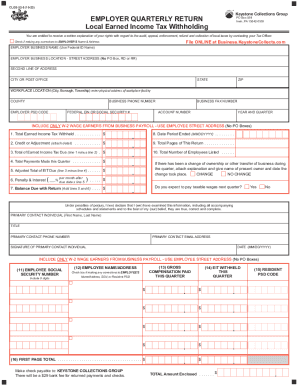

PA DCED CLGS-32-5 2012 free printable template

Show details

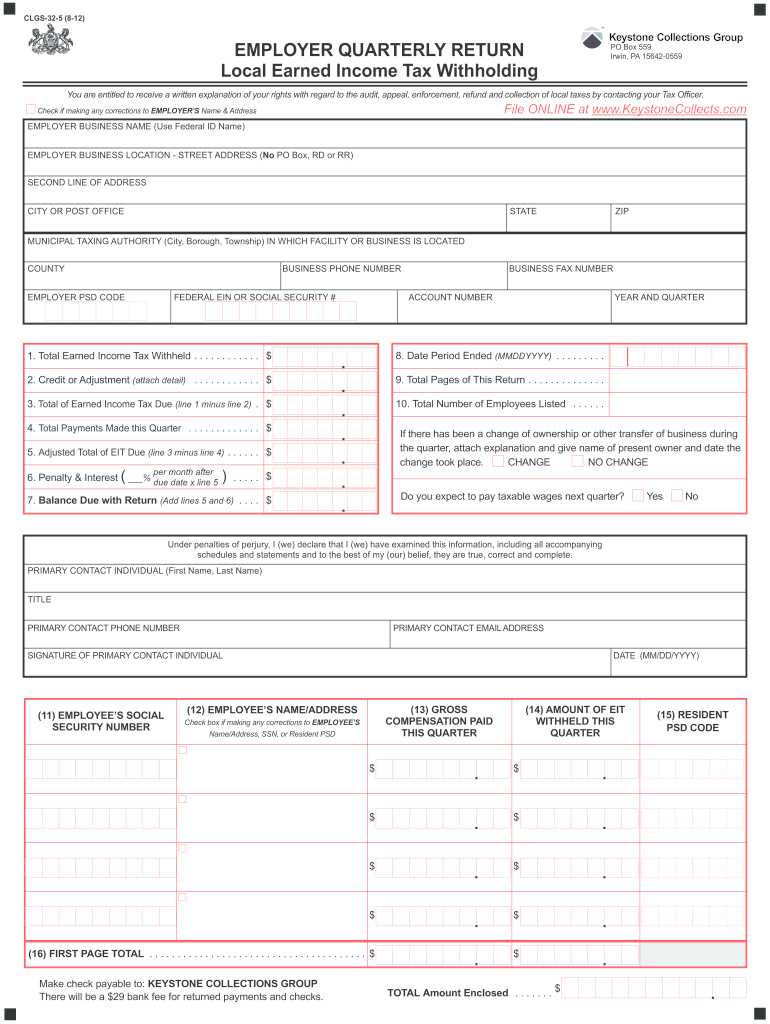

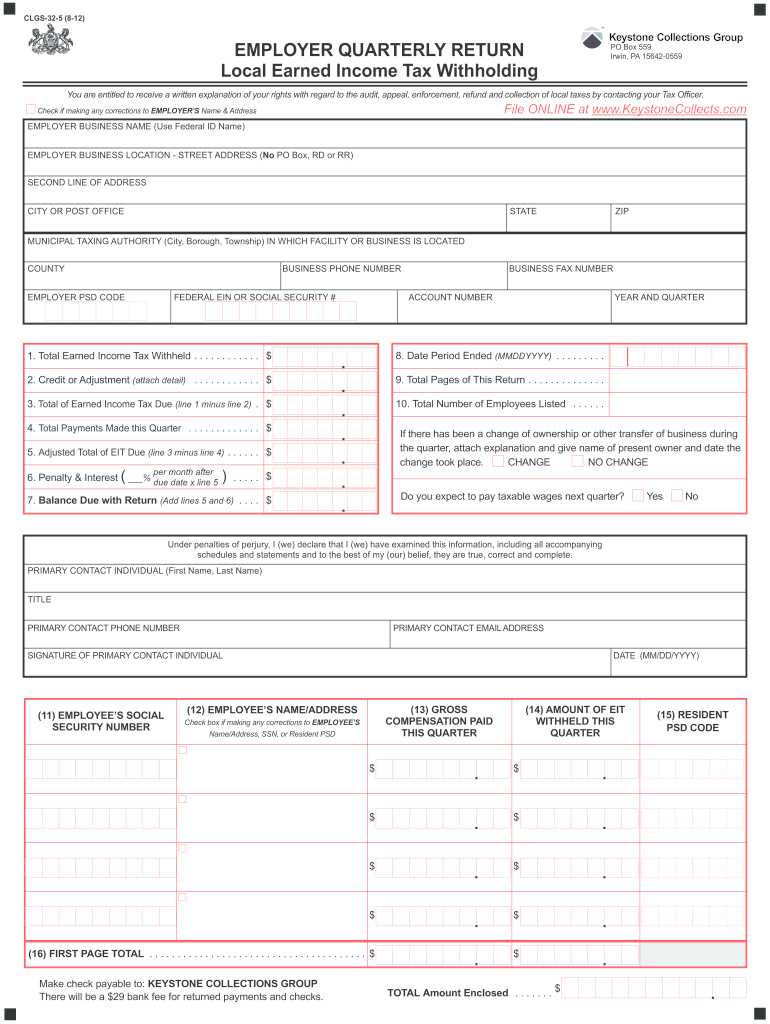

CLGS-32-5 8-12 EMPLOYER QUARTERLY RETURN Local Earned Income Tax Withholding Keystone Collections Group PO Box 559 Irwin PA 15642-0559 You are entitled to receive a written explanation of your rights with regard to the audit appeal enforcement refund and collection of local taxes by contacting your Tax Officer. File ONLINE at www. KeystoneCollects. com Check if making any corrections to EMPLOYER S Name Address EMPLOYER BusINEss NAME use federal ID Name sECOND LINE Of ADDREss CITY OR POsT...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DCED CLGS-32-5

Edit your PA DCED CLGS-32-5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DCED CLGS-32-5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA DCED CLGS-32-5 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA DCED CLGS-32-5. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DCED CLGS-32-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DCED CLGS-32-5

How to fill out PA DCED CLGS-32-5

01

Obtain the PA DCED CLGS-32-5 form from the official Pennsylvania Department of Community and Economic Development website.

02

Begin filling in the applicant information section, including your name, address, and contact details.

03

Provide details of the project for which you are seeking funding, including a description and the total amount requested.

04

If applicable, complete the budget section, detailing how the funds will be allocated.

05

Include any required supporting documentation, such as project plans or financial statements.

06

Review the form for accuracy and completeness.

07

Submit the completed form along with any supporting documents to the appropriate department within the DCED.

Who needs PA DCED CLGS-32-5?

01

Individuals or organizations seeking funding for community and economic development projects in Pennsylvania may need the PA DCED CLGS-32-5 form.

Fill

form

: Try Risk Free

People Also Ask about

What is form 941 and when must it be filed?

You're required to file a separate Form 941 for each quarter (first quarter - January through March, second quarter - April through June, third quarter - July through September, fourth quarter - October through December). Form 941 is generally due by the last day of the month following the end of the quarter.

What is form 941 vs 943?

It's designed to be used in place — or in addition to Form 941 — for businesses that routinely pay farm workers. Form 943 is only used by companies that employ and pay farmworkers wages by cash, checks, or money orders. Non-cash wages are food and lodging, or payment for services other than farm work.

Under which condition is an employer not required to file a quarterly form 941?

The only exceptions to this filing requirement are for seasonal employers who don't pay employee wages during one or more quarters, employers of household employees and employers of agricultural employees.

How do I get a copy of my IRS Form 941?

Call 800-829-3676.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA DCED CLGS-32-5 for eSignature?

Once your PA DCED CLGS-32-5 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit PA DCED CLGS-32-5 online?

With pdfFiller, the editing process is straightforward. Open your PA DCED CLGS-32-5 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the PA DCED CLGS-32-5 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your PA DCED CLGS-32-5 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is PA DCED CLGS-32-5?

PA DCED CLGS-32-5 is a form used in Pennsylvania for the reporting of tax credits for businesses engaging in specific activities as defined by the Pennsylvania Department of Community and Economic Development (DCED).

Who is required to file PA DCED CLGS-32-5?

Businesses that qualify for certain tax credits under Pennsylvania law are required to file PA DCED CLGS-32-5 to report their eligibility and the details necessary for claiming those credits.

How to fill out PA DCED CLGS-32-5?

To fill out PA DCED CLGS-32-5, businesses should complete the required sections by providing their organization details, specifying the type of tax credit being claimed, reporting any relevant financial figures, and ensuring all information is accurate and submitted by the deadline.

What is the purpose of PA DCED CLGS-32-5?

The purpose of PA DCED CLGS-32-5 is to facilitate the reporting and claiming of tax credits for eligible businesses, ensuring compliance with state regulations and providing necessary information to the DCED.

What information must be reported on PA DCED CLGS-32-5?

The information that must be reported on PA DCED CLGS-32-5 includes the business's name, address, tax identification number, the specific tax credits being claimed, associated income or expenses, and other supporting documentation as required by the form.

Fill out your PA DCED CLGS-32-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DCED CLGS-32-5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.