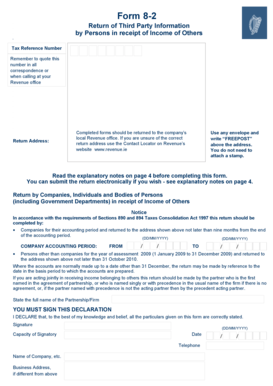

Get the free pera retirement chart

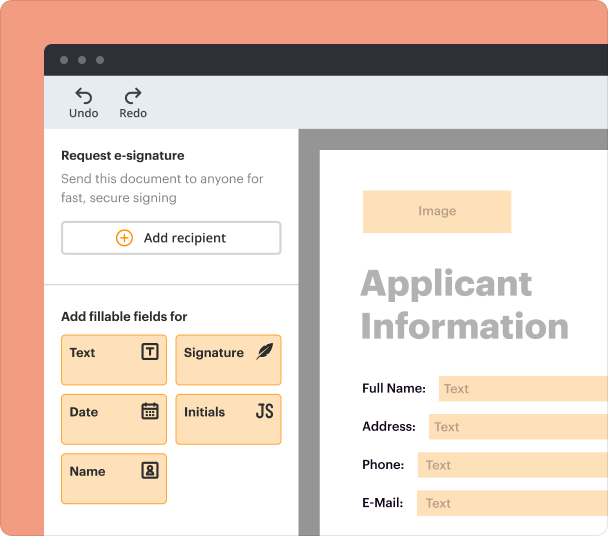

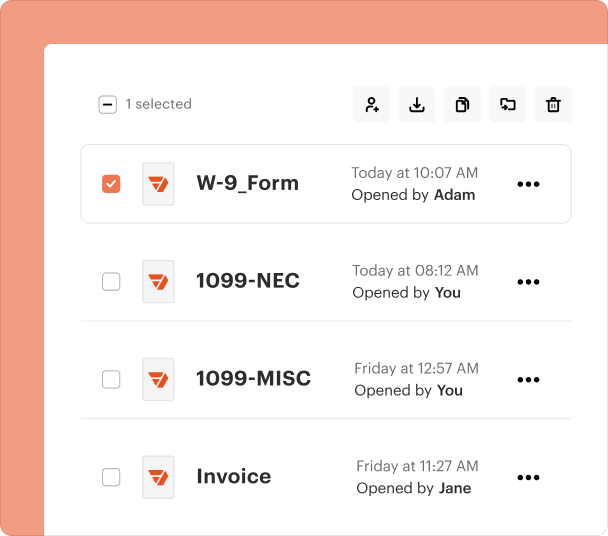

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to the PERA Retirement Chart Form

How does the PERA retirement chart work?

The PERA retirement chart form provides critical information necessary for individuals preparing for retirement under the Public Employees' Retirement Association (PERA). Understanding how to navigate the form can significantly impact retirement planning and benefits.

-

The PERA Retirement Chart outlines benefits based on years of service and age, guiding members on how much they can expect in terms of retirement payouts.

-

The form includes various sections detailing eligibility, benefits tiers, and explanatory notes, crucial for thorough understanding.

What are the eligibility criteria for PERA benefits?

Meeting the eligibility criteria is essential to access PERA benefits, ensuring you can leverage the retirement chart for maximum gain. This segment focuses on who qualifies and how to ascertain your eligibility.

-

Eligibility requires being a member of PERA, typically involving a minimum length of service, which varies by plan.

-

Members must meet specific age and service year benchmarks to access retirement benefits according to the chart.

What are the key components of the PERA retirement chart?

The PERA retirement chart is structured to help you correlate your years of service with potential benefits. Understanding key metrics can enhance your retirement readiness.

-

The chart provides a comparative look at how years of service influence the retirement age calculation and potential payouts.

-

The retirement chart assigns different salary percentages based on the number of years you’ve served, which directly affects the benefit calculation.

How can use the PERA charts effectively?

Utilizing the PERA charts efficiently enhances your understanding and planning for retirement. A step-by-step approach ensures you interpret the data correctly and understand the implications.

-

Begin by locating your years of service on the left side and find your respective benefits on the right. This visual representation helps clarify your potential retirement benefits.

-

Scenario analyses based on varying years of service illustrate how the chart applies in real-world contexts, guiding your retirement timing decisions.

How do fill out the PERA retirement chart form?

Filling out the PERA retirement chart form accurately is vital to prevent delays in processing your retirement benefits. Understanding each part of the form is key.

-

Follow the guidelines provided with the form closely to ensure all required fields are filled out properly, having a checklist can also be helpful.

-

Errors such as incorrect personal information or miscalculations can hinder application approval. Double-check your entries before submission.

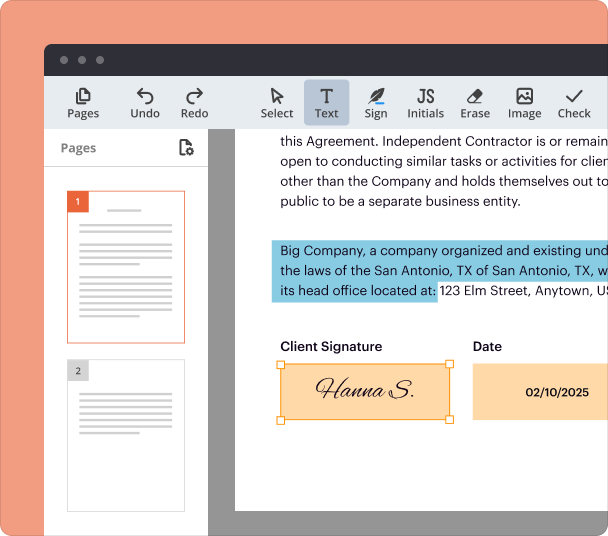

How can edit and manage my retirement form on pdfFiller?

Editing and managing your PERA retirement chart form is seamless with pdfFiller, a tool designed to enhance document handling. It supports users like you in editing and sharing documents efficiently.

-

Simply create an account with pdfFiller, upload your document, and use the online editing tools to make necessary changes.

-

PdfFiller allows multiple users to collaborate on a single document simultaneously, facilitating easier input and eSigning options.

What are recent updates and changes to PERA rules?

Recent updates to PERA rules can significantly influence your retirement planning. Staying informed about these changes is essential for all members.

-

Changes might include revised benefits calculations or changes in the eligibility requirements based on age or service years.

-

These updates can alter the retirement benefits applicable to new applicants and may require existing members to reassess their retirement strategies.

Frequently Asked Questions about colorado pera retirement chart form

What is the PERA retirement chart?

The PERA retirement chart is a tool that outlines potential retirement benefits based on your years of service and age. It's crucial for planning your retirement effectively.

How do I access the PERA retirement chart form?

You can access the PERA retirement chart form online through the official PERA website or platforms like pdfFiller that offer document management solutions.

What should I do if I make a mistake on the PERA form?

If you discover a mistake on your PERA form, you should correct it as soon as possible to avoid processing delays. Utilizing tools like pdfFiller can simplify this process.

Can I submit the PERA retirement form electronically?

Yes, with platforms like pdfFiller, you can complete and submit the PERA retirement form electronically, making the process more efficient and reducing paperwork.

How often does PERA update their retirement rules?

PERA updates their retirement rules periodically based on legislative changes or policy revisions. Staying informed will help you adjust your retirement planning accordingly.

pdfFiller scores top ratings on review platforms