What is a TSP-70 Form?

A TSP-70 is a Thrift Savings Plan (TSP) form is officially called the Request for Full Withdrawal. The plan wasdesigne, soon federal employees could be granted the same retirement savings-related benefits as those given to employees in the private sector through 401(k) plans. However, if an individual employed in the federal sector is willing to terminate their Thrift Savings Plan, the request should be submitted through the completed TSP-70 Form.

Why should a TSP-70 form be filled out?

The form should be used to file a request for an immediate withdrawal of the applicant’s entire vested account balance to be paid after the employer confirms their separation from the federal service.

Is the TSP-70 Form accompanied by any other documents?

The properly completed Request for Full Withdrawal should provide enough information for the claim to be assessed. As such, the TSP-70 form does not require any supporting documentation.

When is the TSP Request for Full Withdrawal due?

The Request for Full Withdrawal does not have a specific deadline and should be filed when needed.

How to fill out the TSP Withdrawal Form 70?

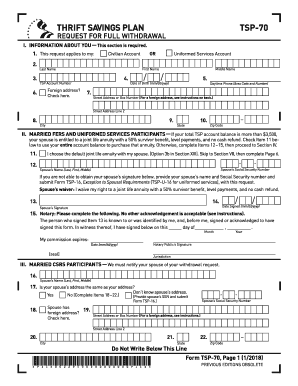

Prior to submission, the applicant should make sure that all the necessary information is provided on all 12 parts of the form:

- Personal details about the federal employee (name, TSP account number, DOB, phone number, address, spouse’s name and SSN if applicable)

- Other details about the spouse (parts 2 or 3)

- Withdrawal election

- The details of the applicant’s transfer

- Information for the IRA or eligible employer plan

- Request for direct deposit

- Certification

- Annuity election

- Data about spouse or other joint annuitant

- Beneficiary designation

- Certification

Where do I send the completed Request for Full Withdrawal?

The completed form TSP-70 should be either faxed or mailed to the TPS.