Get the free mi form 151

Get, Create, Make and Sign mi form 151

How to edit mi form 151 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mi form 151

How to fill out state of Michigan form:

Who needs state of Michigan form:

Video instructions and help with filling out and completing mi form 151

Instructions and Help about mi form 151

Here but it's not looking quite the same way I wish that this may be a ditz found its own formal sensibility of time because it is working or slightly different way right and the surfaces can be improved but still it's an intriguing system by tonight there's a lot of qualities that I'm doing I like pushing up the depth that you didn't or that I gave you a straight whose next John okay or make a heart attack what scheme said this starts to have some interest to it, but then it has these lines that did that just kind of like just brought around I don't really follow any the logic the rest of stuff let's go why don't know I don't know what I'm saying is that it doesn't feel like it belongs right these are kind of interesting but what they're you know a little chopped up from here it has so logic to it, but this cuts against that and this doesn't follow the sensibility here this is at least symmetrical and come to the side, and they're not symmetrical, but it's only that one piece, so it's a bit us trying to get like I've shot it is lacks formal logic is where it's going to be an active life right or maybe this is the better thing to have taken it and not done that at all this is kind of interesting, and it begins to time what's going on there so if you found a particular way in which this should work and force that logic through the remainder of the model then you got something we're seriously Yahoo music exactly

People Also Ask about

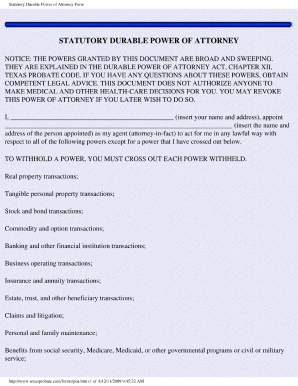

What is a power of attorney for state of Michigan income tax?

What is state of MI Form 151?

What is a special power of attorney in Michigan?

What is a POA for the state of Michigan?

What is power of attorney form Michigan 151?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mi form 151 directly from Gmail?

How can I edit mi form 151 on a smartphone?

How do I fill out mi form 151 on an Android device?

What is state of michigan form?

Who is required to file state of michigan form?

How to fill out state of michigan form?

What is the purpose of state of michigan form?

What information must be reported on state of michigan form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.