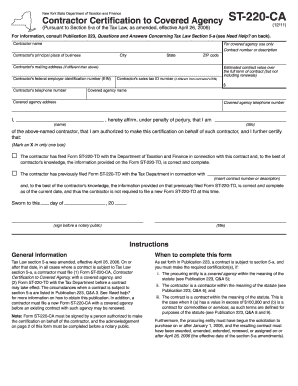

NY DTF ST-220-CA 2006 free printable template

Get, Create, Make and Sign NY DTF ST-220-CA

Editing NY DTF ST-220-CA online

Uncompromising security for your PDF editing and eSignature needs

NY DTF ST-220-CA Form Versions

How to fill out NY DTF ST-220-CA

How to fill out NY DTF ST-220-CA

Who needs NY DTF ST-220-CA?

Instructions and Help about NY DTF ST-220-CA

But you guys got another video here for you in this one we're going to be looking at how to refill your ink jet printer cartridges now ink jet cartridges are pretty expensive and if you do a lot of printing like I do then you're going to want to start to learn how to refill them now it's not as messy as people think and if you know what you're doing it's pretty straightforward so in this video we're going to be covering out of refill those ink jet printer cartridges so here we have an HP I'm just going to show you our remove these you just lift the actual lid here and what will happen is it will then go into maintenance mode where you can remove the actual cartridges themselves and as you can see they've got a little clip on them, you just pull that little clip back and release that from the actual printer itself you can do that with the rest of them now we're going to be needing a set of gloves for this because sometimes a little of ink does get her on your hands and also here is our ink cartridges and a pack of ink now this pack is pretty much the one I use for all my refills and as you can see they've got a load of different colors there, and they've got their own syringes on the actual ink itself there's the actual manual or pamphlet which has all the ink cartridges models, and it's this one's made in the US of A, so that's pretty affordable pack to buy, and I will put the link in the description so is the actual pamphlet that you get and what it's going to do is have all the models for the ink cartridges and printers and as you can see there's quite a few, and it will tell you where the actual screw holes are to make the screw holes, so you can actually inject the ink okay now if yours is not in the actual pamphlet as a picture you can actually go on the internet and look at the website okay so things in this kit that I've got you've got the actual prying tool there to help make a hole, and it's got it's just like a little drill a bit really with a handle on it, you can just make a little hole in the actual cartridge, and also you can see there we have some little bangs to actually burn out the hole, or you can use Villa tape or whatever floats your boat really I've also got in this kit we've actually got some flush which will come in pretty handy if your ink cartridge has dried out a little, or you want to clean it all and these are the actual ink in themselves pretty good quality ink, and it's got its own syringe which means you don't have to keep washing out the actual syringe itself it's got its own syringe part for each ink catch-all there so let's get on with the actual refilling process here I'm going to be doing the yellow one to start off we're just going to make a little hole here I'm sorry that's gone out a camera there just a little tiny hole, so I can be in actual Brad that comes in the kit to actually make the hole now you can use a little tiny screwdriver if you wish but as you can see its see just underneath the actual round...

People Also Ask about

What is excluded from NY sales tax?

What is Section 601 E of the New York State Tax Law?

What is the statute of limitations on sales tax in NY?

What is the statute of limitations on tax audit in NY?

Do contractors charge sales tax on labor in NY?

What is Form ST 220 CA for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF ST-220-CA in Gmail?

How do I edit NY DTF ST-220-CA online?

How do I fill out NY DTF ST-220-CA using my mobile device?

What is NY DTF ST-220-CA?

Who is required to file NY DTF ST-220-CA?

How to fill out NY DTF ST-220-CA?

What is the purpose of NY DTF ST-220-CA?

What information must be reported on NY DTF ST-220-CA?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.