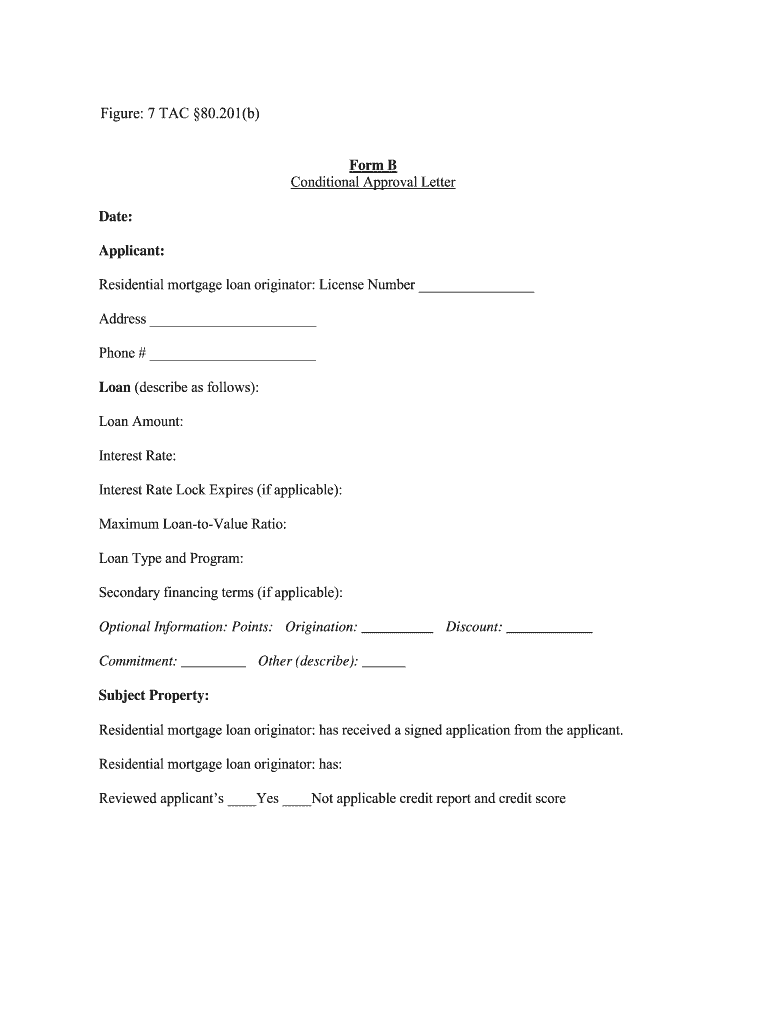

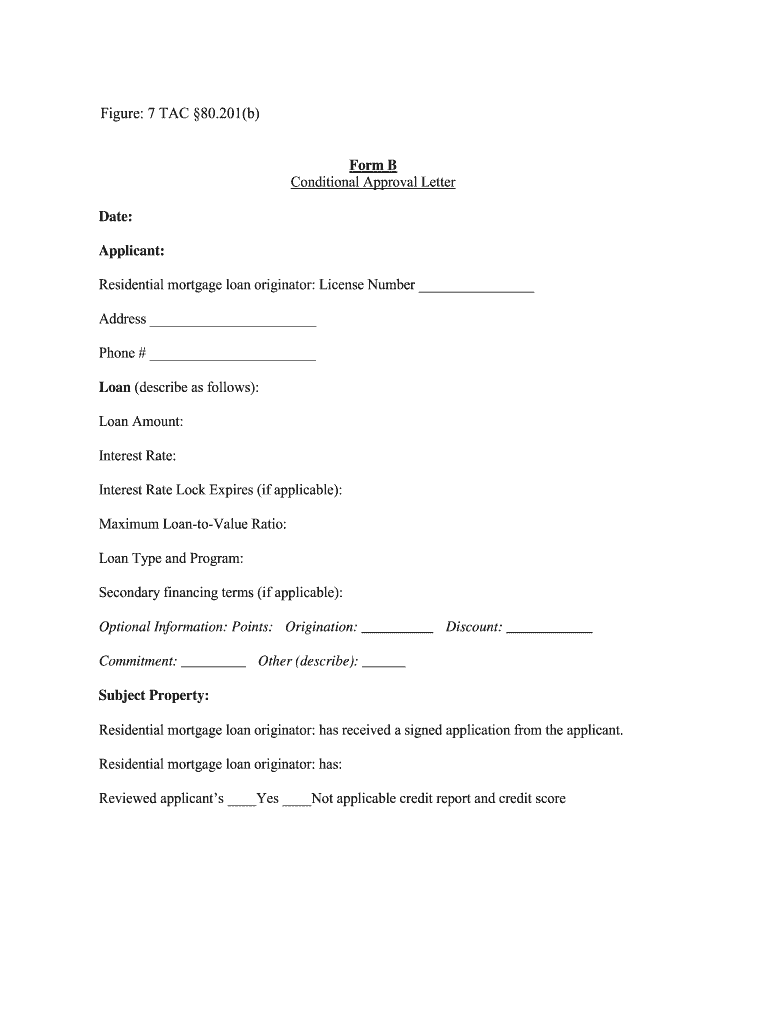

Get the free b conditional approval letter sample

Get, Create, Make and Sign loan approval letter template form

How to edit loan approval letter pdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan approval pdf form

How to fill out Conditional Approval Letter Form B

Who needs Conditional Approval Letter Form B?

Video instructions and help with filling out and completing b conditional approval letter sample

Instructions and Help about blank loan letter sample

Hello everyone this is Ashley Jameson coming to you from Ashley Lambert Realty and this is video 2 of my credit get your credit straight series, and today I'm going to be discussing letters of explanation what they are why you need them why the lender is asking for them and discuss the basic elements that should be included in your letter of explanation first and foremost if your lender requests a letter of explanation over a couple of items that they describe on your credit report do not be stressed out do not be scared this is very, very common the top three reasons why a lender will basically ask you for a letter of explanation is of course any discrepancies late payments defaults on your credit report they can also ask you questions about your employment if there are any gaps in employment if you changed fields completely like if you went from being a doctor to being a gardener, and you want to know what's going on they want to know of any previous addresses they want to make sure that all the address is listed on your credit report are in fact yours typically if your identity has been stolen the previous addresses or the address is listed on your credit report will be the first indicator that something fishy is going on one thing to keep in mind is that if a lender is asking you for a letter of explanation or more details surrounding a specific situation that they discover they want to know not only like what happened and why and how did you fix it and things like that, but I want to know if it was a complete disregard for the fact that you owe that debt or if you were financially unable to pay that debt or if it was due to some type of extenuating circumstance now an extenuating circumstance can definitely be very stressful on your finances especially when you get things together, and you want to buy a home later on extenuating circumstances could be obviously a loss a job separation divorce hospitalization if you break a limb and your job is dependent on you physical, so those are things that they will definitely consider, and you would want to mention those in your letter of explanation now if there's something dealing with a death divorce separation hospitalization you will need to provide some type of supporting documents and whatever type of supporting documents you feel comfortable giving especially when it comes to medical, but you want to have something that says this is what it was this is the date that it occurred it lines up with what's on my credit report that you see and this is the money from my savings or this is the money I saved up to resolve this situation, and it'll never happen again because I have a savings account I'm healthy now I'm back to work something like that very quick very simple super summarized they're not asking for a life story at all they just want to know the basic questions, and they want to make sure that you are a good borrower for their bank other reasons that a lender may ask for a letter of...

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loan pre approval letter template directly from Gmail?

How can I edit blank approval letter on a smartphone?

How do I fill out mortgage forms on an Android device?

What is Conditional Approval Letter Form B?

Who is required to file Conditional Approval Letter Form B?

How to fill out Conditional Approval Letter Form B?

What is the purpose of Conditional Approval Letter Form B?

What information must be reported on Conditional Approval Letter Form B?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.