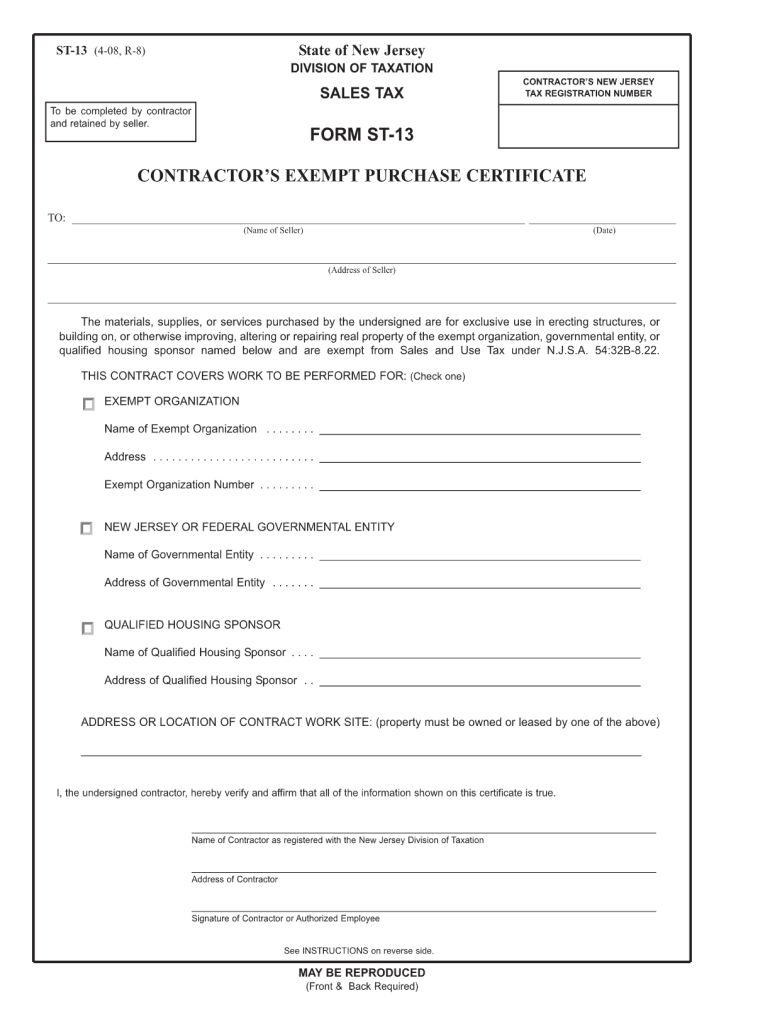

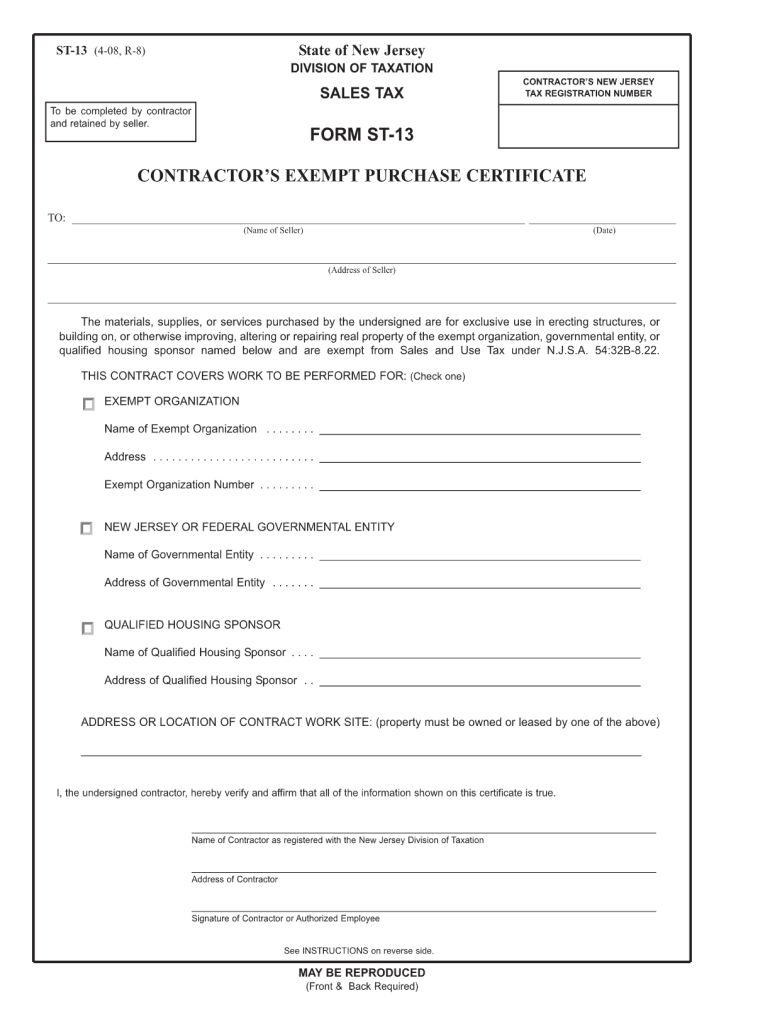

NJ ST-13 2008 free printable template

Get, Create, Make and Sign st13 form

How to edit nj st 13 form online

Uncompromising security for your PDF editing and eSignature needs

NJ ST-13 Form Versions

How to fill out form st 13

How to fill out NJ ST-13

Who needs NJ ST-13?

Video instructions and help with filling out and completing st 13

Instructions and Help about nj tax exempt form st 13

In New York State vendors must collect state and local sales tax on all taxable sales however certain organizations and businesses can make tax-free purchases by using an exemption certificate to claim an exemption for an otherwise taxable purchase the buyer must fill out the appropriate exemption certificate and give it to the seller within 90 days of the sale otherwise both the buyer and seller could be held liable for the sales tax the certificate must be completed properly and signed by an authorized representative of the party claiming the exemption a seller may only accept an exemption certificate in good faith meaning they have no reason to believe that the certificate is fraudulent however a seller has the right to refuse an exemption certificate even if it's correct and properly completed in that case the buyer must pay the sales tax and then apply for a refund from the tax department afterward once a tax-exempt sale is made the seller must keep the exemption certificate with their records for at least three years from the date they report the sale on their sales tax return the seller's records should also associate their certificate with the proof of sale like a register receipt or sale invoice meanwhile the buyer must ensure the purchase goods are actually used for tax-exempt purposes if they are not then the buyer must pay the sales tax due directly to the tax department it's important that both the buyer and seller exercise good judgement when using an exemption certificate the tax department may impose severe penalties on those who knowingly issuer except for all joint certificates and keep in mind that some products and services are always exempt from sales tax an exemption certificate is only needed for sales that are normally taxable to learn about the different kinds of exemption certificates and their requirements see our sales tax Boulton exemption certificates for sales tax available on our website at WWE

People Also Ask about fillable st13 for nj

How do I get a PA state tax certificate?

What is the tax exempt form in Massachusetts?

What is the tax exempt form for a church in Virginia?

How do I fill out a PA tax exemption certificate?

What is the tax exempt form for NYC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form st 13 contractor's exempt purchase certificate from Google Drive?

How do I make edits in st 13 2008 form without leaving Chrome?

How do I fill out st 13 2008 form using my mobile device?

What is NJ ST-13?

Who is required to file NJ ST-13?

How to fill out NJ ST-13?

What is the purpose of NJ ST-13?

What information must be reported on NJ ST-13?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.