Get the free u1 form uk

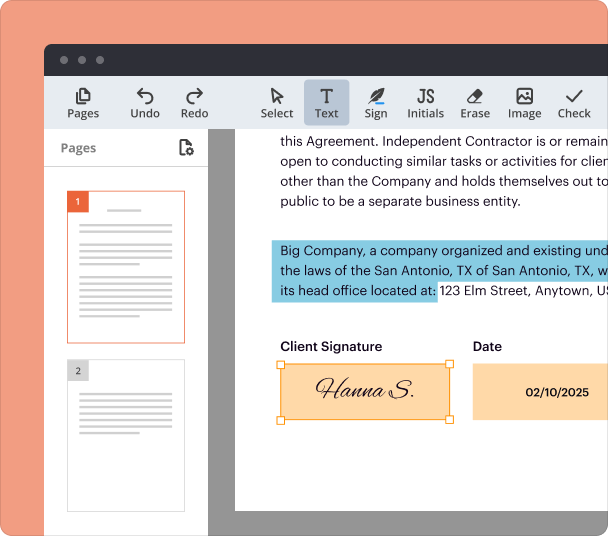

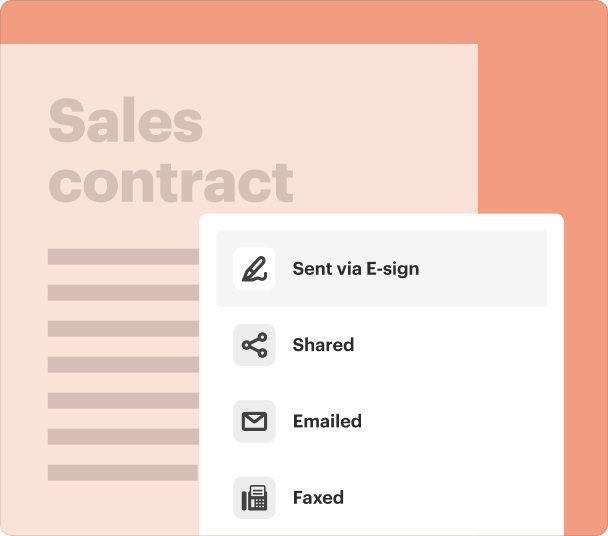

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

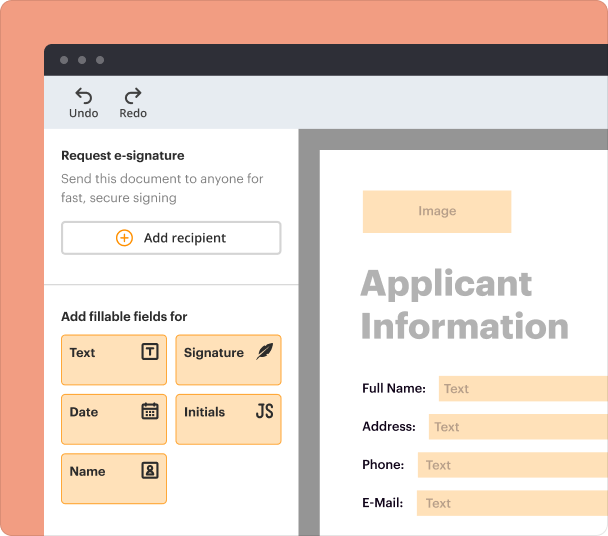

Create professional forms

Simplify data collection

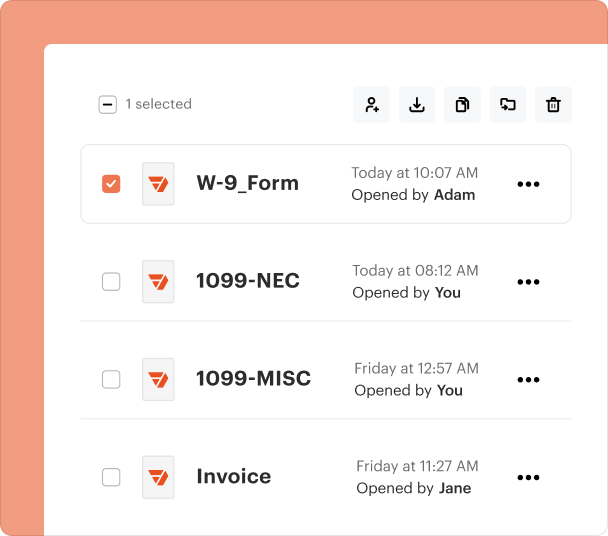

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

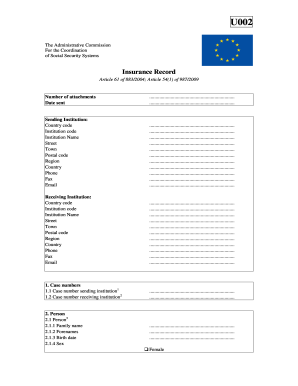

Comprehensive Guide to the u1 Form in the UK

Understanding the u1 form

The u1 form, also known as the Portable document U, is an essential document for individuals seeking unemployment benefits within the European Economic Area. It provides a summary of National Insurance contributions, which may be required for claims in various EEA member states. This form is particularly significant for those who have worked in the UK and are transitioning to other EEA countries.

Key features of the u1 form

The u1 form has several vital features that assist users in understanding their National Insurance contributions. It includes details such as employment history, contributions made during employment, and eligibility for unemployment benefits in other EEA countries. Knowing these details can streamline the process of filing a claim abroad.

When to use the u1 form

The u1 form should be utilized when an individual plans to move to another EEA country and requires confirmation of their previous employment and contributions for unemployment benefits. It is essential to request this form before leaving the UK to ensure all necessary documentation is available for a smooth transition.

Eligibility criteria for the u1 form

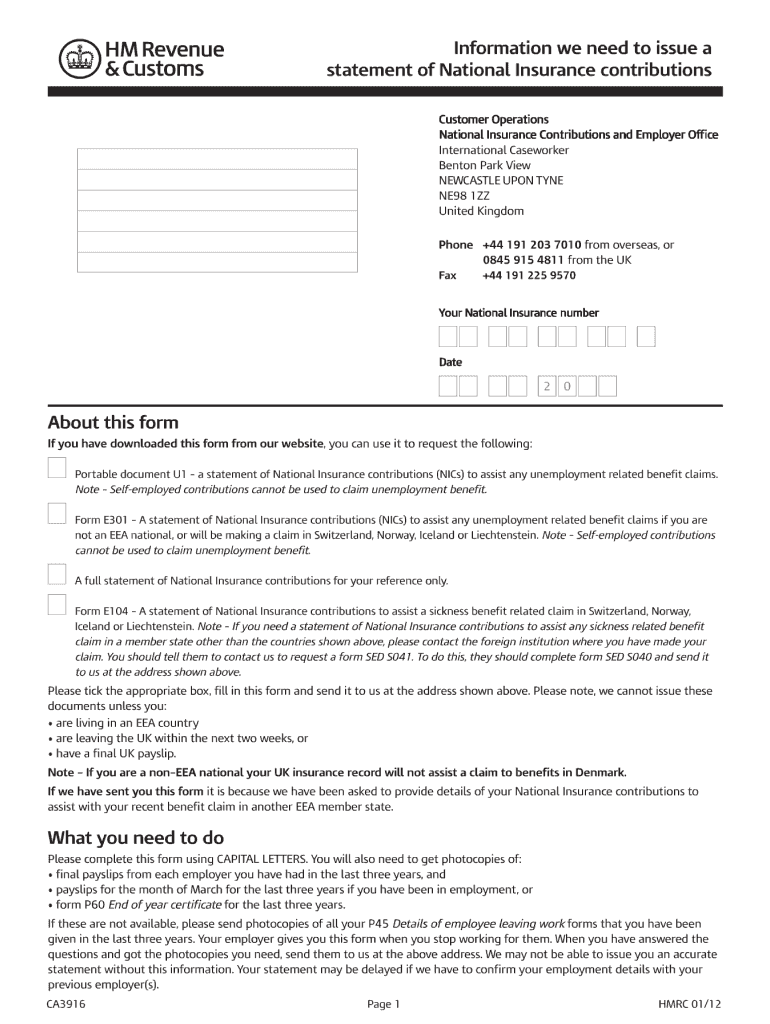

Individuals seeking to obtain the u1 form must meet specific eligibility criteria. This typically includes having a valid National Insurance number, having made sufficient contributions while employed in the UK, and currently being a resident of, or moving to, an EEA country where you wish to claim unemployment benefits.

Required documents and information

To complete the u1 form application, several documents and pieces of information are needed. You must provide your National Insurance number, personal identification details, employment history, and, if applicable, a letter from your former employer confirming your job details and reason for leaving. Gathering this information beforehand can expedite the completion of your request.

Best practices for accurate completion

To ensure the u1 form is completed accurately, it is advisable to double-check all entries for errors and omissions. Make sure that all personal information, including names and dates, is spelled correctly. It is also helpful to review any specific guidelines provided by the issuing authority, as following these may help you avoid delays in processing.

Common errors and troubleshooting

Several common errors can occur when filling out the u1 form, such as mistakes in personal identification details or failing to include necessary documents. If you encounter issues with your application, it is beneficial to contact the issuing authority directly. They can provide assistance in resolving any problems and offer guidance for resubmission if required.

Frequently Asked Questions about u1 form download

What is the purpose of the u1 form?

The u1 form serves to summarize your National Insurance contributions, which are needed to support claims for unemployment benefits in other EEA countries.

Who can request a u1 form?

Anyone who has worked in the UK and is planning to move to another EEA country to claim unemployment benefits can request the u1 form.

pdfFiller scores top ratings on review platforms