Get the free itr 1 illinois

Show details

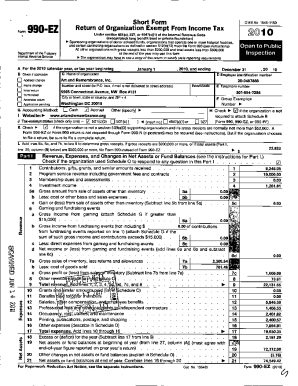

Illinois Department of Revenue ITR-1 Request for Tax Clearance Read this information first Form ITR-1 will not be processed until all returns are filed and balances paid including penalty and interest if applicable. See Form IL-2848 Power of Attorney. // Signature Title Title i.e. president owner partner individual Step 5 Send your request ILLINOIS DEPARTMENT OF REVENUE PROBLEMS RESOLUTION 3-515 PO BOX 19014 SPRINGFIELD IL 62794-9014 Fax 217 785...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign illinois tax clearance certificate form

Edit your itr 1 illinois form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your itr 1 illinois form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit itr 1 illinois form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit itr 1 illinois form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out itr 1 illinois form

How to fill out the Illinois tax clearance certificate:

01

Obtain the form - The Illinois tax clearance certificate form can be found on the website of the Illinois Department of Revenue.

02

Provide personal information - Fill in your name, address, social security number, and any other required personal details.

03

Provide business information - If you are representing a business, provide the business name, address, and federal employer identification number.

04

Fill in tax obligations - Indicate any outstanding tax obligations you may have with the state of Illinois. This can include income tax, sales tax, withholding tax, or any other applicable taxes.

05

Calculate any amounts owed - If you have outstanding tax liabilities, calculate the amount owed to the state of Illinois.

06

Include payment - If you have any outstanding tax liabilities, enclose payment for the amount owed with the form. This can be done through a check or money order made payable to the Illinois Department of Revenue.

07

Explanation - If necessary, provide an explanation for any unpaid taxes or outstanding liabilities.

08

Signature - Sign and date the form to certify its accuracy and completeness.

Who needs an Illinois tax clearance certificate:

01

Individuals - Individuals who are planning to move out of Illinois and establish residency in another state may need an Illinois tax clearance certificate to ensure they have met their tax obligations before leaving.

02

Businesses - Businesses that are closing or moving out of Illinois may need an Illinois tax clearance certificate to confirm that all tax liabilities have been satisfied.

03

Contractors - Contractors who are applying for certain contracts in Illinois may need an Illinois tax clearance certificate to demonstrate their compliance with state tax laws.

04

Financial institutions - Financial institutions that are processing loan requests or other financial transactions may require individuals or businesses to provide an Illinois tax clearance certificate as part of the application process.

05

Government agencies - Various government agencies, including the Illinois Secretary of State, may require individuals or businesses to submit an Illinois tax clearance certificate for specific permits or licenses.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get an Illinois state tax form?

How to get Forms Download Forms. Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

What is the difference between ITR-1 and ITR 2?

The choice of the appropriate ITR form primarily depends on your sources of income. If you are a salaried individual, you can file returns using ITR Form 1. However, if you have both salaried income and capital gains from investments, you should use ITR Form 2.

Does Illinois have a state income tax form?

IL-1040 Individual Income Tax Return.

What is a ITR-1 form Illinois?

ITR-1, Request for Tax Clearance.

How do I print Illinois tax forms?

If you have created a MyTax Illinois account, login to your account to view and print your return. If you filed your IL-1040 without creating a MyTax Illinois account, go to the MyTax Illinois home screen. Click the "Retrieve a return, application, or payment" button.

What is a state of Illinois tax clearance certificate?

Illinois Tax Clearance Certificates are required for any business that is registered with the Illinois Department of Revenue to verify that the business has no delinquent taxes due. The certificate is required when a business applies for a license, permit, or other authorization from the state of Illinois.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send itr 1 illinois form to be eSigned by others?

itr 1 illinois form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the itr 1 illinois form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your itr 1 illinois form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the itr 1 illinois form form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign itr 1 illinois form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is illinois tax clearance certificate?

The Illinois Tax Clearance Certificate is an official document issued by the Illinois Department of Revenue that certifies that a business is in compliance with all Illinois tax obligations.

Who is required to file illinois tax clearance certificate?

Businesses that are applying for certain licenses or permits, or those that are involved in specific transactions such as mergers, acquisitions, or dissolutions may be required to file for an Illinois Tax Clearance Certificate.

How to fill out illinois tax clearance certificate?

To fill out the Illinois Tax Clearance Certificate, complete the application form provided by the Illinois Department of Revenue, providing all necessary information about the business, including its name, tax ID number, and relevant tax details.

What is the purpose of illinois tax clearance certificate?

The purpose of the Illinois Tax Clearance Certificate is to ensure that businesses have no outstanding tax debts and are compliant with state tax laws, thereby protecting the integrity of the state's tax system and promoting fair business practices.

What information must be reported on illinois tax clearance certificate?

The Illinois Tax Clearance Certificate must report information such as the business name, address, tax identification number, and details regarding the business's tax compliance status, including any outstanding liabilities or issues with the Illinois Department of Revenue.

Fill out your itr 1 illinois form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Itr 1 Illinois Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.