Fidelity Investment Distribution Form free printable template

Show details

Your authority to sign this form must be on file with Fidelity. distribution is not required Step 6 and The amount of the distribution is over 100 000 OR Your address has changed within the last 15 days Place signature guarantee stamp in box. Taxable distributions to nonresident aliens are subject to 30 withholding unless a valid IRS Form W-8BEN is submitted to claim no withholding or a reduced rate of withholding on the distribution. State Income Taxes withheld. Fidelity will withhold state...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign contractors plan withdrawal form

Edit your contractors plan withdrawal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contractors plan withdrawal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing contractors plan withdrawal form online

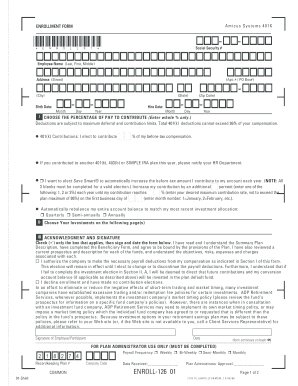

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit contractors plan withdrawal form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

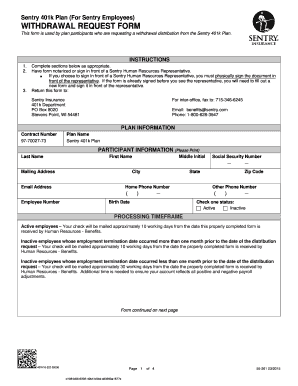

How to fill out contractors plan withdrawal form

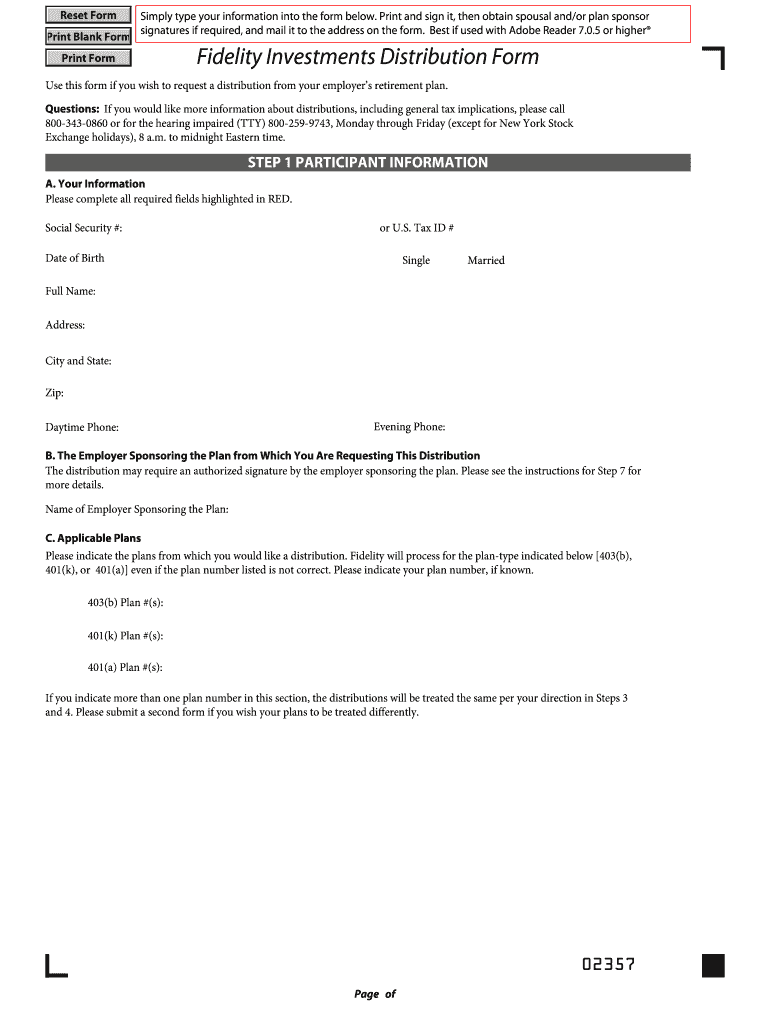

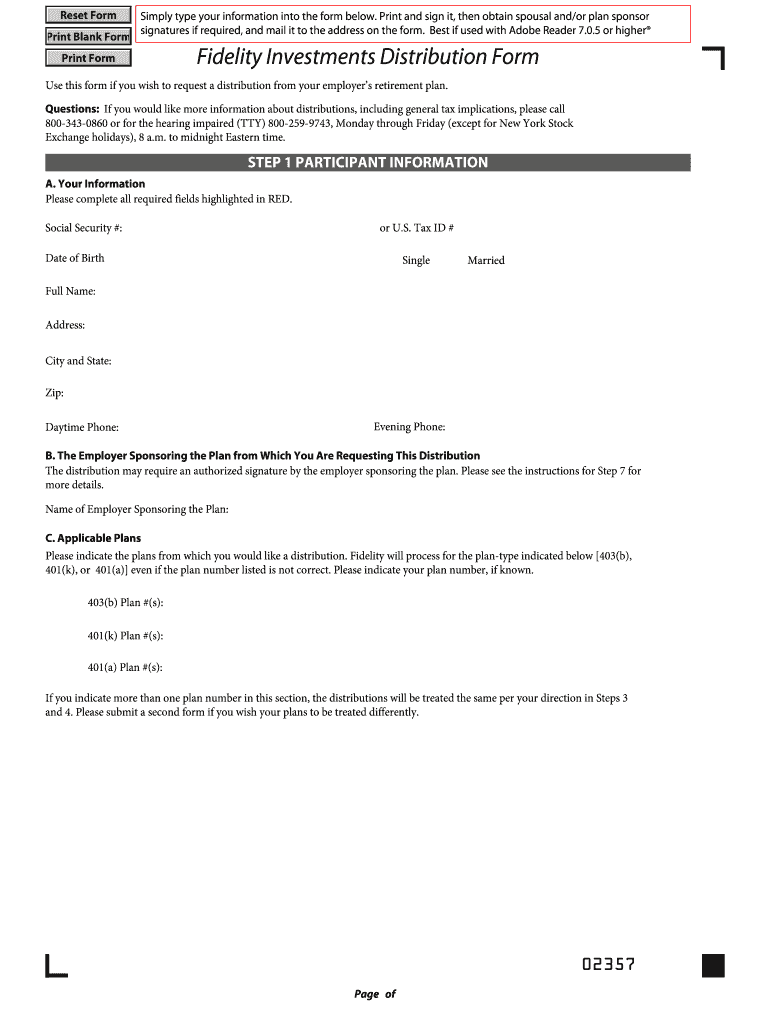

How to fill out Fidelity Investment Distribution Form

01

Obtain the Fidelity Investment Distribution Form from the Fidelity website or your financial advisor.

02

Provide your personal information, including your name, address, and account number, in the designated fields.

03

Specify the reason for the distribution, such as a withdrawal, transfer, or rollover.

04

Indicate the amount you wish to distribute or whether you want to take a specific percentage of your investments.

05

Choose your distribution method (e.g., check, direct deposit) and provide any necessary banking information if applicable.

06

Review your selections carefully for accuracy to avoid any mistakes.

07

Sign and date the form at the bottom to confirm your request.

08

Submit the completed form as per the instructions (mail, fax, or electronic submission).

Who needs Fidelity Investment Distribution Form?

01

Individuals looking to withdraw funds from their Fidelity investment accounts.

02

Account holders wanting to transfer investments from one account to another.

03

Clients who are rolling over retirement accounts to another financial institution.

04

Beneficiaries accessing funds from an inherited account.

Fill

form

: Try Risk Free

People Also Ask about

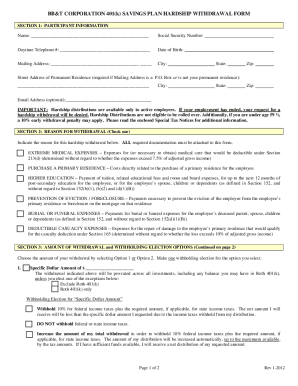

How do I withdraw money from my 401k?

By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

What are the penalties for withdrawing from 401k?

If you're under the age of 59½, you typically have to pay a 10% penalty on the amount withdrawn. The IRS does allow some exceptions to the penalty, including: Total and permanent disability.

Are retirement distributions considered earned income?

Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits. For tax years after 2003, members of the military who receive excludable combat zone compensation may elect to include it in earned income.

When can I start withdrawing from my 401k?

If you retire after age 59½, you can start taking withdrawals without paying an early withdrawal penalty. If you don't need to access your savings just yet, you can let them sit—though you won't be able to contribute.

Is 401k withdrawal considered earned income?

No, these types of income are not considered earned income on the Disability Earnings Survey Form RI 30-2.

Does 401k withdrawal count as adjusted gross income?

Traditional 401(k) contributions effectively reduce both adjusted gross income (AGI) and modified adjusted gross income (MAGI).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find contractors plan withdrawal form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the contractors plan withdrawal form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in contractors plan withdrawal form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing contractors plan withdrawal form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the contractors plan withdrawal form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign contractors plan withdrawal form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

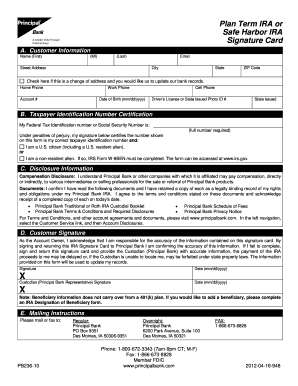

What is Fidelity Investment Distribution Form?

The Fidelity Investment Distribution Form is a document used to report distributions made from Fidelity investment accounts, including retirement accounts, to the Internal Revenue Service (IRS) and account holders.

Who is required to file Fidelity Investment Distribution Form?

Individuals or entities who receive distributions from their Fidelity investment accounts, such as retirement accounts or funds, are required to file the Fidelity Investment Distribution Form.

How to fill out Fidelity Investment Distribution Form?

To fill out the Fidelity Investment Distribution Form, you must provide details such as your personal information, account number, the amount of distribution received, and the type of account from which the distribution was made.

What is the purpose of Fidelity Investment Distribution Form?

The purpose of the Fidelity Investment Distribution Form is to ensure accurate reporting of investment income and distributions to the IRS and to provide necessary information to account holders for their tax filings.

What information must be reported on Fidelity Investment Distribution Form?

The information that must be reported includes the account holder's personal information, the type of distribution (e.g., lump sum, periodic), the amount distributed, and the tax withholding amount if applicable.

Fill out your contractors plan withdrawal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contractors Plan Withdrawal Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.