Get the free Alternative Student Loan Borrowing Options

Show details

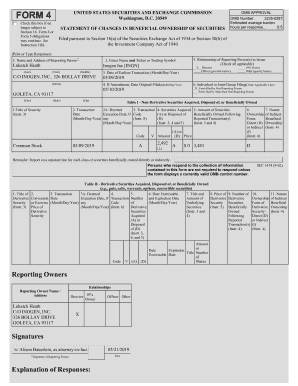

This document provides information on alternative student loan options available to students at Minnesota State University, including details about the Federal PLUS Loan, the SELF Loan, and other

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alternative student loan borrowing

Edit your alternative student loan borrowing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alternative student loan borrowing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alternative student loan borrowing online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit alternative student loan borrowing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alternative student loan borrowing

How to fill out Alternative Student Loan Borrowing Options

01

Research and compare different alternative student loan lenders.

02

Gather necessary financial documents, including income information and credit history.

03

Determine the amount you need to borrow based on your education expenses.

04

Check eligibility requirements for each lender, including minimum credit score and income criteria.

05

Complete the application form provided by your chosen lender, ensuring all information is accurate.

06

Submit any required documentation for verification.

07

Review loan terms and conditions, including interest rates, repayment options, and any fees.

08

Accept the loan offer if it meets your needs and sign the loan agreement.

09

Keep records of the loan details and payment schedules.

Who needs Alternative Student Loan Borrowing Options?

01

Students who have exhausted federal financial aid options.

02

Those who need additional funds to cover the cost of education.

03

Students attending private colleges or graduate programs where costs are high.

04

Borrowers with a good credit score looking for better interest rates.

05

Those who do not qualify for federal student loans due to financial circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is a student alternative loan?

Private Education Loans, also known as Alternative Education Loans, help bridge the gap between the actual cost of your education and the limited amount the government allows you to borrow in its programs. Private loans are offered by private lenders and there are no federal forms to complete.

Do parents who make $120000 still qualify for FAFSA?

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens for the following school year.

How much is a $30,000 student loan per month?

Federal student loans are issued by the federal government and offer benefits such as fixed interest rates and income-driven and flexible payment plans. There are four types of federal student loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans and Direct Consolidation Loans.

What are alternative student loans?

Private Education Loans, also known as Alternative Education Loans, help bridge the gap between the actual cost of your education and the limited amount the government allows you to borrow in its programs. Private loans are offered by private lenders and there are no federal forms to complete.

How much is a $30,000 student loan per month?

How much is a $30,000 student loan per month? Interest rateRepayment termMonthly payment 6.53% 25 years $203 9.08% 10 years $381 9.08% 25 years $253 15.00% 5 years $7142 more rows • Feb 20, 2025

What is the 7 year rule for student loans?

Both federal and private student loans fall off your credit report about seven years after your last payment or date of default. Student loans default after nine months of nonpayment for federal student loans, and you're not in deferment or forbearance.

What are the 3 types of student loans?

Types of student loan borrowing options Direct Subsidized Loans are based on financial need. Direct Unsubsidized Loans are not based on financial need. They're not credit-based, so you don't need a cosigner. Direct PLUS Loans are credit-based, unsubsidized federal loans for parents and graduate/professional students.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Alternative Student Loan Borrowing Options?

Alternative Student Loan Borrowing Options refer to non-federal loans that students can obtain to help cover educational expenses. These loans typically come from private lenders and may have varying terms, interest rates, and repayment options.

Who is required to file Alternative Student Loan Borrowing Options?

Students who wish to borrow money through private lenders for education-related expenses may need to file for Alternative Student Loan options. This typically includes undergraduate and graduate students who do not have sufficient funding through federal student loans.

How to fill out Alternative Student Loan Borrowing Options?

To fill out Alternative Student Loan Borrowing Options, students should gather necessary documentation, compare lenders, complete the application provided by the selected lender, and provide required financial information for credit evaluation.

What is the purpose of Alternative Student Loan Borrowing Options?

The purpose of Alternative Student Loan Borrowing Options is to provide additional financial resources for students who need funding beyond what federal student loans can offer, covering tuition, fees, and other educational expenses.

What information must be reported on Alternative Student Loan Borrowing Options?

Information that must be reported includes personal identification details, income and financial status, the school attended, the amount of loan being requested, and any other financial aid received.

Fill out your alternative student loan borrowing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alternative Student Loan Borrowing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.