Get the free Publication 523 - IRS.gov

Show details

Apr 5, 2018 ... supply of power along with the target year fixed for electricity to all? .... Region (NEW) through various interregional AC links at 220kV, 400KV, 765kV Cleveland .... construction

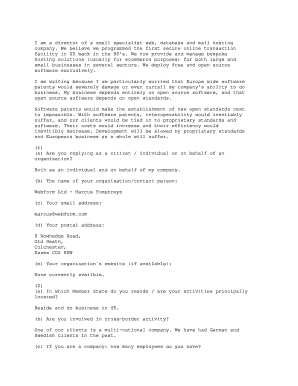

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 523 - irsgov

Edit your publication 523 - irsgov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 523 - irsgov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 523 - irsgov online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit publication 523 - irsgov. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 523 - irsgov

How to fill out publication 523 - irsgov:

01

Start by reading through the publication thoroughly to understand its purpose and the specific instructions provided by the IRS.

02

Gather all the necessary documentation and financial information related to the topic that publication 523 covers, which is "Selling Your Home."

03

Review the eligibility criteria and determine if you qualify for any tax benefits or deductions mentioned in the publication.

04

Follow the step-by-step instructions provided in the publication to fill out the respective forms accurately and completely.

05

Pay attention to any specific deadlines or requirements mentioned that might affect the filing process.

06

If you have any doubts or questions, consider seeking guidance from a tax professional or contacting the IRS for clarification.

Who needs publication 523 - irsgov:

01

Individuals who are planning to sell their primary residence or a property that they used as their primary residence at some point.

02

Homeowners who want to understand the various tax implications, benefits, and deductions associated with selling a home.

03

Individuals who want to learn about the eligibility criteria and exemptions related to the exclusion of capital gains from the sale of a primary residence.

04

Taxpayers who want to ensure they are correctly reporting the sale of a home and complying with the IRS regulations.

Overall, publication 523 - irsgov is designed to provide guidance to homeowners who are selling their property and want to understand the tax implications and potential benefits associated with it. It aims to help taxpayers accurately complete the necessary forms and fulfill their tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get publication 523 - irsgov?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific publication 523 - irsgov and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in publication 523 - irsgov without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your publication 523 - irsgov, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the publication 523 - irsgov form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign publication 523 - irsgov and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is publication 523 - irsgov?

Publication 523 from the IRS provides information on selling your home.

Who is required to file publication 523 - irsgov?

Individuals who have sold or are planning to sell their primary residence need to file publication 523.

How to fill out publication 523 - irsgov?

To fill out publication 523, you need to provide details about the sale of your home, including the selling price, any improvements made, and any exemptions claimed.

What is the purpose of publication 523 - irsgov?

The purpose of publication 523 is to help taxpayers understand the tax implications of selling their home.

What information must be reported on publication 523 - irsgov?

Information such as the selling price of the home, any exemptions claimed, and any improvements made to the property must be reported on publication 523.

Fill out your publication 523 - irsgov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 523 - Irsgov is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.