Get the free ohio resale certificate

Show details

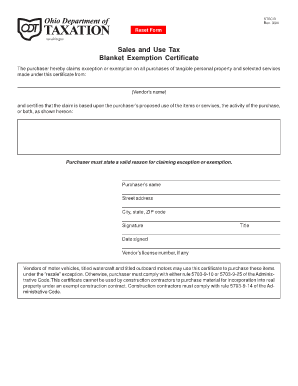

STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from vendor s name and certifies that the claim is based upon the purchaser s proposed use of the items or services the activity of the purchaser or both as shown hereon OHIO UNIVERSITY PURCHASES ARE EXEMPT FROM SALES TAX BASED ON THE EXEMPTION FOUND IN SECTION...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ohio sales tax exemption form

Edit your ohio sales and use tax blanket exemption certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales tax exemption certificate ohio form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ohio tax exemption certificate online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit resale certificate ohio form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ohio sales tax exempt form

How to fill out Ohio State Resale Certificate:

01

Obtain a copy of the Ohio State Resale Certificate form. This can typically be found on the website of the Ohio Department of Taxation.

02

Fill out the top section of the form with your business information, including your business name, address, and taxpayer ID number.

03

Indicate the period being covered by the resale certificate, such as a specific date range or an ongoing period.

04

Provide a detailed description of the type of tangible personal property or services that you will be purchasing for resale. This should include specific information about the products or services being sold.

05

Sign and date the form, certifying that the information provided is accurate and that the items purchased will be resold.

06

Keep a copy of the completed resale certificate for your records.

Who needs Ohio State Resale Certificate:

01

Individuals or businesses engaged in the sale of tangible personal property in Ohio generally need a resale certificate.

02

Wholesalers, retailers, and resellers who purchase products for the purpose of resale are required to have a valid resale certificate on file.

03

It is important for businesses to have a resale certificate as it allows them to make tax-free purchases of items that will be resold, thus avoiding double taxation.

Fill

ohio sales tax exemption certificate

: Try Risk Free

People Also Ask about ohio resale certificate example

What qualifies for sales tax exemption Ohio?

Physical fitness facility service. Recreation and sports club service. Repair of tangible personal property (except repair of property which is exempt from sales tax). Installation of tangible personal property (except installation of property which is exempt from sales tax).

Does Ohio require a resale certificate?

Ohio does not require registration with the state for a resale certificate.

What is Ohio sales tax resale exemption certificate?

Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate Tax Commission as a valid exemption certificate. By its terms, this certificate may be used only for claiming an exemption based on resale or on the incorporation of the item purchased into a product for sale.

How do I get a resale certificate?

But how do you get a resale certificate? You can apply for a resale certificate through your state's tax department. Be sure to apply to the state tax department in the state you physically have an address—not the state in which you are incorporated, if it's different.

How do I get a resale certificate in Ohio?

Ohio does not require registration with the state for a resale certificate. How can you get a resale certificate in Ohio? To get a resale certificate in Ohio, you will need to fill out the Sales and Use Blanket Exemption Certificate (Form STEC B).

Do Ohio resale certificates expire?

Ohio Resale Certificates do not expire.

What is the resale tax in Ohio?

The state sales and use tax rate is 5.75 percent. Counties and regional transit authorities may levy additional sales and use taxes. For more information about the sales and use tax, look at the options below. Registration — Ohio law requires any person or business making taxable retail sales to first obtain a license.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ohio resale certificate pdf straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing sales and use tax blanket exemption certificate ohio right away.

How do I fill out the ohio blanket exemption certificate form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ohio resale tax certificate and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit ohio state sales tax exemption form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as resale certificate. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Ohio resale certificate?

An Ohio resale certificate is a document that allows a buyer to purchase goods without paying sales tax, provided those goods are intended for resale.

Who is required to file Ohio resale certificate?

Any business or individual in Ohio that purchases goods for the purpose of resale is required to file an Ohio resale certificate.

How to fill out Ohio resale certificate?

To fill out an Ohio resale certificate, provide your business name, address, and tax identification number, along with a description of the property being purchased and a declaration that the items are for resale.

What is the purpose of Ohio resale certificate?

The purpose of the Ohio resale certificate is to facilitate the resale of goods without the burden of sales tax, ensuring that tax is collected only when the final consumer purchases the goods.

What information must be reported on Ohio resale certificate?

The information that must be reported on an Ohio resale certificate includes the buyer's name and address, seller's name, the nature of the business, a description of the property being purchased, and the buyer’s sales tax identification number.

Fill out your ohio resale certificate form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio Exemption Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to blanket certificate of exemption ohio

Related to state of ohio resale certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.