WI BenefitElect FSA & DCA Claim Reimbursement Form 2013-2025 free printable template

Show details

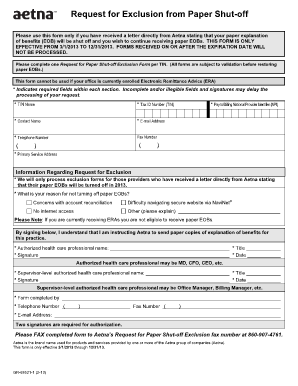

Com or call us at 800-257-0986 FSA DCA CLAIM REIMBURSEMENT FORM Not for FSA Debit Card Receipts FSA CLAIM REIMBURSEMENT REQUEST FORM - Receipts received with this form will be processed for reimbursement. Do not use this form for submitting FSA Debit Card Purchase Receipts - use the forms in your enrollment/confirmation kit or download those from the web. Employee Name Employee ID / SSN Daytime Phone Number Email Address Health Care Reimbursement...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI BenefitElect FSA DCA Claim Reimbursement

Edit your WI BenefitElect FSA DCA Claim Reimbursement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI BenefitElect FSA DCA Claim Reimbursement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI BenefitElect FSA DCA Claim Reimbursement online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WI BenefitElect FSA DCA Claim Reimbursement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out WI BenefitElect FSA DCA Claim Reimbursement

How to fill out WI BenefitElect FSA & DCA Claim Reimbursement

01

Gather all necessary documentation for your qualified expenses.

02

Obtain a WI BenefitElect FSA & DCA Claim Reimbursement form, available online or from your HR department.

03

Fill in your personal information, including your name, employee ID, and contact details.

04

Clearly list each expense, including the date, amount, and a brief description to ensure they meet eligibility requirements.

05

Attach copies of receipts or any supporting documents for the listed expenses.

06

Sign and date the form to certify the accuracy of the information provided.

07

Submit the completed form and documentation to the designated claims administrator via the specified submission method (mail or online portal).

08

Keep a copy of the submitted form and receipts for your records.

Who needs WI BenefitElect FSA & DCA Claim Reimbursement?

01

Employees who have enrolled in a Flexible Spending Account (FSA) or a Dependent Care Account (DCA) through WI BenefitElect.

02

Individuals who have incurred eligible medical, dental, or childcare expenses that can be reimbursed through their FSA or DCA.

03

Anyone seeking to reclaim funds for expenses that were paid out-of-pocket, utilizing their pre-tax contributions.

Fill

form

: Try Risk Free

People Also Ask about

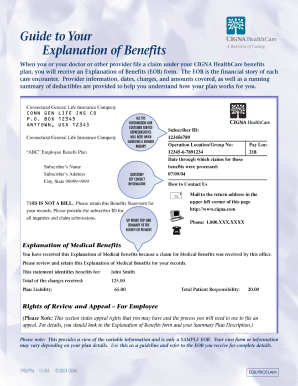

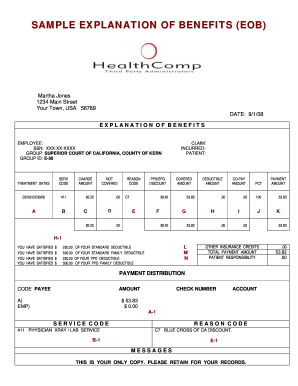

What is the difference between an EOB and a bill?

The key difference between an EOB and a health insurance bill is that an EOB form breaks down how much or what part of the service(s) are covered by insurance and what parts are not. A bill, on the other hand, shows how much each service costs, the overall amount, and what you still owe.

What is the purpose of an EOB?

You may receive an EOB from your health plan after your visit with the provider. It will show you the total charges for your visit and how much you and your health plan owe. An EOB is NOT A BILL. You can also use it to track how you and your family use your coverage.

What is an EOB from an insurance company?

Each time your insurer pays for a service you use, they send you an Explanation of Benefits (EOB). The EOB is your insurance company's written explanation for that claim, showing the name of the provider that covered the service and date(s) of service.

How do you read an EOB for dummies?

1:34 2:35 How to Read Your Medical EOB - YouTube YouTube Start of suggested clip End of suggested clip The amount you pay for the service this is the amount that you will be billed. Remember the EOB isMoreThe amount you pay for the service this is the amount that you will be billed. Remember the EOB is not a bill it just shows you how the costs are distributed. If you have any questions by your EOB.

How do you use EOB?

Additional workplace acronyms you can use EOB (end of business day): This is a combination of both COB and EOD and can represent the end of an employee's workday. It's also commonly used interchangeably with both of these acronyms.

How is EOB calculated?

The formula can be calculated a couple different ways. The first is: allowed+adjustment = billed charges. The second more detailed method is: payment+adjustment+patient responsibility = billed charges. Even a third method can be used: payment + patient responsibility = allowed amount.

How do you explain an EOB to a patient?

Your EOB is a list of the services you received. It shows you how expenses are divided between your doctor, your plan, and your copay, but it's not a bill. You don't need to send any payments or take any action. Your EOB makes it easy to keep track of the medical services you received and their costs.

How is an EOB generated?

The EOB is generated when your provider submits a claim for the services you received. The insurance company sends you EOBs to help make clear: The cost of the care you received. Any money you saved by visiting in-network providers.

How do you read EOB?

How to read your EOB Provider—The name of the doctor or specialist who provided the service. Service/Procedure—The type of service you received. Total Cost—The amount we pay for the service. Not Covered—The amount of the service not covered (this usually only occurs if the service is denied).

How do I read BCBS EOB?

How do I read an EOB? The name of the person who received services (you or a family member your plan covers) The claim number, group name and number, and patient ID. The doctor, hospital or other health care professional that provided services. Dates of services and the charges.

What is shown on an EOB?

You may receive an EOB from your health plan after your visit with the provider. It will show you the total charges for your visit and how much you and your health plan owe. An EOB is NOT A BILL. You can also use it to track how you and your family use your coverage.

What are the key areas to look at on an EOB?

Key Sections of an EOB Provider Information. This section includes the name of your health care provider (doctor, hospital, or other health care professional or service). Member Information. Provided Services and Charges. Plan Responsibility. Member Responsibility. Plan Status. Claim Notes.

What is a paper EOB?

EOB stands for Explanation of Benefits. This is a document we send you to let you know a claim has been processed. The most important thing for you to remember is an EOB is NOT a bill.

What is allowed amount in EOB?

5. Allowed Charges is the amount your provider will be paid; this may not be the same as the Provider Charges. You may receive an EOB from your health plan after your visit with the provider. It will show you the total charges for your visit and how much you and your health plan owe.

Can you read and understand an Explanation of Benefits EOB )?

An Explanation of Benefits (EOB) is a statement that your insurance company sends that summarizes the costs of health care services you received. An EOB shows how much your health care provider is charging your insurance company and how much you may be responsible for paying. This is not a bill.

What are three figures that are commonly depicted on an EOB?

An EOB typically describes: the payee, the payer and the patient.

What is an example of EOB?

It's calculated as a percentage of the allowed amount. For example: If your coinsurance is 20%, you'd pay $20 if the allowed amount is $100. A fixed amount (for example, $15) you pay for a covered health care service, usually when you get the service. The amount can vary by the type of covered service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WI BenefitElect FSA DCA Claim Reimbursement in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your WI BenefitElect FSA DCA Claim Reimbursement along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an eSignature for the WI BenefitElect FSA DCA Claim Reimbursement in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your WI BenefitElect FSA DCA Claim Reimbursement and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out WI BenefitElect FSA DCA Claim Reimbursement using my mobile device?

Use the pdfFiller mobile app to fill out and sign WI BenefitElect FSA DCA Claim Reimbursement on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is WI BenefitElect FSA & DCA Claim Reimbursement?

WI BenefitElect FSA & DCA Claim Reimbursement is a process that allows participants to claim reimbursement for qualified medical and dependent care expenses using funds set aside in a Flexible Spending Account (FSA) or Dependent Care Account (DCA).

Who is required to file WI BenefitElect FSA & DCA Claim Reimbursement?

Participants who have incurred eligible expenses and wish to use their FSA or DCA funds to receive reimbursement are required to file the WI BenefitElect FSA & DCA Claim Reimbursement.

How to fill out WI BenefitElect FSA & DCA Claim Reimbursement?

To fill out the WI BenefitElect FSA & DCA Claim Reimbursement, participants must complete the claim form by providing their personal information, detailing the expenses incurred, attaching any required receipts, and submitting the completed form to the designated reimbursements department.

What is the purpose of WI BenefitElect FSA & DCA Claim Reimbursement?

The purpose of WI BenefitElect FSA & DCA Claim Reimbursement is to enable participants to access their pre-tax funds to cover out-of-pocket medical expenses and dependent care costs, thus reducing their overall taxable income and maximizing savings.

What information must be reported on WI BenefitElect FSA & DCA Claim Reimbursement?

Participants must report the date of service, type of service, amount of expense, provider details, and attach corresponding receipts or documentation for each claim submitted on the WI BenefitElect FSA & DCA Claim Reimbursement.

Fill out your WI BenefitElect FSA DCA Claim Reimbursement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI BenefitElect FSA DCA Claim Reimbursement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.