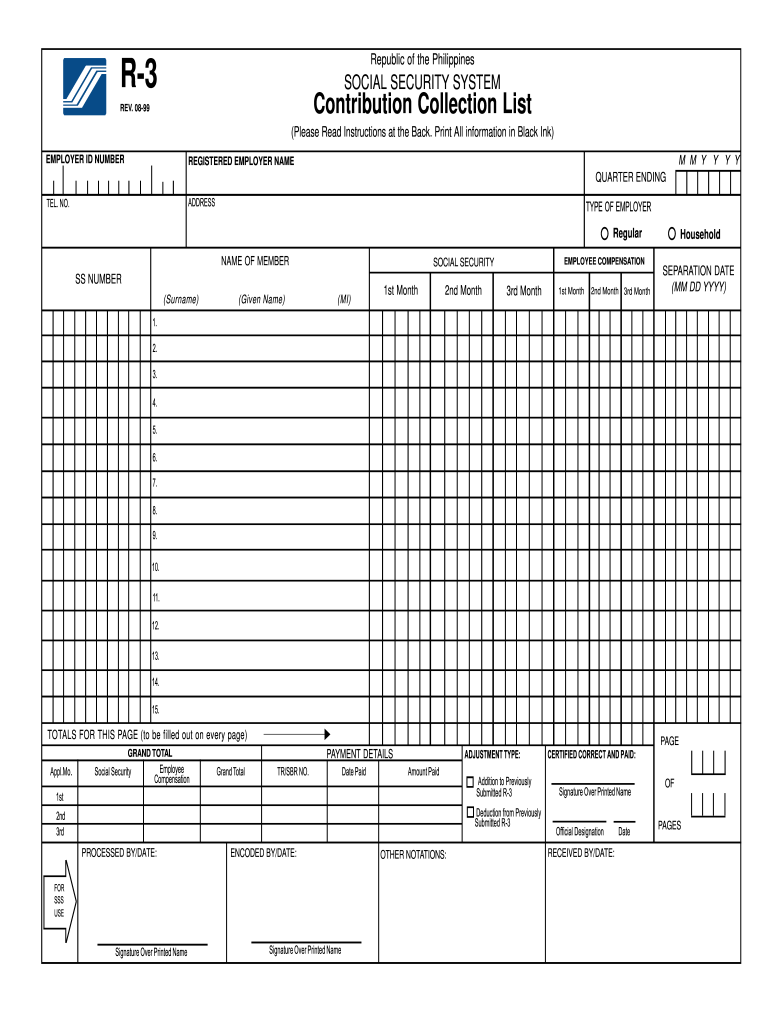

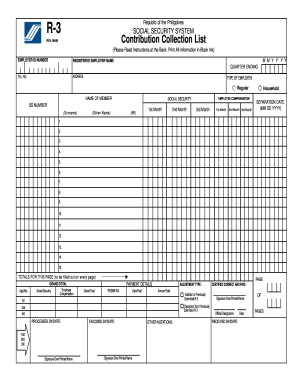

What is Form R-3?

Form R-3 is known as the Social Security System Collection List. You may complete this form online. Simply find it on our site, open and fill out all fields. Doing it with a help of filler you will save plenty of time. This method will release you from going to bank and standing in long lines.

What is Form R-3 for?

This form is a sort of report that includes the details about the contributions of the employers or Social Security System members. Every new employee must be included in this list. Before you fill this form out, make sure that all your hired employees have their SSS enrollments set up and that at least a single payroll was generated from the start date and the period of cut-off. You must know how to generate the payroll and how to add the enrollment to the profile of the employee.

When is Form R-3 Due?

This report must be filed on the monthly basis. The employer must complete it every month including all new employees that were hired for 30-days period.

Is Form R-3 Accompanied by Other Forms?

No, this report does not require any attachments and may be filed separately.

What Information do I Include in Form R-3?

The following information must be provided in the form:

-

Employer number;

-

Registered employer name;

-

Quarter ending;

-

Telephone number;

-

Address;

-

Type of employer (regular or household);

-

Information about the member (SS number, name, compensation, separation date);

-

Payment details and total amounts;

-

Date and signature;

Where do I Send Form R-3 after Completion?

Send the form to the nearest SSS or postal services office.