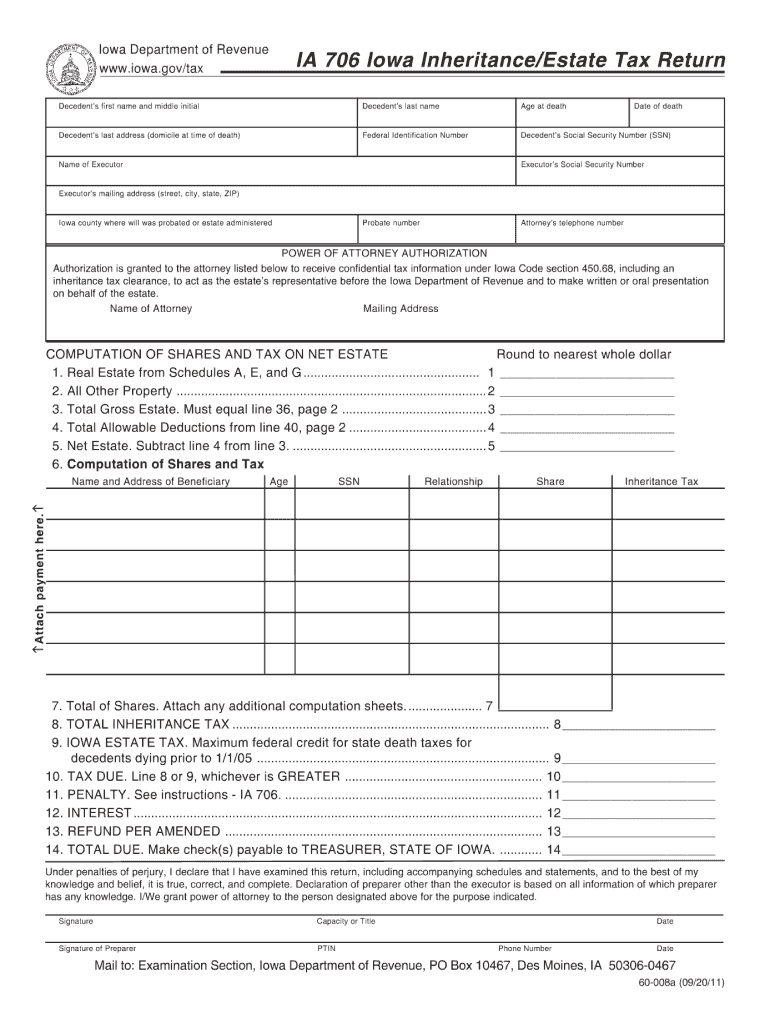

What is Form IA 706?

Form IA 706 is the Iowa Inheritance Tax Return. Inheritance is the transfer of the rights and duties from the decedent (testator) to the editors. The form must be filed by the executor of the decedent’s will.

What is Form IA 706 for?

There are two types of inheritance in Iowa. The first one is executed with the help of a will and is called a testate succession. It is a personal instruction of the person in contemplation of death. It must be in a written form and must contain the date, place and signature of the testator.

The second one is an intestate succession that does not require the will. In this case the editors obtain the right to inherit one by one. Or they can elect not to take the inheritance. Form IA 706 is designed for these two cases as the tax is imposed on each of them.

When is Form IA 706 Due?

You must pay the tax before the last day of the 9th month after the decedent’s death or right on this day. Check if you can claim the time extension for this form if you will not be able to submit in within the established deadline.

Is Form IA 706 Accompanied by Other Forms?

If it is the testate succession, you must provide the will of the decedent. If it is the intestate succession, the representatives of the court will ask you to come and will provide you with all necessary documents.

What Information do I Include in Form IA 706?

The first block of the form is devoted to the following information: decedent’s name and address, estate identification number, decedent’s social security number, the date of death and the age at death, executor’s name, address, social security number and phone. This block also includes the power of attorney authorization with the name and signature. After that, check 14 prompts for figuring the total tax amount. Moreover, you must indicate the total gross estate and deductions.

Where do I Send Form IA 706?

You must send the Iowa Inheritance Tax Return to the Iowa Department of Revenue.