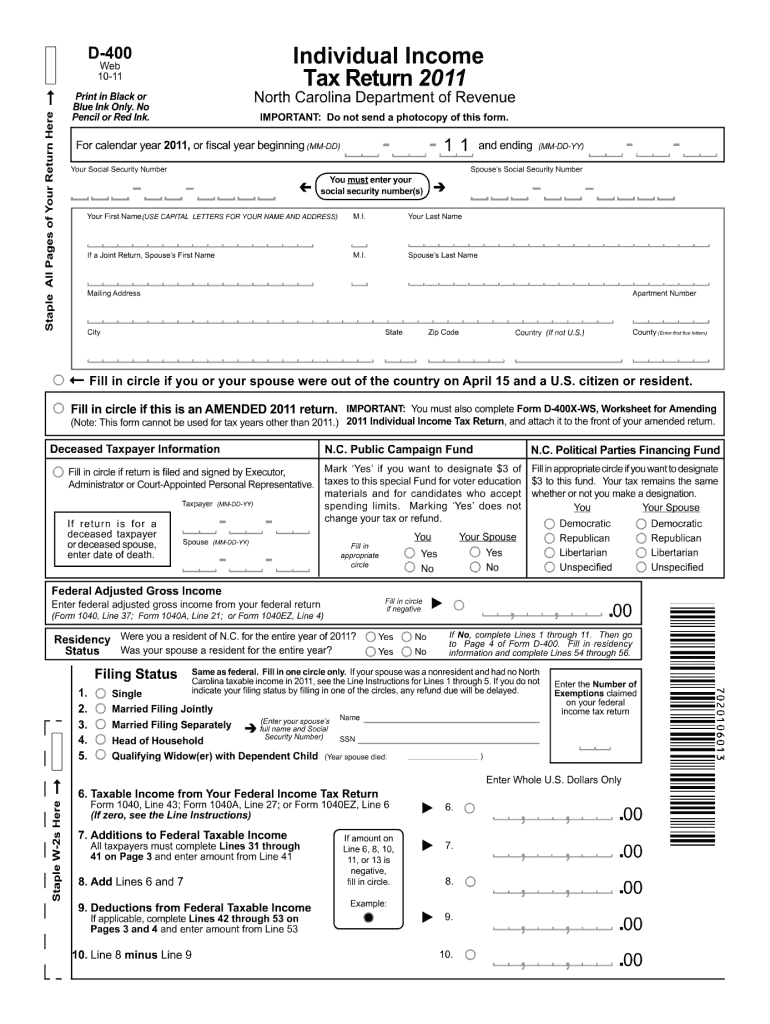

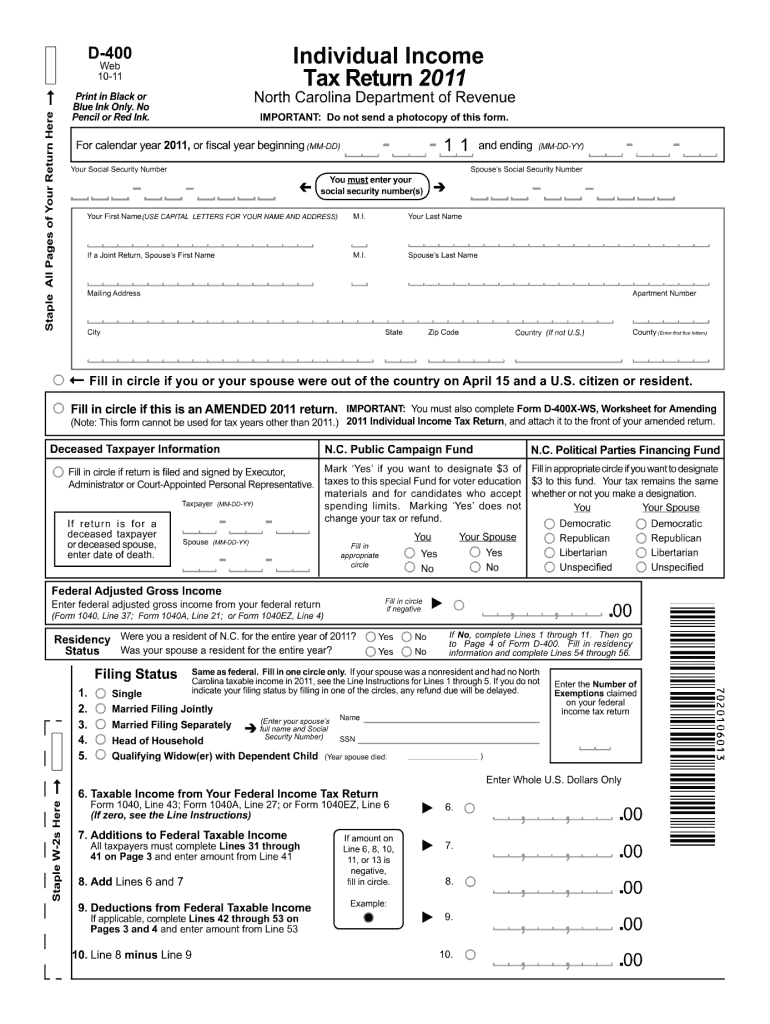

NC DoR D-400 2011 free printable template

Show details

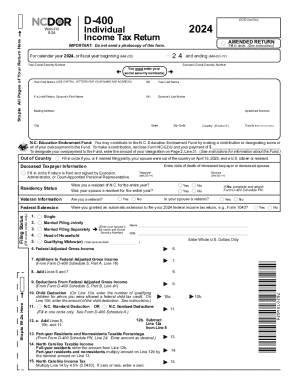

D-400 Web 10-11 Print in Black or Blue Ink Only. No Pencil or Red Ink. North Carolina Department of Revenue IMPORTANT: Do not send a photocopy of this form. Individual Income Tax Return 2011 11 Staple

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR D-400

Edit your NC DoR D-400 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR D-400 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC DoR D-400 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NC DoR D-400. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR D-400 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR D-400

How to fill out NC DoR D-400

01

Gather your personal information, including your Social Security number, filing status, and any dependent information.

02

Collect all necessary income documentation, such as W-2s, 1099s, and other income statements.

03

Obtain the NC DoR D-400 form from the North Carolina Department of Revenue website or a physical location.

04

Fill out your personal details at the top of the form, including your name, address, and Social Security number.

05

Report your total income from all sources in the designated section.

06

Subtract any allowable deductions to calculate your taxable income.

07

Complete the tax calculation section to determine your total tax owed.

08

Input any payments made throughout the year, such as withholding and estimated payments.

09

Review your calculations for accuracy and make necessary adjustments.

10

Sign and date the form before submission, and retain a copy for your records.

Who needs NC DoR D-400?

01

Individuals who have earned income in North Carolina and need to report their state taxes.

02

Residents of North Carolina who meet the filing thresholds based on income and filing status.

03

Anyone who is required to file a tax return under North Carolina tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What is form D-40B?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022. •

What is d40 tax form?

If you need to change or amend an accepted Washington, D.C. State Income Tax Return for the current or previous Tax Year you need to complete Form D-40. Form D-40 is used for the Tax Return and Tax Amendment.

What is the DC D 40P payment voucher?

Use the D-40P Payment Voucher to make any payment due on your D-40 return. Make sure your check or electronic payment will clear. You will be charged a $65 fee if your check or electronic payment is not honored by your financial institution and returned to OTR. Do not use this voucher to make estimated tax payments.

What is NC Form d400?

2022 D-400 Individual Income Tax Return | NCDOR.

Do I need to file NC state tax return?

You must file a North Carolina income tax return if you received income while being a resident of NC or received income from NC sources. If you had North Carolina income tax withheld but do not meet the filing requirements, you must file a North Carolina return in order to receive a refund for any withholdings.

What is D-400 Schedule S?

You must attach Form D-400 Schedule S (Pages 1 and 2) to Form D-400 if you claim N.C. itemized deductions. mortgage interest (excluding mortgage insurance premiums), real estate property taxes, charitable contributions, medical and dental expenses, and repayment of claim of right income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NC DoR D-400?

The editing procedure is simple with pdfFiller. Open your NC DoR D-400 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the NC DoR D-400 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NC DoR D-400 in seconds.

How do I edit NC DoR D-400 on an iOS device?

Create, modify, and share NC DoR D-400 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is NC DoR D-400?

NC DoR D-400 is the North Carolina Individual Income Tax Return form that residents use to report their income and calculate their state tax liability.

Who is required to file NC DoR D-400?

Any individual who earns income in North Carolina and meets the income threshold set by the state is required to file the NC DoR D-400.

How to fill out NC DoR D-400?

To fill out the NC DoR D-400, individuals need to provide personal information, report their income, claim deductions or credits, and calculate their tax liability, following the instructions provided with the form.

What is the purpose of NC DoR D-400?

The purpose of NC DoR D-400 is to enable residents to report their income and pay any taxes owed to the state of North Carolina.

What information must be reported on NC DoR D-400?

The information that must be reported on NC DoR D-400 includes personal identification details, total income, adjustments to income, deductions, credits, and the calculated tax owed or refund due.

Fill out your NC DoR D-400 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR D-400 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.