541, 100. 100S, 100W, 109, 565, 568.

When is form 593-C due?

You should file this form before the close of escrow to prevent withholding on the transaction.

How do I fill out a form 593-C?

Provide your name and your spouse’s name and both your contacts and addresses in the upper box. Don’t forget to write down the address of the property that is the subject of sale or transfer in the bottom line of this box. Choose the sentence that applies to your situation from those given on the list in Part II, ‘Certifications which fully exempt the sale from withholding’. Do the same in Part III, ‘Certifications that may partially or fully exempt the sale from withholding’. Both you and your spouse must add signatures at the bottom of this form.

Where do I send it?

Send the completed 593-C to your escrow company.