Get the free citibank direct deposit form

Fill out, sign, and share forms from a single PDF platform

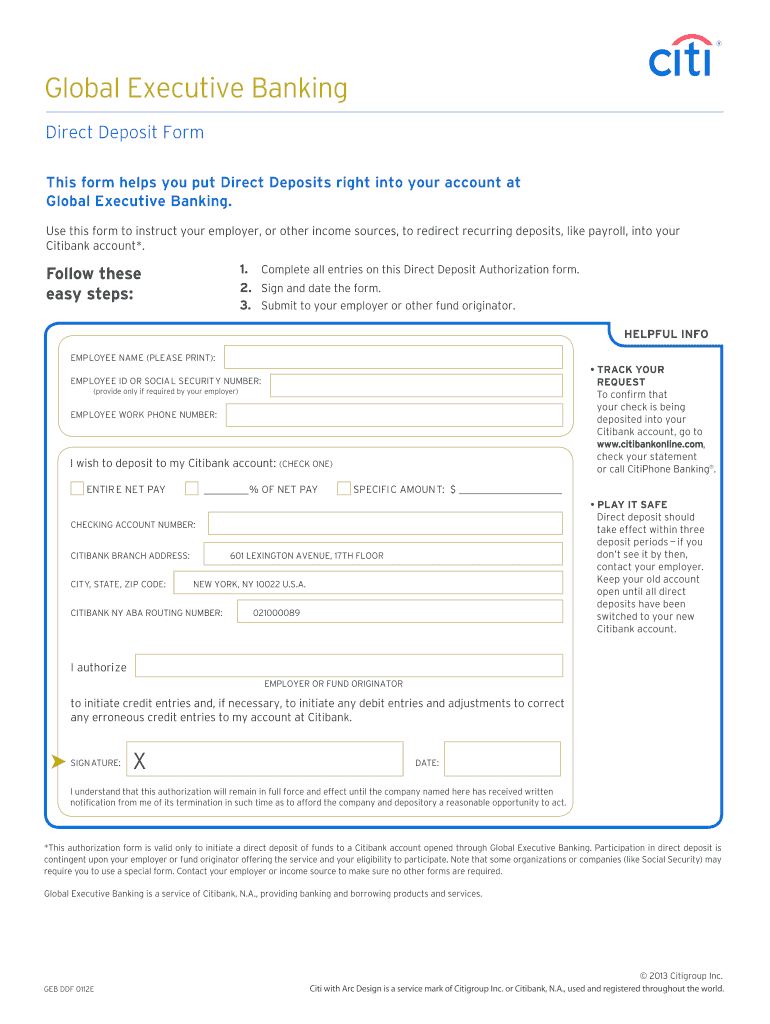

Edit and sign in one place

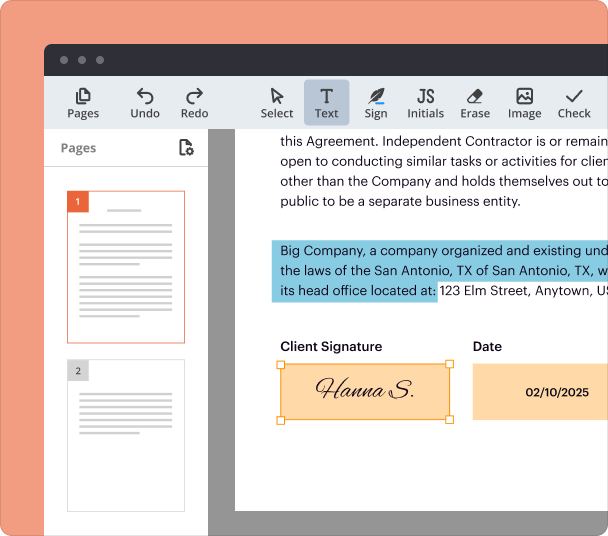

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive guide to completing the Citibank direct deposit form

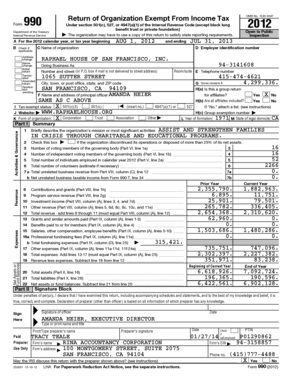

What is a Citibank direct deposit form?

A direct deposit is a convenient method for receiving payments electronically, allowing funds to be deposited directly into your bank account without the need for physical checks. Completing the Citibank direct deposit form specifically enables you to authorize your employer or other sources to deposit payments, such as salaries or benefits, automatically into your Citibank account. This ensures timely access to your funds and eliminates the risk of lost or delayed checks.

-

Enhanced security, faster transactions, and fewer trips to the bank make direct deposits a preferred choice for many individuals.

-

Using the specific Citibank form ensures compliance with the bank’s requirements, making the process smoother for both you and your employer.

-

Direct deposits streamline payroll processes, allowing employers to manage payments efficiently while ensuring employees receive their funds without delay.

How can access the Citibank direct deposit form?

The Citibank direct deposit form is easily accessible through online platforms, such as pdfFiller, which offers a user-friendly interface for finding and managing forms. By navigating to the site and utilizing search filters, you can quickly locate the direct deposit form tailored specifically for Citibank customers.

-

Go directly to the pdfFiller website and use the search bar to input 'Citibank direct deposit form' for easy access.

-

Utilize available filters to sort documents by category or form type, ensuring you find the right template swiftly.

-

pdfFiller allows you to fill out the form online, enhancing accessibility and convenience for users.

How do fill out the Citibank direct deposit form?

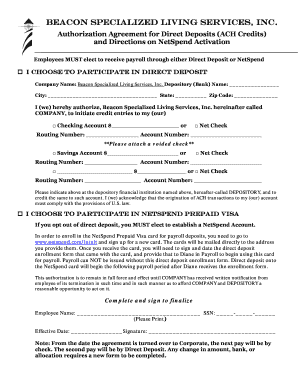

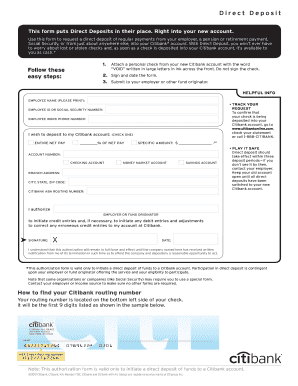

Filling out the Citibank direct deposit form requires careful attention to detail, as inaccuracies can lead to delayed payments. The form typically asks for essential information such as your name, employee ID or Social Security Number, and your work phone number. Additionally, you'll need to provide your checking account information, which includes the ABA routing number and your account number.

-

Start with personal details, then proceed to bank account information, ensuring that all entries are accurate to avoid processing issues.

-

Accurate identification, contact details, and banking information are crucial for correct direct deposit processing.

-

The ABA routing number identifies your bank in transactions; ensure that you obtain this information from your bank statement to avoid errors.

What deposit preferences should consider?

When filling out your Citibank direct deposit form, you'll have the option to select how your pay is deposited. You can choose to receive your full net pay or specify a certain amount to be deposited. It's essential to make this selection carefully, and it's wise to keep your old account open during this transition period to avoid any disruptions in your payment.

-

Opting for full net pay ensures that your entire salary is automatically deposited, maximizing your access to funds.

-

If you prefer to allocate funds or save a portion, specifying an amount can support budgeting practices.

-

Keep your previous account open until you confirm deposits are successfully processed in the new account, minimizing financial risks.

How do submit my direct deposit authorization?

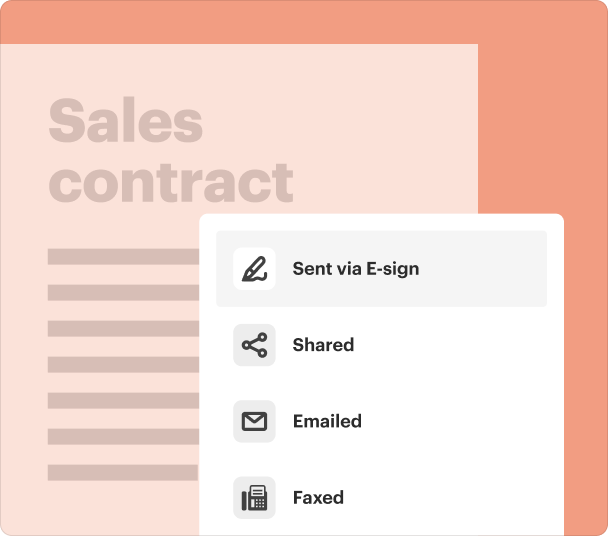

Submitting your completed Citibank direct deposit form is a straightforward process. Typically, after you fill out the form, you will submit it directly to your employer or the organization responsible for your payments. It's also advisable to follow up and confirm that your request has been received and processed.

-

Submit the completed form via email or in person, depending on your employer’s preferred method.

-

Request a confirmation once your form is submitted to ensure that it has been processed efficiently.

-

Typically, it can take one or two pay cycles for changes to reflect in your account, so patience is essential.

How can manage my direct deposit authorization?

Managing your direct deposit authorization is vital to ensure that your deposits continue without interruption. Understanding the validity period of your authorization will help you know when to update or modify your information. Additionally, if you decide to terminate your authorization, there are clear steps you must follow to ensure everything is done correctly.

-

Usually, the authorization remains valid until you decide to change it; however, it's essential to monitor for any required updates.

-

To terminate, complete a new authorization form indicating the change, or contact your HR department for assistance.

-

If deposits do not appear in your account, directly contact your employer’s payroll department for timely assistance.

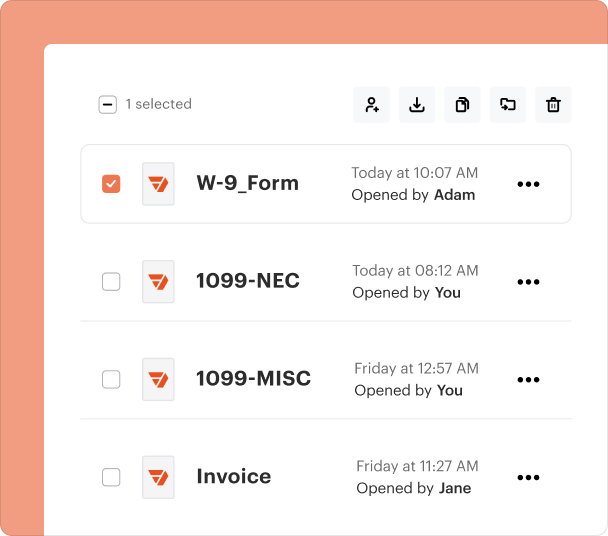

How does pdfFiller enhance document management?

Using pdfFiller for your Citibank direct deposit form provides robust document management capabilities, streamlining the entire process. The platform supports features such as e-signing, collaboration, and secure cloud storage, making it easy to manage your forms from any device. This ensures a smooth experience in filling out, editing, and managing your direct deposit authorization.

-

pdfFiller offers tools that simplify the completion of forms and allows easy access to all your documents from a centralized location.

-

Quickly eSign documents digitally, ensuring that submissions are both secure and legally binding.

-

Access your documents from any location, protecting your sensitive information while ensuring that you can work effectively.

Frequently Asked Questions about Citibank Direct Deposit Form

What details are needed to complete the Citibank direct deposit form?

To complete the form, you will need your personal details like your name and Social Security Number, as well as your checking account information including the ABA routing number.

Can I change my deposit amount later?

Yes, you can adjust your deposit amount in future submissions of the direct deposit form or by contacting your payroll department.

How long does it take for direct deposit to become active?

Typically, it takes one to two pay cycles for the changes to be reflected in your direct deposit after submission.

What should I do if my salary isn't deposited?

If your deposit does not appear on the expected date, contact your employer's payroll department immediately for assistance.

Is there a validity period for direct deposit authorizations?

While direct deposit authorizations generally remain active until changed or revoked, it's essential to keep track of any required updates, especially when changing banking information.

pdfFiller scores top ratings on review platforms