NJ ST-7 2011 free printable template

Show details

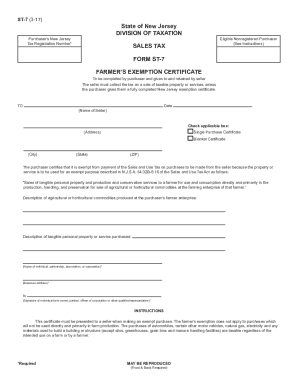

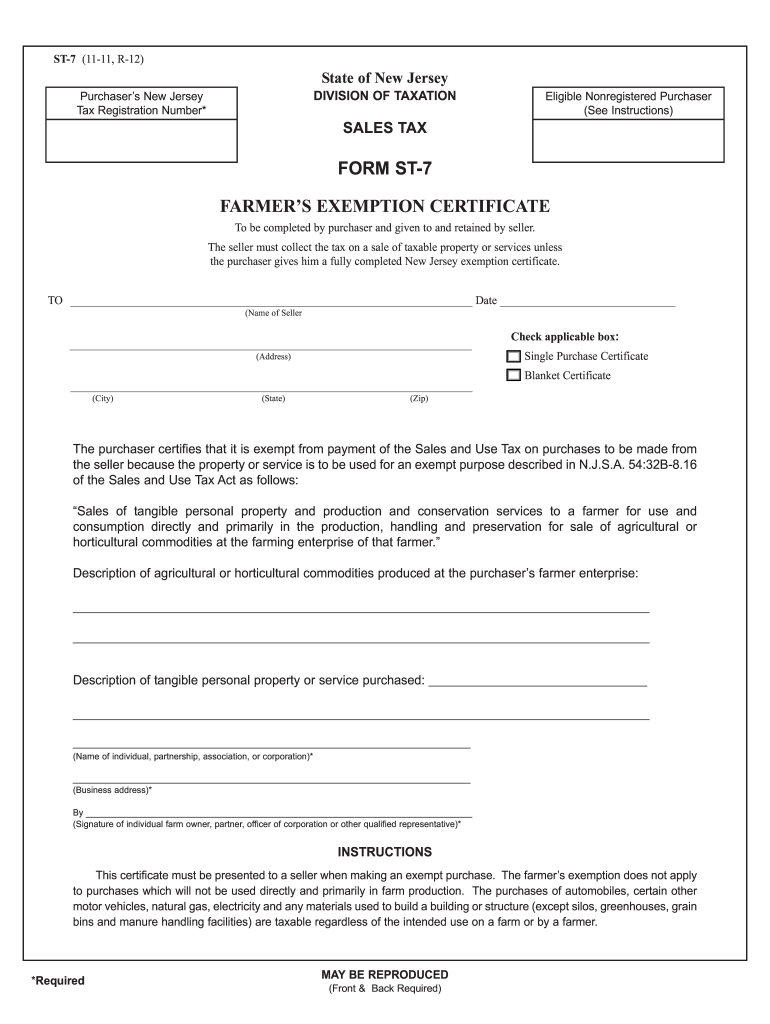

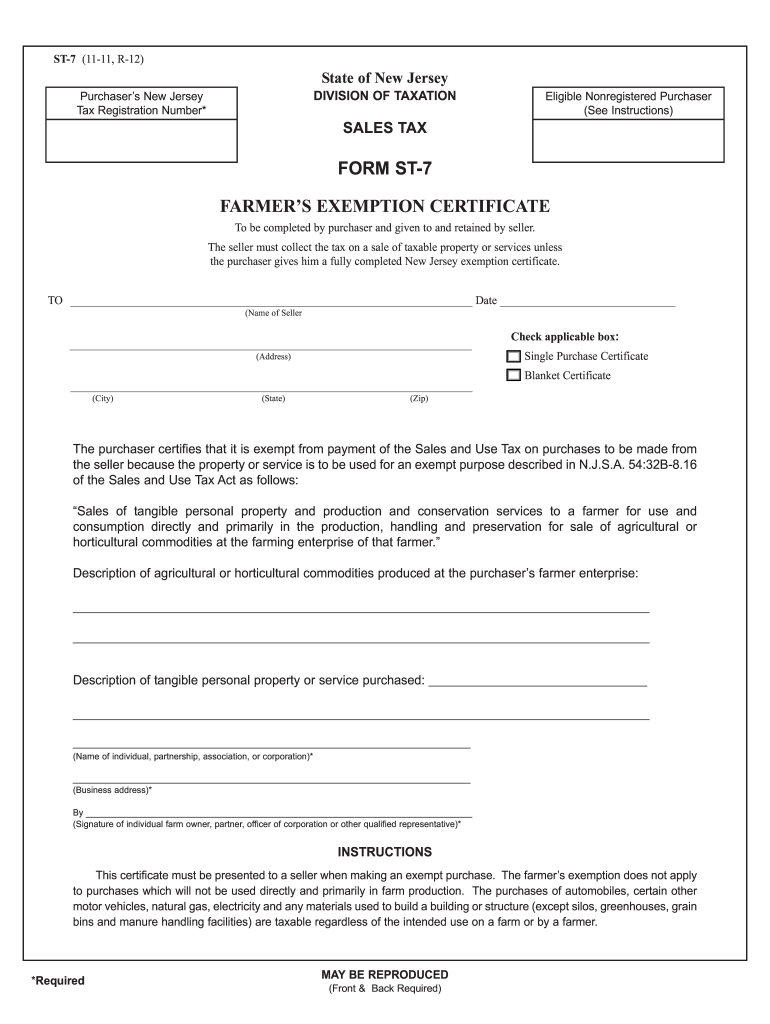

ST-7 11-11 R-12 State of New Jersey DIVISION OF TAXATION Purchaser s New Jersey Tax Registration Number Eligible Nonregistered Purchaser See Instructions SALES TAX FORM ST-7 FARMER S EXEMPTION CERTIFICATE To be completed by purchaser and given to and retained by seller.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nj st 7

Edit your nj st 7 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nj st 7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nj st 7 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nj st 7. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ ST-7 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nj st 7

How to fill out NJ ST-7

01

Obtain the NJ ST-7 form from the New Jersey Division of Taxation website or your employer.

02

Fill in your name and business details at the top of the form.

03

Indicate the type of exemption you are claiming by checking the appropriate box.

04

Provide your tax identification number or Social Security Number if required.

05

Include the name and address of your supplier.

06

Enter the date of the purchase or transaction.

07

Sign and date the form to certify the information provided.

08

Submit the completed NJ ST-7 form to your vendor to exempt yourself from sales tax.

Who needs NJ ST-7?

01

Businesses or individuals who are purchasing goods for resale or who qualify for specific sales tax exemptions in New Jersey need to complete the NJ ST-7 form.

Fill

form

: Try Risk Free

People Also Ask about

What is the farmland assessment tax in NJ?

Farmland Tax Assessment in NJ allows land actively devoted to an agricultural or horticultural use to be taxed on its farm value instead of its development value. All land qualifying for farmland assessment must meet a minimum income threshold from the sale of the agricultural output of the farm.

What is NJ ST 8 used for?

To the property owner: In cases where the contractor performs work which results in an exempt capital improvement to your house or land (real property, they may not charge you any Sales Tax if you issue them a fully completed Certificate of Exempt Capital Improvement (Form ST-8).

What items are exempt from NJ sales tax?

The current Sales Tax rate is 6.625% and the specially designated Urban Enterprise Zones rate is one half the Sales Tax rate. Certain items are exempt from sales tax, such as food, clothing, drugs, and manufacturing/processing machinery and equipment. A resale exemption also exists.

What is a NJ ST 8 form for?

A ST-8 form is a sales tax form in the state of New Jersey for the certificate of exempt capital improvements. New Jersey Sales Taxes do not treat all work on your property the same way. When you have work done on your real property (building or land) it can fall into one of three categories: Capital Improvement.

How do I qualify for farm tax exemption in NJ?

NJ Taxation You must own at least 5 contiguous acres devoted to agricultural/horticultural use; Land must be devoted to agricultural/horticultural uses for at least two consecutive years prior to the tax year; You must apply for Farmland Assessment with the tax assessor on or before August 1 of the pretax year;

What qualifies as a capital improvement in NJ?

A maintenance service is a service which preserves the existing condition of property. A capital improvement is an installation of tangible personal property which results in an increase of the capital value of real property or a significant increase in the useful life of property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find nj st 7?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific nj st 7 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the nj st 7 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your nj st 7 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out nj st 7 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign nj st 7 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NJ ST-7?

NJ ST-7 is a New Jersey Sales Tax Exempt Certificate that allows qualified organizations to purchase goods and services without paying sales tax.

Who is required to file NJ ST-7?

Organizations that are exempt from sales tax under New Jersey state law, such as non-profit entities, government agencies, and certain educational institutions, are required to file NJ ST-7.

How to fill out NJ ST-7?

To fill out NJ ST-7, provide the name and address of the purchaser, the type of exempt organization, the reason for exemption, and the signature of an authorized representative.

What is the purpose of NJ ST-7?

The purpose of NJ ST-7 is to provide a way for exempt organizations to document their tax-exempt status and avoid paying sales tax on qualified purchases.

What information must be reported on NJ ST-7?

The information that must be reported on NJ ST-7 includes the organization's name and address, type of exemption, reason for exemption, and the signature of an authorized representative, along with the date.

Fill out your nj st 7 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nj St 7 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.