Get the free quess corp salary slip

Show details

IKEA Human Capital Solutions (A Division of Quest Corp Limited) Head Office 3/3/2, Amblipura, Hollander Gate, Scraper Road, Bengaluru, Karnataka 560103Payslip for the Month February 2018EMPLOYEE ID

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quess corp salary slip

Edit your quess corp salary slip form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quess corp salary slip form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing quess corp salary slip online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit quess corp salary slip. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

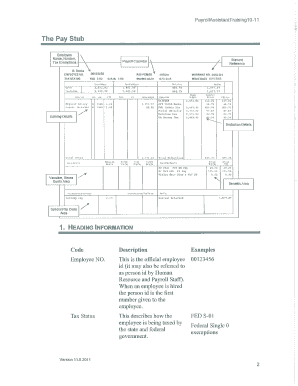

How to fill out quess corp salary slip

How to fill out a Quess Corp salary slip:

01

Start by gathering all the necessary information: Before filling out the salary slip, make sure you have gathered important details such as your employee identification number, your basic salary, incentives or bonuses, deductions, and any other relevant information required by your organization.

02

Fill in your personal information: Begin by entering your personal details like your name, designation, department, and employee code. These details should be accurately filled to ensure the slip is attributed to the correct individual.

03

Enter your salary details: Provide accurate information about your salary. This includes your basic salary, allowances, overtime pay, incentives, and any other additional earnings you may receive. Make sure to carefully double-check the figures you enter to avoid any inaccuracies.

04

Mention statutory deductions: Deductions are amounts subtracted from your gross salary to account for taxes and other mandatory contributions. These may include income tax, provident fund contributions, professional tax, and health insurance premiums. Be sure to enter the correct figures based on the applicable regulations and rules.

05

Include voluntary deductions, if any: Certain deductions may be voluntary and can be opted for by the employee. These can include contributions towards charity, loan repayments, or any other deductions agreed upon between the employee and the employer. Fill in these details accurately, ensuring the consent and agreement of both parties for such deductions.

06

Calculate the net salary: Once you have filled in all the necessary information, calculate the net salary by subtracting the total deductions from the gross salary. This will give you the final amount that you will receive.

07

Review and verify: Before submitting the salary slip, take a moment to review all the information you have entered. Make sure everything is accurate and matches your records. If there are any mistakes, rectify them before finalizing the slip.

Who needs a Quess Corp salary slip?

01

Quess Corp employees: All employees working at Quess Corp, regardless of their designation or department, would require a salary slip. It serves as a document that provides a breakdown of their salary, deductions, and net pay.

02

Employers and HR departments: The salary slip also holds value for employers and HR departments as it helps them maintain accurate records of their employees' earnings and deductions. It serves as evidence for payment and ensures transparency in salary calculations.

03

Government authorities: In certain instances, government authorities may require salary slips as supporting documents for various purposes such as income tax filings, loan applications, or visa processing. Such documents help authenticate the stated income of an individual.

Overall, both employees and employers find Quess Corp salary slips important for financial and administrative purposes, ensuring transparency, and fulfilling legal obligations.

Fill

form

: Try Risk Free

People Also Ask about

Who is the owner of Quess Corp?

Ajit Isaac - Chairman - Quess Corp Limited | LinkedIn.

Who is the CEO of Quess Corporation?

Guruprasad Srinivasan Guru is the Executive Director and Group CEO of the company. A founding member, Guru was the fourth employee of the company. He has more than 25 years of experience of industry experience, including leadership roles at GE Health, Hewitt Associates and People One Consulting.

How do I log into IKYA portal?

IKYA Salary Slip Login The link will direct you to the IKYA homepage, here you're required to enter the user id and password. Next, click on the login button to access the page. The IKYA salary account will show displaying different choices related to employee's payment details.

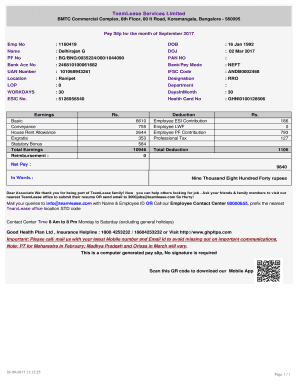

What is a monthly salary slip?

Payslip or salary slip is a document record that employers give to employees each time they receive their earnings. The payslip mainly informs the employee of the gross pay, deductions done and the remaining net pay. The payslip also provides evidence of earnings and proof of employment.

What is salary slip for?

What is a Salary Pay Slip? An employee salary slip is a document which an employee receives from their employer every month. It indicates everything from the gross salary to the net take-home pay and deductions. After an employer provides your pay, the salary slip gets sent out each month.

What is the highest salary in Quess Corporation?

What is the highest salary in Quess? The highest-paying job at Quess is a Sales Director with a salary of ₹56.3 Lakhs per year. The top 10% of employees earn more than ₹8.51 lakhs per year. The top 1% earn more than a whopping ₹28.10 lakhs per year.

How do I make a monthly payslip?

How to Make a Payslip The date and the pay range. Pay rate (hourly or salary) Total hours. Overtime hours, if there are any. Overtime pay rate. Individualized deductions, such as taxes. Gross pay. Net Pay.

How do you write a salary slip?

Format of Salary Slip Company name, logo and address, Salary Slip month and year. Employee Name, Employee Code, Designation, Department. Employee PAN/Aadhaar, Bank Account Number. EPF Account Number, UAN (Universal Account Number) Total Work Days, Effective Work Days, Number of Leaves.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in quess corp salary slip?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your quess corp salary slip to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in quess corp salary slip without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your quess corp salary slip, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit quess corp salary slip on an iOS device?

Use the pdfFiller mobile app to create, edit, and share quess corp salary slip from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

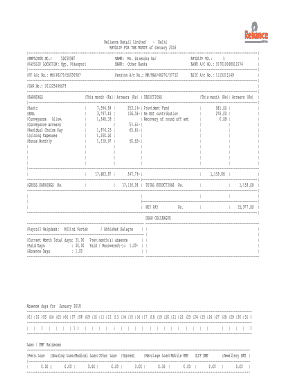

What is quess corp salary slip?

Quess Corp salary slip is a document that outlines the earnings, deductions, and net pay of an employee for a specific period within Quess Corp.

Who is required to file quess corp salary slip?

Employees of Quess Corp are required to receive and review their salary slips, while the HR or payroll department is responsible for issuing them.

How to fill out quess corp salary slip?

To fill out the Quess Corp salary slip, the payroll department should input details such as employee name, employee ID, basic salary, allowances, deductions, and the total net pay.

What is the purpose of quess corp salary slip?

The purpose of the Quess Corp salary slip is to provide employees with a detailed breakdown of their earnings and deductions for transparency and record-keeping.

What information must be reported on quess corp salary slip?

The Quess Corp salary slip must report information such as employee name, employee ID, pay period, gross salary, various deductions (like tax, provident fund), and net pay.

Fill out your quess corp salary slip online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quess Corp Salary Slip is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.