IL DoR IL-1040-Rcpt 2004 free printable template

Show details

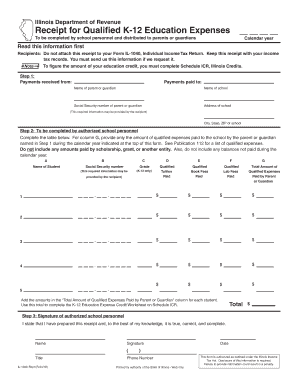

Illinois Department of Revenue Receipt for Qualified Education Expenses Calendar year To be completed by school personnel and distributed to parents or guardians Recipients Attach this receipt to your Form IL-1040 Individual Income Tax Return if you figure an Illinois Income Tax credit for education expenses.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-1040-Rcpt

Edit your IL DoR IL-1040-Rcpt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-1040-Rcpt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR IL-1040-Rcpt online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IL DoR IL-1040-Rcpt. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-1040-Rcpt Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-1040-Rcpt

How to fill out IL DoR IL-1040-Rcpt

01

Gather all necessary documentation, including your personal identification and income information.

02

Start by filling in your name, address, and Social Security number at the top of the form.

03

Input the tax year for which you are submitting the form.

04

Report your total income and any adjustments as required on the form.

05

Fill in any applicable deductions to arrive at your taxable income.

06

Calculate your tax owed based on the provided tax tables or tax rates.

07

Indicate any credits that you are eligible for and subtract them from your total tax owed.

08

If applicable, report any payments already made towards your tax liability.

09

Ensure all calculations are correct and fill in the final amount owed or refund due.

10

Sign and date the form before submitting it to the Illinois Department of Revenue.

Who needs IL DoR IL-1040-Rcpt?

01

Illinois residents who need to report income, deductions, and eligibility for tax credits for the state of Illinois.

02

Individuals who have income from sources within Illinois that are subject to state taxation.

03

Taxpayers claiming a refund for overpaid state taxes or those who need to report tax owed.

Instructions and Help about IL DoR IL-1040-Rcpt

Listen up parents Here's a tax time savings tip You could lower your taxes and get a larger refund with the K-12 Education Subtraction and Credit Textbooks laptops musical instruments for music class and even educational summer camp may qualify Just remember to save your receipts To see if you qualify for theK-12 Education Subtraction or Credit visit revenuestatemnus and search 'K-12'

Fill

form

: Try Risk Free

People Also Ask about

Are K-12 education expenses deductible?

Federal tax law doesn't allow you to deduct private school tuition to lower your federal tax liability. If your child is attending a private school for special needs, you may be able to get a tax break on your K-12 private school tuition.

How much can I claim for qualified education expenses?

It is a tax credit of up to $2,500 of the cost of tuition, certain required fees and course materials needed for attendance and paid during the tax year. Also, 40 percent of the credit for which you qualify that is more than the tax you owe (up to $1,000) can be refunded to you.

What counts as adjusted qualified education expenses?

Remember to include books, supplies, course related materials and equipment if claim- ing the American opportunity credit. Also remember to include out of pocket payments made by the student or on the student's behalf. This includes student loans, payments, credit cards and taxable portions of scholarships/grants.

How to get the full $2,500 American Opportunity credit?

Anyone who falls within the income guidelines and is paying $4,000 or more in educational expenses per year will be eligible for the full $2,500. If you have less than $4,000 in qualifying educational expenses your credit will be less than this.

How much education expenses can I claim without receipts?

The American opportunity tax credit lets you claim all of the first $2,000 you spent on tuition, school fees and books or supplies needed for coursework — but not living expenses or transportation — plus 25% of the next $2,000, for a total of $2,500.

How is education credit calculated?

For your 2022 taxes, the American Opportunity Tax Credit: Can be claimed in amounts up to $2,500 per student, calculated as 100% of the first $2,000 in college costs and 25% of the next $2,000. May be used toward required course materials (books, supplies and equipment) as well as tuition and fees.

What is Illinois K-12 education expense credit?

The Illinois Education Expense Credit allows parents or legal guardians of a full- time K-12 student under the age of 21, to take a 25% tax credit on qualified education expenses over $250 this year. The total credit may not exceed $750, regardless of the number of qualifying students.

How do I calculate my qualified education expenses?

To calculate your total qualified education expenses, you need to add up all qualifying expenses incurred during the tax year. If you have received a Form 1098-T, you can use the information on it to determine the total expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IL DoR IL-1040-Rcpt in Gmail?

IL DoR IL-1040-Rcpt and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I edit IL DoR IL-1040-Rcpt on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IL DoR IL-1040-Rcpt on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete IL DoR IL-1040-Rcpt on an Android device?

Use the pdfFiller Android app to finish your IL DoR IL-1040-Rcpt and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is IL DoR IL-1040-Rcpt?

IL DoR IL-1040-Rcpt is a form used by individuals in Illinois to document their refund or payment information related to their state income tax returns.

Who is required to file IL DoR IL-1040-Rcpt?

Taxpayers who have received a refund or made a payment related to their state income tax must file the IL DoR IL-1040-Rcpt.

How to fill out IL DoR IL-1040-Rcpt?

To fill out the IL DoR IL-1040-Rcpt, enter your personal information, the amount of refund or payment received, and any relevant tax period information as specified on the form.

What is the purpose of IL DoR IL-1040-Rcpt?

The purpose of the IL DoR IL-1040-Rcpt is to provide documentation for individuals regarding their Illinois state tax refund or payment, ensuring accurate record-keeping for tax purposes.

What information must be reported on IL DoR IL-1040-Rcpt?

Information that must be reported on the IL DoR IL-1040-Rcpt includes the taxpayer's name, Social Security number, amount of refund or payment, and tax period for which the refund or payment applies.

Fill out your IL DoR IL-1040-Rcpt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-1040-Rcpt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.