Who needs a TSP-75 Form?

All active civilian Federal Government employees and members of the uniformed services who participate in the Thrift Savings Plan (TSP) may request a one-time-only age-based in-service withdrawal of all or a portion of their vested account balance after they reach the age of 59 and a half. To claim such a withdrawal, the eligible TSP participants must file form TSP-75, which is the Thrift Savings Age-Based In-Service Withdrawal Request.

What is the purpose of the TSP-75 form?

The TSP 75 form must be filed to request withdrawals the amount of which equals or exceeds $1,000, or to withdraw the entire vested account balance which may not reach $1,000. Only one age-based withdrawal may be requested during the time the TSP member is actively employed in Federal service or the uniformed services.

Is the TSP-75 Form accompanied by any other forms?

According to the filing requirements, there is no need to attach any other forms to the completed TSP-75 Withdrawal Request Form. However, as for the filling directions, it is vital to review the instructions included in the content of the form.

When is the TSP-75 Age-Based In-Service Withdrawal Request form due?

The form does not have any time restrictions or a particular date for submission, except for the age requirements of the requesting individual.

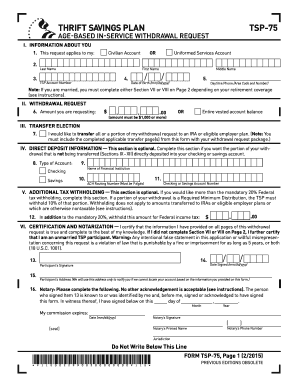

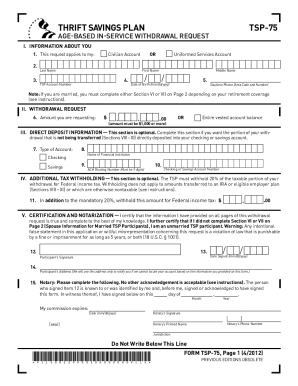

How to fill out the TSP Age-Based In-Service Withdrawal Request?

Prior to submission, the applicant should make sure that all the necessary information is provided on all the appropriate parts of the form:

- Information about the requesting party (name, TSP account number, DOB, phone number, withdrawal request, direct deposit information, certification and notarization);

- Information about the spouse;

- Transfer details;

- Transfer-Roth details.

Where do I send the completed Request for Full Withdrawal?

The completed form TSP-70 should be either faxed or mailed to the TPS.