Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

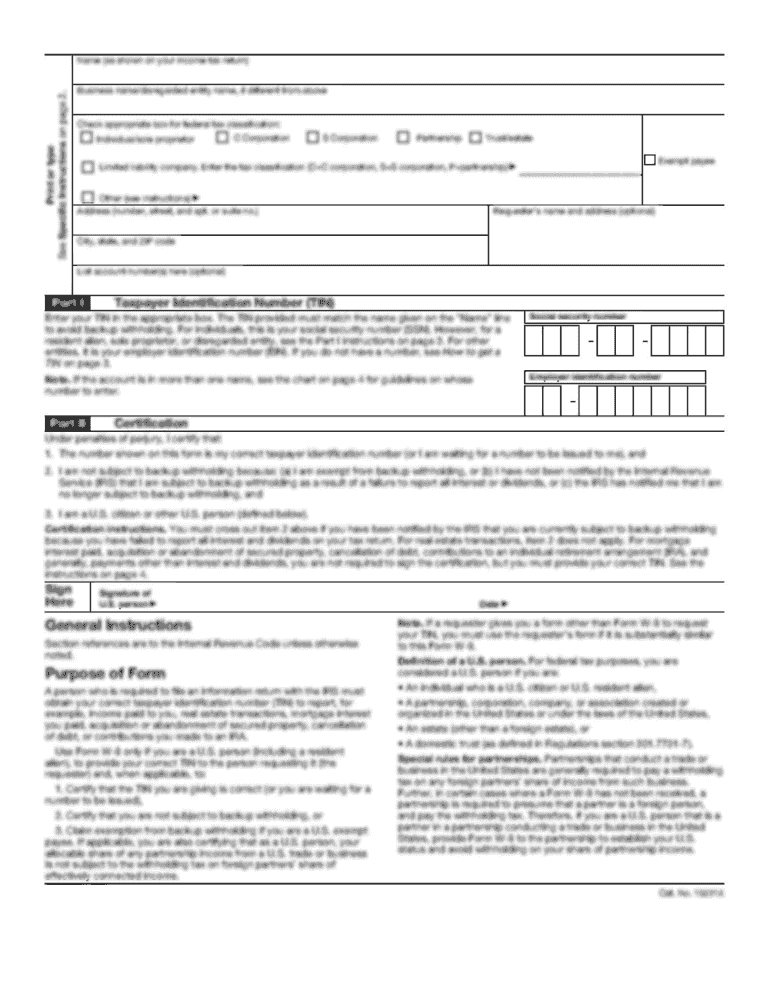

What is diifinancial counseling client intake?

Financial counseling client intake refers to the process of gathering information about a client when they seek financial counseling or assistance. It typically involves a structured meeting or consultation with the client to understand their financial situation, goals, and challenges. The purpose of client intake is to assess the individual's financial needs and develop an appropriate plan or strategy to help them improve their financial well-being. This may include reviewing their income, expenses, debt, assets, and financial habits. Additionally, counselors may ask about their financial goals, such as saving for retirement, buying a home, or clearing debt, in order to tailor advice and recommendations to the client's unique circumstances.

Who is required to file diifinancial counseling client intake?

Financial counseling client intake forms are typically completed by individuals seeking financial counseling services. These individuals may be facing financial difficulties, seeking assistance with budgeting, debt management, or other financial concerns. The purpose of the intake form is to gather information about the client's financial situation to help the counselor understand their needs and develop an appropriate plan or strategy.

How to fill out diifinancial counseling client intake?

When filling out a financial counseling client intake, there are several steps you can follow:

1. Personal Information: Start by providing basic personal details such as the client's name, contact information (address, phone number, email), and their primary language.

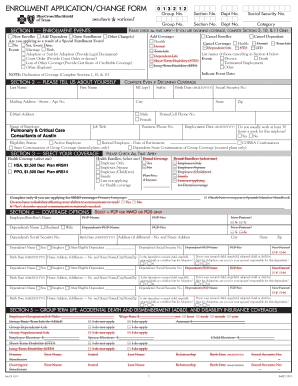

2. Household Information: Request information about the client's household situation, including the number of people living in the household, their relationship to the client, and any dependents.

3. Employment Information: Ask the client to provide details about their current employment status, including their occupation, employer's name, contact details, and income information. If the client has multiple sources of income, have them provide details about each source separately.

4. Financial Information: In this section, gather information about the client's assets, liabilities, and monthly expenses. Ask them to list their bank accounts, investments, properties, vehicles, and any other valuable assets they own. Additionally, request details about their debts, such as credit cards, loans, or mortgages. Finally, have the client outline their monthly expenses, including housing, utilities, transportation, groceries, and any other recurring expenses they have.

5. Financial Goals: It's important to understand the client's financial goals and objectives. Ask them about their short-term and long-term goals, such as saving for emergencies or retirement, paying off debt, buying a home, or funding education.

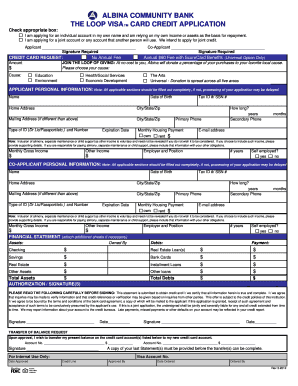

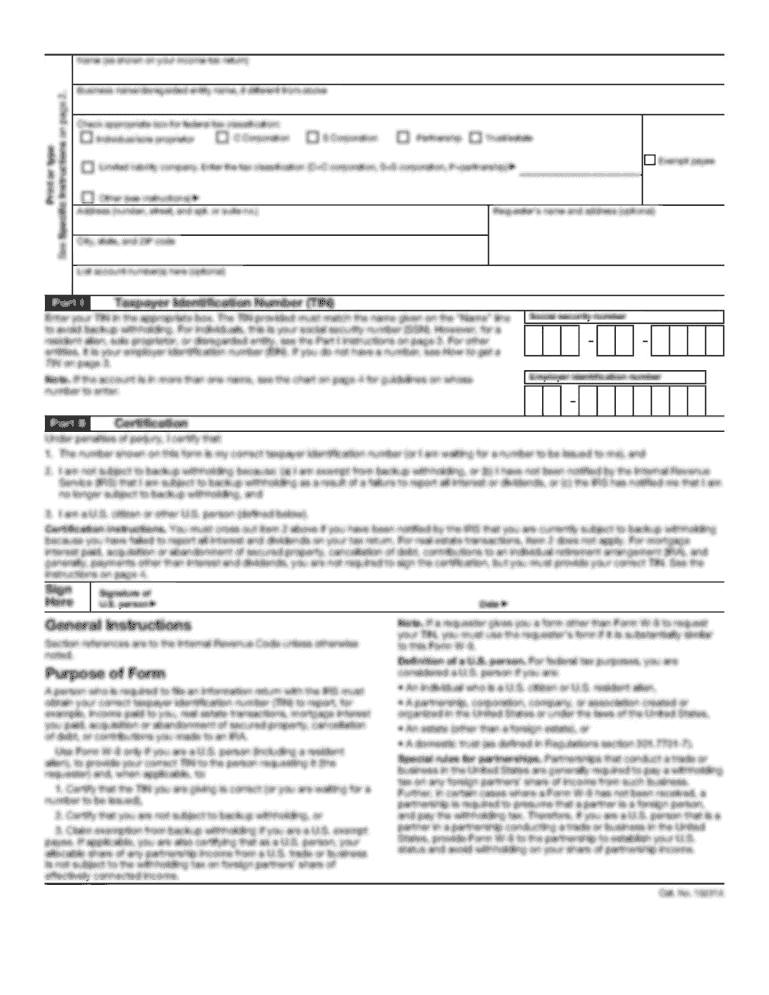

6. Credit Report and Score: In order to assess the client's credit situation, request authorization to access their credit report and score. This will provide valuable insights into their existing credit history and any potential issues they may be facing.

7. Financial Challenges and Concerns: Provide an opportunity for the client to explain their financial challenges and concerns. This can include issues related to debt management, budgeting, saving, or any other financial stressors they are experiencing.

8. Additional Information: Include a section where the client can provide any other relevant information they feel is important for the financial counselor to know.

9. Consent and Agreement: Include a consent and agreement section that outlines the terms and conditions of the financial counseling services being provided, such as confidentiality, fees (if applicable), and the counselor's responsibilities.

Remember to make sure the intake form is user-friendly and easy to understand. Leave space for the client to write or provide additional information, and ensure that the form is securely stored and accessible only to authorized individuals.

What is the purpose of diifinancial counseling client intake?

The purpose of diifinancial counseling client intake is to gather relevant information about the client's financial situation and goals in order to assess their financial needs and provide appropriate counseling services. It helps in understanding the client's financial challenges, identifying their strengths and weaknesses, and determining the most effective strategies to improve their financial well-being. By conducting a thorough intake process, financial counselors can personalize their advice and recommendations to meet the client's unique circumstances and objectives. It also helps establish a foundation for building a strong client-counselor relationship based on trust and understanding.

What information must be reported on diifinancial counseling client intake?

When conducting financial counseling, several types of information should be reported on the client intake form. The specific information may vary depending on the organization and the purpose of the counseling, but generally, the following details are important to include:

1. Personal Information: Client's name, address, phone number, email address, and date of birth.

2. Demographic Details: Information such as gender, marital status, dependents, and household size.

3. Employment and Income: Client's employment status, occupation, employer's name, job duration, gross monthly income, and any other sources of income.

4. Expenses and Budgeting: A detailed breakdown of the client's monthly expenses, including housing costs, utilities, transportation, food, insurance, child/dependent care expenses, debt payments, and other essential and discretionary expenses.

5. Debt and Credit Information: List of all debts, including credit cards, loans, mortgages, student loans, and any other outstanding obligations. Each debt should include the creditor's name, the amount owed, the minimum monthly payment, and the interest rate. Additionally, requesting the client's credit report or credit score can be useful.

6. Assets and Savings: Information on the client's assets, such as savings accounts, retirement accounts, investments, real estate, vehicles, and any other valuable possessions.

7. Financial Goals and Challenges: The client's specific financial goals, both short-term and long-term, as well as any challenges they are facing or areas in which they require assistance.

8. Other Financial Data: Additional relevant information may include information about bankruptcy filings, tax issues, legal concerns, financial hardships, or any other unique circumstances.

It is essential to maintain client confidentiality and follow privacy laws when handling this information. The specifics of the client intake form may vary among organizations, so tailoring it to the specific needs of the financial counseling program is important.

What is the penalty for the late filing of diifinancial counseling client intake?

The penalty for the late filing of financial counseling client intake forms can vary depending on the specific context and regulations of the jurisdiction in question. Generally, penalties for late filing can include fines, penalties, or other regulatory consequences. It is advisable to consult with relevant regulatory bodies or legal professionals to determine the specific penalties applicable to your situation.

How can I send diifinancial counseling client intake to be eSigned by others?

When you're ready to share your diifinancial counseling client intake, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get diifinancial counseling client intake?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific diifinancial counseling client intake and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I fill out diifinancial counseling client intake on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your diifinancial counseling client intake, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.