Get the free l3 form - rev louisiana

Get, Create, Make and Sign l3 form - rev

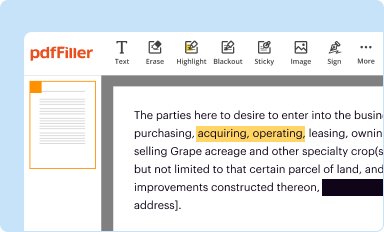

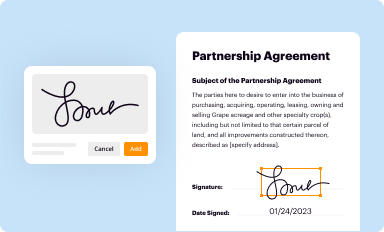

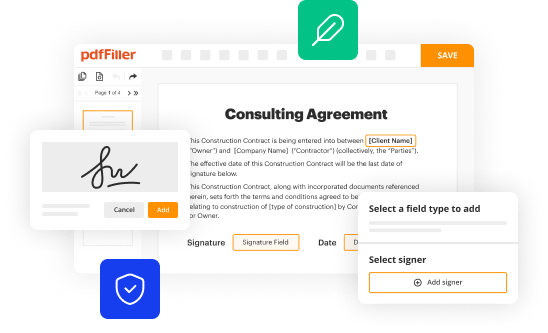

How to edit l3 form - rev online

Uncompromising security for your PDF editing and eSignature needs

How to fill out l3 form - rev

How to fill out l3 form:

Who needs l3 form:

Instructions and Help about l3 form - rev

We want to examine the elements of a rich zip code and a poor zip code in Louisiana The rich zip code is home to 177 separate industries It produces 53 billion in economic activity each year -- higher than the GDP of 40 countries Now I want to remind you I'm not talking about a state I'm not talking about a region I'm talking about a zip code It generates 39 billion in business profits per year -- the highest in Louisiana And it accounts for 12 billion in exports per year One zip code Now let's look at the poor zip code 381 of residents live in poverty Median household income of 21000 Highest unemployment rate The Highest murder rate The 2nd highest incarceration rate And the lowest life expectancy in East BatonRouge Parish And you know what's the Louisiana paradox Guess what This is the same zip code 70805 Ladies and gentlemen we can no longer pretend this is the best form of economic development As Edgar has joked in the past we are just normal people presenting this information We're just average citizens That's an upgrade for me to be called normal and average But thank you very much I really appreciated the complement I think there's one thing we can agree one's citizens of Louisiana -- things are not great We feel like we are a very poor state But I'm going to tell you about how we area extremely rich state Louisiana is home to extraordinary wealth Louisiana ranks #2 in the nation in crude oil refining -- that's a quarter of the refining in the entire nation Louisiana ranks #4 in the nation in natural gas production We rank #3 in the nation in chemical production Louisiana is a top 10 oil producing state Louisiana forms the heart of the nation'pipeline system This is how natural gas and other different important resources are moving around the country We are so central to the processing and moving of natural gas the world price for natural gas is set in Earth Louisiana at Henry Hub Earth Louisiana We could be considered the Silicon Valley for petrochemicals Were also the center of the nations inland waterway system #1 in the nation for port tonnage We have 5 of the 15 top ports in our State We rank #1 in the nation in salt production Almost all of Louisiana is a salt deposit We rank #2 in the nation in sugar production #3 in the nation in rice production And Louisiana has ranked #1 or #2 in foreign direct investment every single year since 2008 That means that more money is coming from around the world through Louisiana than almost anywhere else in the country Now let's see how others are faring Infant mortality Louisiana ranks 46th49th for poverty 47th for household income 47th for food insecurity 50th in income gap by gender 47th for property crimes46th for violent crimes 48th for reading scores Louisiana ranks 49th for math scores And 48th for life expectancy US News and World Report commissions an analysis every year using 75 different indicators Lets see if we can find Louisiana We can scroll down It's not 10th It's not 20th It's not...

People Also Ask about

How to print Louisiana tax return?

What is the L 3 form for Louisiana?

What is Louisiana tax POA form?

Can I download my tax forms?

What is an LDR form in Louisiana?

Does Louisiana have a state income tax form?

How do I get my Louisiana state tax forms?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is l3 form?

How to fill out l3 form?

What is the purpose of l3 form?

What information must be reported on l3 form?

How can I get l3 form - rev?

How do I execute l3 form - rev online?

How do I make edits in l3 form - rev without leaving Chrome?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.