Get the free fatca full form

Show details

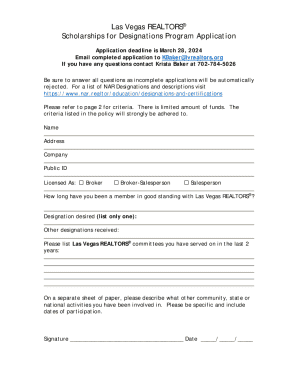

FATWA/CRS Declaration Form (For Individuals)

(Foreign Account Tax Compliance Act / Common Reporting Standard)

Customer ID:

Mobile No :Customer Name:

Email:(Prefix with country code)City of Birth:Occupation:PAN:Aadhaar

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fatca full form

Edit your fatca full form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fatca full form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fatca full form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fatca full form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fatca full form

How to fill out fatca full form:

01

Start by gathering all the necessary documents and information required for the form, such as personal identifying information, financial account details, and taxpayer identification numbers.

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Begin filling out the form by entering the required personal information, such as name, address, and social security number.

04

Proceed to the sections that require information about foreign financial accounts, including the account number, account balance, and the country where the account is held.

05

If you have financial assets exceeding the reporting threshold, make sure to fill out the appropriate sections disclosing those assets.

06

Understand and complete the sections related to any exemptions or special circumstances that may apply to you.

07

Review the completed form for any errors or inconsistencies before submitting it.

08

Sign and date the form, and include any additional documentation that may be required.

09

Keep a copy of the filled-out form for your records.

Who needs fatca full form:

01

US citizens and residents who have foreign financial accounts or assets above a certain threshold are required to fill out the FATCA full form.

02

Foreign financial institutions are also required to comply with FATCA reporting regulations and may need to gather information from their account holders to determine their US tax status.

03

Individuals or entities involved in certain financial transactions or investments abroad may also need to file the FATCA full form to meet their reporting obligations.

Fill

form

: Try Risk Free

People Also Ask about

Is FATCA mandatory in india?

Is every investor required to submit FATCA/CRS declaration? Yes, every customer who opens a new account with any mutual fund is required to give FATCA/CRS self-certification.

What is the purpose of FATCA?

The purpose of FATCA is to prevent U.S. persons from using banks and other financial institutions outside the USA to park their wealth outside U.S. and consequently avoid U.S. taxation on income generated from such wealth.

What is FATCA in banking?

The Foreign Account Tax Compliance Act (FATCA), which was passed as part of the HIRE Act, generally requires that foreign financial Institutions and certain other non-financial foreign entities report on the foreign assets held by their U.S. account holders or be subject to withholding on withholdable payments.

Who needs to file a FATCA?

You must file Form 8938 if you must file an income tax return and: You are unmarried and the total value of your specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year.

Is FATCA only for us citizens?

FATCA applies to individual citizens, residents, and non-resident aliens. Residents and entities in U.S. territories must file FBARs but don't need to file FATCA forms.

Who is exempt from FATCA?

You may be exempt from FATCA if you have a beneficial interest in what the IRS recognizes as a foreign trust or a foreign estate. However, ownership of a foreign trust or foreign estate is, unfortunately, not a get-out-of-jail-free card.

Who needs to file FATCA?

FATCA filing rules require certain U.S. taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about those assets on Form 8938, which must be attached to the taxpayer's annual income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fatca full form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the fatca full form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit fatca full form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing fatca full form, you can start right away.

How do I complete fatca full form on an Android device?

On Android, use the pdfFiller mobile app to finish your fatca full form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is fatca full form?

FATCA stands for the Foreign Account Tax Compliance Act.

Who is required to file fatca full form?

Foreign financial institutions and certain non-financial foreign entities must file FATCA forms to report U.S. account holders.

How to fill out fatca full form?

Filing FATCA forms can be done online through the IRS website using the appropriate forms like Form 8966 for foreign financial institutions.

What is the purpose of fatca full form?

The purpose of FATCA is to prevent tax evasion by U.S. taxpayers through foreign accounts.

What information must be reported on fatca full form?

FATCA forms must report information such as account holder details, account balances, and income from the accounts held by U.S. taxpayers.

Fill out your fatca full form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fatca Full Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.