HSBC Form 15G free printable template

Show details

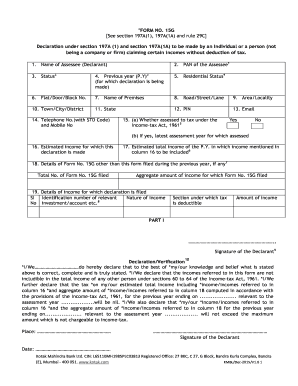

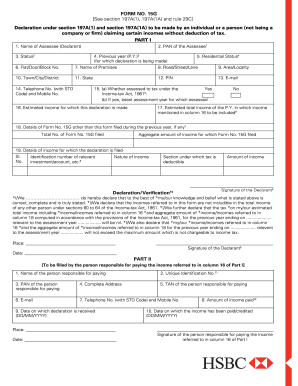

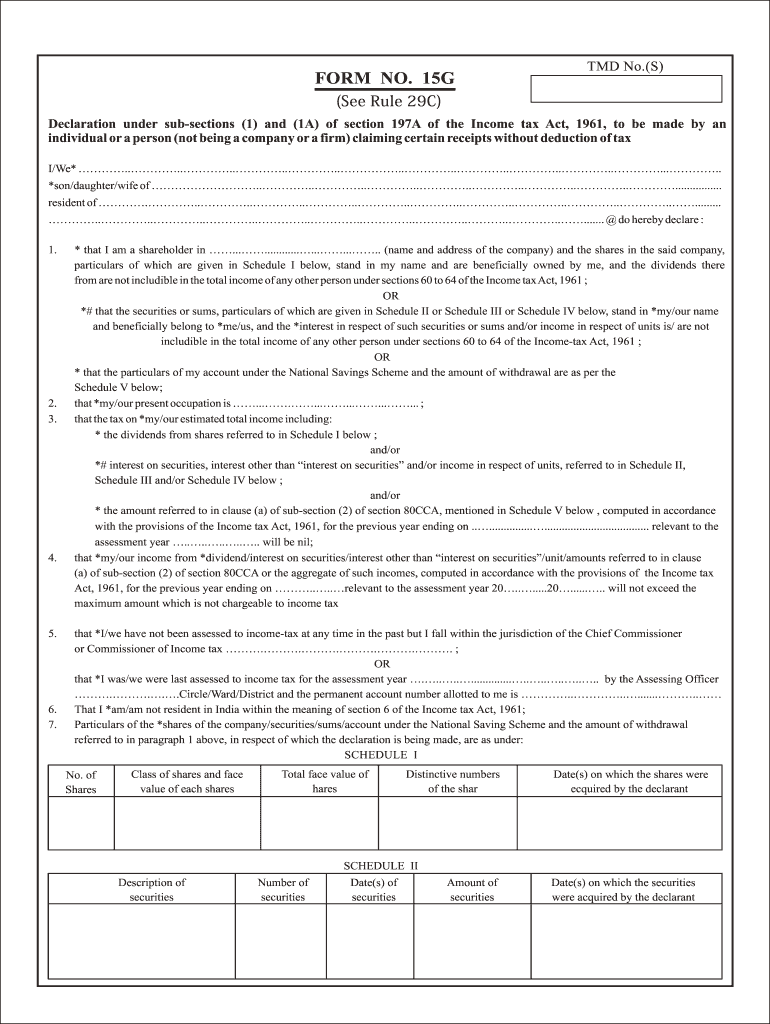

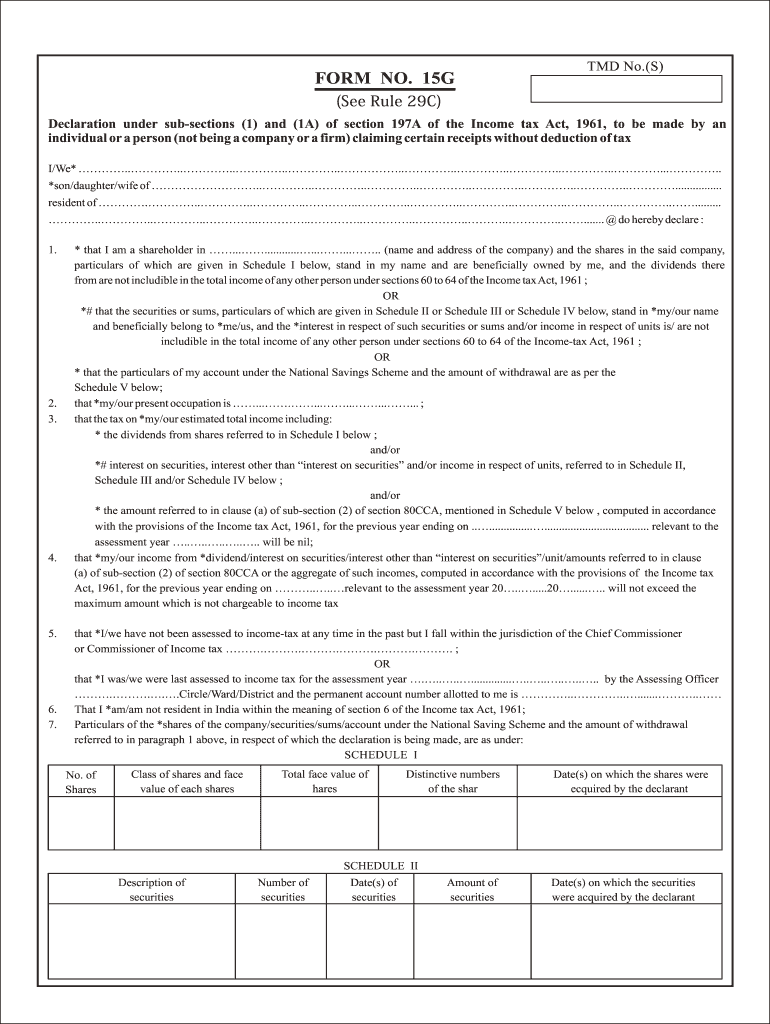

FORM NO. 15G (See Rule 29C) TMD No.(S) Declaration under sub-sections (1) and (1A) of section 197A of the Income tax Act, 1961, to be made by an individual or a person (not being a company or a firm)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsbc site pdffiller com site blog pdffiller com form

Edit your what is upload form 15g for pf withdrawal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 15 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample filled form 15g online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 15g filling sample. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pf withdrawal form 15g filled sample pdf

How to fill out HSBC Form 15G

01

Obtain HSBC Form 15G from the bank or download it from the HSBC website.

02

Fill in your name as it appears on your PAN card.

03

Provide your PAN number in the designated section.

04

Enter your address including the city and PIN code.

05

Mention the financial year for which you are submitting the form.

06

Fill in the details of the income earned during the financial year in the appropriate fields.

07

Sign the form at the bottom to confirm that the information provided is accurate.

08

Submit the completed Form 15G to your bank branch.

Who needs HSBC Form 15G?

01

Individuals who are residents of India and whose total taxable income is below the taxable limit in a financial year.

02

Individuals receiving interest income from fixed deposits or other sources who wish to avoid TDS deduction.

Fill

form 15g filled sample

: Try Risk Free

People Also Ask about 15g form sample

Is 15G required for PF withdrawal?

If you are early withdrawing your PF amount before the completion of five years, then it becomes necessary for you to fill the Form 15G to avoid tax deduction. However, if PF withdrawal happens after five years, then there is no requirement of Form 15G as the withdrawal would be tax free.

How to fill form 15G for PF settlement?

How to fill Form 15G for PF withdrawal? Name of the Assessee (Declarant) – Name must be as per your PAN Card. PAN of the Assessee: Form 15G can be submitted only by an individual and not by any firm or company. Status: Your applicable income tax status ,i.e Individual in this case.

How do I fill out a 15G form?

1:15 6:52 How to Fill Form 15G for PF Withdrawal in 2022 - YouTube YouTube Start of suggested clip End of suggested clip Let's see how to fill form 15g for pfv driver in field number 1 write your name as for your epf.MoreLet's see how to fill form 15g for pfv driver in field number 1 write your name as for your epf. Account in field number 2 write your pan number in field number. Three write the status as individual

How to file form 15G?

Filing Process Click on FORM 15G/FORM 15H (Consolidated) and prepare the xml zip file. Select the Form Name either Form 15G or Form 15H, Financial Year, Quarter and the Filing Type. Click Validate. Once the details are validated, the following screen is displayed.

Is form 15G required for PF withdrawal?

Is Form 15G mandatory for PF withdrawal? Yes, Form 15G is mandatory if you do not want TDS to be deducted from the withdrawal amount. Section 192A of the Finance Act 2015 states that PF withdrawal will attract TDS if the withdrawal amount is more than Rs.50,000 and your employment tenure is of less than 5 years.

How to fill up 15G form for fixed deposit?

How to Fill Form 15G Online Name of Declarant - Your name. PAN card details - Your PAN number. Status - To distinguish between an individual, HUF or a Trust. Previous Year - It refers to the current financial year for which you are filling up the form. Residential Status - Mention your nationality.

How can I download and fill Form 15G for PF withdrawal?

2:11 6:52 How to Fill Form 15G for PF Withdrawal in 2022 - YouTube YouTube Start of suggested clip End of suggested clip Year in field number five mention the residential status as indian from field number six to fieldMoreYear in field number five mention the residential status as indian from field number six to field number 13 write your address details including your email in field number 14 write your mobile. Number

How can I download filled form 15G?

Where to Get Form 15G? Form 15G can be easily found and downloaded for free from the website of all major banks in India as well as the official EPFO portal. Additionally, this form can also be easily downloaded from the Income Tax Department website.

What should I fill in column 17 in form 15G?

To comprehend the position of 15G/15H under IT Laws, required inputs are given below. 17- Estimated total income of the P.Y. (Previous year meaning current Financial Year) for which declaration is made, including the income mentioned in point no 16.

How to fill form 15G step by step?

How to Fill Form 15G for PF Withdrawal Login to EPFO UAN Unified Portal for members. Click on the ONLINE SERVICES option – Claim (Form 31, 19, 10C). Verify the last 4 digits of your bank account. Below the option, 'I want to apply for', click on Upload form 15G as depicted in the image.

How can I know my form 15G is submitted or not?

To view the status of uploaded file, Go to My account –>View Form 15G/15H. Once uploaded the status of the statement shall be “Uploaded”. The uploaded file shall be processed and validated. Upon validation the status shall be either “Accepted” or “Rejected” which will reflect within 24 hours from the time of upload.

What is Form 15G for PF withdrawal PDF?

Download 15G Form PDF For PF Withdrawal Form 15G is meant for individuals who want to claim no-deduction of TDS on certain incomes. It should be filled out by fixed deposit holders (less than 60 years) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year.

How can I download and fill form 15G?

Here's how you can do it: Log into your bank's internet banking with applicable User ID and Password. Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed. On the same page, you should have the option to generate Form 15G and Form 15H.

How to fill form 15G with example?

Form 15G Example Ram, aged 43 years and residing in Delhi has an annual income of Rs 1.2 lakh from his job and he also earns Rs 60,000 as interest from various deposits, making his total income Rs 1.8 lakh. He is eligible for deductions worth Rs 1 lakh, taking his total income after deductions to Rs 80,000.

Can I fill 15G form online?

EPFO portal has launched online submission of form 15G while submitting EPF withdrawal claim online. However, you can also fill and submit a physical copy to EPFO regional office for non-deduction of TDS.

How to fill form 15G for PF withdrawal?

How to fill Form 15G for PF withdrawal? Name of the Assessee (Declarant) – Name must be as per your PAN Card. PAN of the Assessee: Form 15G can be submitted only by an individual and not by any firm or company. Status: Your applicable income tax status ,i.e Individual in this case.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 15g form filled example for eSignature?

Once your 15g form filling sample is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find 15g filled sample?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 15g and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete 15 g sample online?

Filling out and eSigning epf 15g form download is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is HSBC Form 15G?

HSBC Form 15G is a self-declaration form used in India by taxpayers to ensure that no tax is deducted at source (TDS) on interest income earned from deposits when the total income is less than the taxable limit.

Who is required to file HSBC Form 15G?

Individuals whose total income is below the taxable limit and who want to avoid TDS on their interest income are required to file HSBC Form 15G.

How to fill out HSBC Form 15G?

To fill out HSBC Form 15G, individuals need to provide their personal details such as name, PAN (Permanent Account Number), address, and the relevant financial institution details. They must also declare that their total income is below the taxable limit.

What is the purpose of HSBC Form 15G?

The purpose of HSBC Form 15G is to allow individuals to avoid TDS on their interest income by declaring that their total income is below the taxable threshold, ensuring that they can receive the total interest amount without deductions.

What information must be reported on HSBC Form 15G?

HSBC Form 15G requires reporting of personal details such as the taxpayer's name, age, PAN, address, email, phone number, and details of interest income as well as a declaration regarding the total income and tax liabilities.

Fill out your HSBC Form 15G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

15g Form Uan is not the form you're looking for?Search for another form here.

Keywords relevant to form 15 filled sample

Related to 15g sample filled form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.