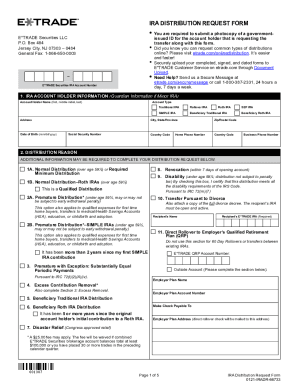

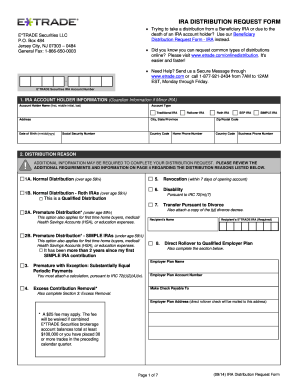

ETrade IRA Distribution Request Form 2011 free printable template

Show details

Etrade. com/onlinedistribution. It s easier and faster ETRADE Securities LLC P. O. Box 484 Jersey City NJ 07303 0484 General Fax 1-866-650-0003 Trying to take a distribution from a Beneficiary IRA or due to the death of an IRA account holder Use our Beneficiary Distribution Request Form - IRA instead. Need Help Send us a Secure Message through www.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ETrade IRA Distribution Request Form

Edit your ETrade IRA Distribution Request Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ETrade IRA Distribution Request Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ETrade IRA Distribution Request Form online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ETrade IRA Distribution Request Form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ETrade IRA Distribution Request Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ETrade IRA Distribution Request Form

How to fill out ETrade IRA Distribution Request Form

01

Obtain the ETrade IRA Distribution Request Form from the ETrade website or your ETrade account.

02

Provide your personal information, including your name, address, and account number.

03

Specify the type of IRA account from which you are requesting the distribution.

04

Indicate the amount of distribution you are requesting, or select whether you want to withdraw all funds.

05

Choose the method of distribution (e.g., check, wire transfer, etc.).

06

If applicable, provide any required tax withholding information.

07

Review and sign the form to certify that the information is accurate and complete.

08

Submit the completed form according to the submission instructions provided.

Who needs ETrade IRA Distribution Request Form?

01

Individuals who wish to withdraw funds from their ETrade IRA accounts.

02

Account holders who need to access their retirement savings for qualified distributions.

03

People seeking to understand the tax implications of their IRA distributions.

Fill

form

: Try Risk Free

People Also Ask about

Can you borrow money from Roth IRA?

You can't borrow from a Roth IRA. The only qualified retirement plans that offer loans to investors are employer-sponsored plans such as 401(k)s. Of course, with this loan, you're technically borrowing from yourself, but you are accessing the money in the account without penalty.

How long does it take for cash to be available for withdrawal on E-Trade?

Trade Date + 1 business day (T+1) T+1 means funds can be withdrawn the next business day after the closing trade.

How do I withdraw my IRA distribution?

A 60-day rollover In this case, you'd have to do what's known as a 60-day rollover to reverse the withdrawal. That is, you redeposit the money into the IRA within 60 days of taking the distribution. You also must not have made any rollovers from one IRA to another in the last 12 months.

How long does it take for unsettled cash on Etrade?

Prior to placing an order in a cash account (type 1), the investor is expected to be able to pay for the transaction in full. Using Unsettled Funds: Upon the sale of a stock, it takes 2 business days for the funds from that sale to settle (with options it is 1 business day).

How do I withdraw money from my E-Trade IRA?

At E*TRADE, the only available option to withdraw money to your account is via Bank transfer.

Can I withdraw money from my Etrade IRA?

Fortunately, money can be withdrawn from an IRA at any time, for any reason (unlike withdrawals from employer-sponsored qualified plans).

How long until money is available on Etrade?

Funds availability will depend on the method of transfer: Transfer money electronically: Up to 3 business days. By check: Up to 5 business days. By wire transfer: Same business day if received before 6 p.m. ET.

Does TD Ameritrade offer self-directed IRAs?

TD Ameritrade is great for investors that want to trade standard investments and have a self directed IRA at a low cost. It's also great for those that want access to lending and other banking products.

How do I get my money out of Etrade?

Transfer Money Select the appropriate accounts from the From and To menus and enter your transfer amount. Enter the date you want the transfer to occur in the Date field. Select how often you want your transfer to occur from the Repeat this transfer? dropdown, click on Preview transfer, and then Confirm.

Can you set up an IRA account with E-Trade?

IRA accounts are eligible for cash management features, such as free debit card, checking, and Bill Pay, if you're over age 59½ and upon conversion to the E*TRADE Complete™ IRA account.

What banks offer self-directed IRAs?

The Best Self-Directed IRA Providers Best Overall: Rocket Dollar. Best for Investor Experience: Alto. Best for Client Support: Equity Trust Company. Best for Real Estate Investing: uDirect. Best for International or Financed Real Estate: Pacific Premier Trust. Best for Real Estate Crowdfunding: Millennium Trust Company.

How can I borrow money from my IRA without penalty?

Circumstance-based borrowing In the case of a traditional or Roth IRA, you're able to withdraw up to $10,000 without penalty to assist in your first home purchase. Under the Roth IRA rules, you can access your contributions (but not your earnings) at any time without tax or penalty.

Can I borrow from my Etrade IRA account?

While you may be tempted to borrow from your IRA, it's not actually possible to get an IRA loan. However, it may be possible to borrow from other types of retirement accounts, such as 401(k)s.

Does E-Trade allow self directed IRA?

With IRA Financial Group's Self-Directed Solo 401(k) Plan at E-Trade, you will be able to make traditional investments, such as stocks, as well as alternative asset investments, such as real estate, precious metals, hard money loans, tax liens, private business investments, and much more and incur NO custodian fees.

Does E-Trade offer a self-directed IRA?

With IRA Financial Group's Self-Directed Solo 401(k) Plan at E-Trade, you will be able to make traditional investments, such as stocks, as well as alternative asset investments, such as real estate, precious metals, hard money loans, tax liens, private business investments, and much more and incur NO custodian fees.

Can I borrow from my E-Trade IRA account?

While you may be tempted to borrow from your IRA, it's not actually possible to get an IRA loan. However, it may be possible to borrow from other types of retirement accounts, such as 401(k)s.

How do I withdraw money from my e TRADE IRA?

At E*TRADE, the only available option to withdraw money to your account is via Bank transfer.

How can I withdraw money from my Etrade account?

0:17 1:21 So so what we're going to do here is on the main page of etrade. We're going to go to an area thatMoreSo so what we're going to do here is on the main page of etrade. We're going to go to an area that says transfers. Right up. Here. So if we hover over you're going to see a bunch of different options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ETrade IRA Distribution Request Form online?

pdfFiller has made filling out and eSigning ETrade IRA Distribution Request Form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out ETrade IRA Distribution Request Form using my mobile device?

Use the pdfFiller mobile app to complete and sign ETrade IRA Distribution Request Form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete ETrade IRA Distribution Request Form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your ETrade IRA Distribution Request Form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is ETrade IRA Distribution Request Form?

The ETrade IRA Distribution Request Form is a document that clients use to request distributions from their individual retirement accounts (IRAs) held with ETrade.

Who is required to file ETrade IRA Distribution Request Form?

Clients who wish to withdraw funds from their ETrade IRAs are required to file the ETrade IRA Distribution Request Form.

How to fill out ETrade IRA Distribution Request Form?

To fill out the ETrade IRA Distribution Request Form, clients must provide their personal information, specify the amount and type of distribution, and sign the form to authorize the transaction.

What is the purpose of ETrade IRA Distribution Request Form?

The purpose of the ETrade IRA Distribution Request Form is to facilitate the withdrawal of funds from an IRA while ensuring compliance with regulatory requirements.

What information must be reported on ETrade IRA Distribution Request Form?

The information that must be reported on the ETrade IRA Distribution Request Form includes the account holder's name, account number, type of distribution, amount requested, and any necessary tax withholding preferences.

Fill out your ETrade IRA Distribution Request Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ETrade IRA Distribution Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.