CA CDPH 8686 2011-2025 free printable template

Show details

State of California Health and Human Services Agency California Department of Public Health SELF-EMPLOYMENT FORM INSURANCE ASSISTANCE SECTION This form is to be completed by self-employed applicants

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign printable 1049 form

Edit your form 1049 client's statement of self employment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing h1049 form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit substantiate self employment examples of templates form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self employment form

How to fill out CA CDPH 8686

01

Obtain the CA CDPH 8686 form from the California Department of Public Health website.

02

Fill out the applicant's information, including name, address, and contact details.

03

Provide the type of service or product being requested in the designated section.

04

If applicable, include details of any previous applications or permits related to the request.

05

Sign and date the form at the bottom to certify that the information provided is accurate.

06

Submit the completed form by mail or electronically through the designated submission method provided by the CDPH.

Who needs CA CDPH 8686?

01

Individuals and entities seeking to apply for or renew specific health-related permits or certifications in California.

02

Businesses that need to comply with regulations set by the California Department of Public Health.

03

Healthcare providers and organizations needing to report information relevant to public health.

Fill

h1049 self employment form

: Try Risk Free

People Also Ask about

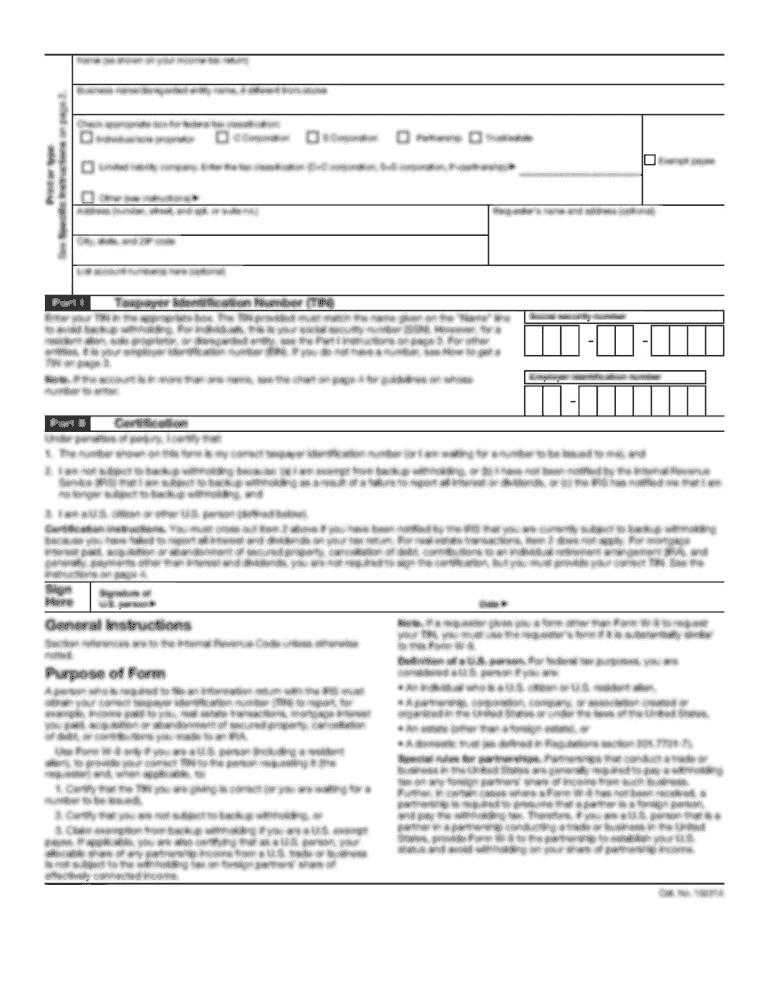

Do I need to report income if I didn't receive a 1099?

If you do not get the 1099 form, you will be required to report the income under miscellaneous income under Section C of the 1040 tax form. This applies even to earnings under $600 as they are still part of your personal income for the tax year.

What if I am self-employed without a 1099?

If you did not receive a 1099 form from your employer, you are still required to report your income on your tax return. You can do this by using Form 1040 Schedule C. This form is for self-employment income and expenses. You will need to provide your Social Security number and the EIN of your business if you have one.

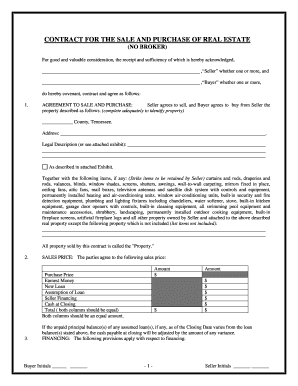

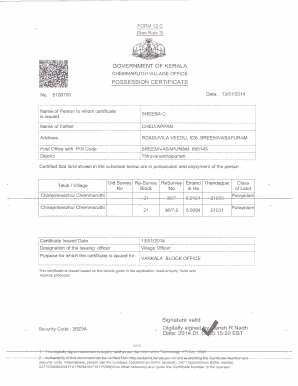

What is considered self-employment documentation?

If you're self-employed, you can show proof of income in the following ways: Use a 1099 form from your client showing how much you earned from them. Create a profit and loss statement for your business. Provide bank statements that show money coming into the account.

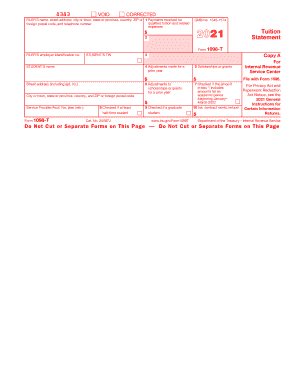

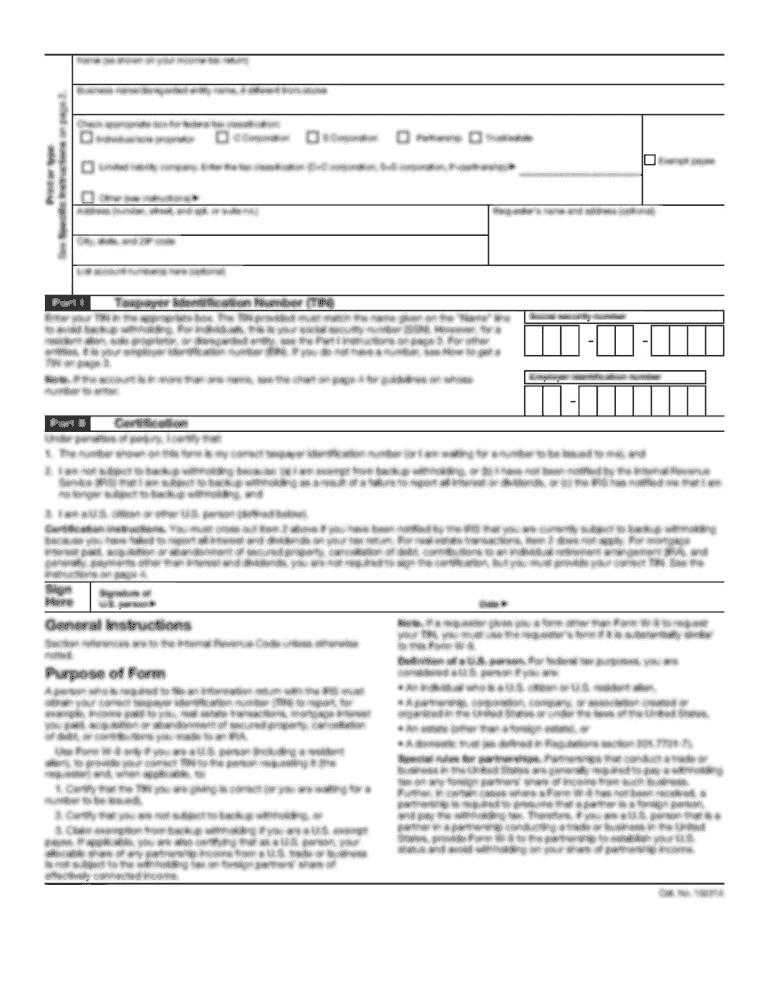

What is a Form 1049?

1049 Self Employment Form: List your Hours Worked, Income Earned & Work Expenses for the past three months. Add the amounts for each column and complete the TOTAL at the bottom of the page. Subtract your expenses from your total self-employment income and enter your Net Self-Employment Income.

How do I prove self-employment income to the IRS?

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 1049 form in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 1049 form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit 1049 form on an iOS device?

Create, modify, and share 1049 form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete 1049 form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your 1049 form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is CA CDPH 8686?

CA CDPH 8686 is a form used for reporting requirements related to the California Department of Public Health, specifically for the notification of the results of lead blood tests in patients.

Who is required to file CA CDPH 8686?

Health care providers, laboratories, and other entities that conduct blood lead testing are required to file CA CDPH 8686.

How to fill out CA CDPH 8686?

To fill out CA CDPH 8686, complete all required fields including patient information, test results, and provider details, ensuring accuracy and compliance with reporting guidelines.

What is the purpose of CA CDPH 8686?

The purpose of CA CDPH 8686 is to monitor lead exposure and health effects in California residents, facilitating public health interventions and data collection.

What information must be reported on CA CDPH 8686?

Information that must be reported includes patient demographics, test results, dates of testing, and the provider's details pertaining to the lead blood test.

Fill out your 1049 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1049 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.