CO JDF 951 2007 free printable template

Show details

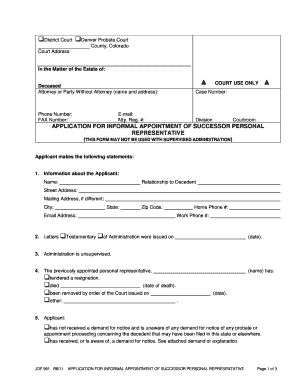

District Court Denver Probate Court County, Colorado Court Address: IN THE MATTER OF THE ESTATE OF: Deceased Attorney or Party Without Attorney (name and address): COURT USE ONLY Case Number: Phone

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO JDF 951

Edit your CO JDF 951 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO JDF 951 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO JDF 951 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CO JDF 951. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO JDF 951 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO JDF 951

How to fill out CO JDF 951

01

Obtain the CO JDF 951 form from the appropriate source.

02

Begin by filling out the header section with your name and contact information.

03

Provide the date of submission on the designated line.

04

Clearly state the purpose of the form in the relevant section.

05

Fill out each section with accurate and complete information as required, ensuring to follow any instructions provided with the form.

06

Double-check for any required signatures and ensure they are included.

07

Review the entire form for accuracy and completeness.

08

Submit the form to the appropriate authority as designated in the instructions.

Who needs CO JDF 951?

01

Individuals or entities submitting specific documentation to the Colorado Department of Finance or relevant regulatory bodies may need CO JDF 951.

02

Businesses required to report certain financial information as mandated by state law.

03

Professionals seeking to comply with state regulations regarding financial disclosures.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get letters of administration in Florida?

How Long Does it Take to Get Letters of Administration? Obtaining the probate Letters of Administration for the estate is usually a straightforward process under Florida probate rules. It typically takes 1 to 4 weeks after filing with the local circuit court.

How much does a personal representative get paid in Florida?

A personal representative is compensated: At the rate of 3 percent for the first $1 million in estate assets. At the rate of 2.5 percent for all above $1 million and not exceeding $5 million in estate assets.

What power does a personal representative have in Florida?

A personal representative shall use the authority conferred by this code, the authority in the will, if any, and the authority of any order of the court, for the best interests of interested persons, including creditors.

How do I become a personal representative in Florida?

The personal representative can be an individual or a bank or trust company, subject to certain restrictions. To qualify to serve as a personal representative, an individual must be either a Florida resident or, regardless of residence, a spouse, sibling, parent, child, or other close relative of the decedent.

How do you become a personal representative after death in Florida?

The surviving spouse has the first right to serve as the personal representative. If the spouse declines to serve or if there is no surviving spouse, then the heirs who represent the majority interest can select who shall serve as the personal representative.

Does a personal representative need an attorney in Florida?

See, §733.305(1), Fla. Stat. Every personal representative must be represented by an attorney unless the personal representative is the "sole interested person" or is an attorney.

How is a personal representative appointed in Florida?

When a person dies intestate (without a will), a petition for administration of the estate is filed, and the probate court appoints a qualified person to serve as the "personal representative" to administer the estate. Preferences in appointment of the personal representative are governed by §733.301(1)(b), Fla. Stat.

How long does it take to be appointed personal representative in Florida?

The formal probate administration usually takes 6-9 months under most circumstances - start to finish. This process includes appointing a personal representative (i.e., the "executor"), a 90 days creditor's period that must run, payment of creditor's claims and more.

How much is a personal representative fee in Florida?

Your fee is based on the value of the estate. If the estate value is between $1 million and $5 million, your fee is 2.5% of the estate assets. If the estate value is between $5 million and $10 million, your fee is 2% of the estate assets. For assets over $10 million, the fee is 1.5% of of those assets.

What are the qualifications for a personal representative in Florida?

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative. See, §733.302, Fla. Stat.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CO JDF 951 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your CO JDF 951 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit CO JDF 951 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign CO JDF 951. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out CO JDF 951 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your CO JDF 951. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is CO JDF 951?

CO JDF 951 is a form used in Colorado for reporting juvenile delinquency cases and requirements mandated by the court.

Who is required to file CO JDF 951?

Typically, legal representatives, guardians, or officials involved in juvenile cases are required to file CO JDF 951.

How to fill out CO JDF 951?

To fill out CO JDF 951, follow the instructions provided on the form, ensure all required information is completed accurately, and submit it as specified.

What is the purpose of CO JDF 951?

The purpose of CO JDF 951 is to provide a standardized report on juvenile delinquency cases for legal and administrative processes.

What information must be reported on CO JDF 951?

The information that must be reported includes the juvenile's personal details, case information, and specifics regarding the alleged offenses.

Fill out your CO JDF 951 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO JDF 951 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.