FL DOL 173-2 2011 free printable template

Show details

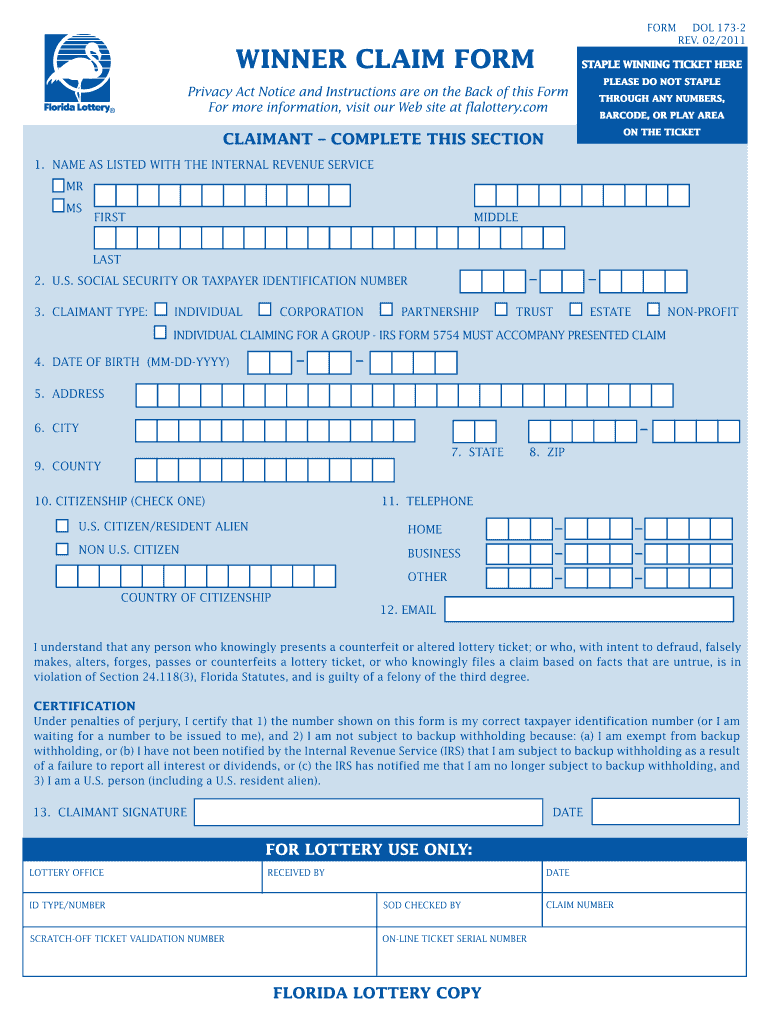

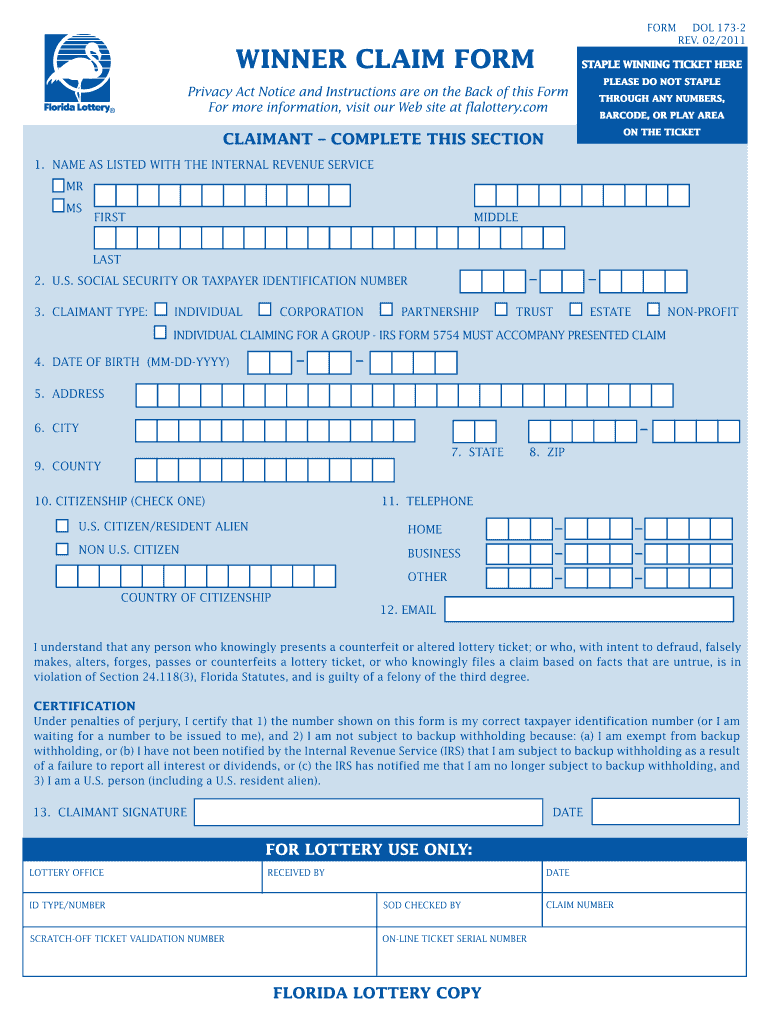

EMAIL I understand that any person who knowingly presents a counterfeit or altered lottery ticket or who with intent to defraud falsely makes alters forges passes or counterfeits a lottery ticket or who knowingly files a claim based on facts that are untrue is in violation of Section 24. 118 3 Florida Statutes and is guilty of a felony of the third degree. CERTIFICATION Under penalties of perjury I certify that 1 the number shown on this form is my correct taxpayer identification number or I...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DOL 173-2

Edit your FL DOL 173-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DOL 173-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DOL 173-2 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL DOL 173-2. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DOL 173-2 Form Versions

Version

Form Popularity

Fillable & printabley

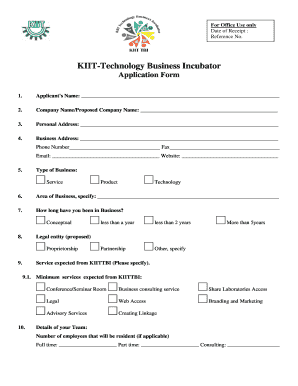

How to fill out FL DOL 173-2

How to fill out FL DOL 173-2

01

Obtain the FL DOL 173-2 form from the Florida Department of Labor website or your local office.

02

Fill out the applicant's personal information in the designated sections, including name, address, and contact information.

03

Provide the details of the job or position for which you are applying.

04

Complete any sections related to your qualifications and experience pertinent to the job.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form to certify that all information is true and correct.

07

Submit the form according to the instructions provided, either online, by mail, or in person.

Who needs FL DOL 173-2?

01

Individuals applying for a job within certain sectors in Florida.

02

Employers needing to verify applicant qualifications.

03

Entities requiring documentation for employment verification processes.

Fill

form

: Try Risk Free

People Also Ask about

What is the first thing you should do if you win lottery?

0:43 1:58 If you win the Mega Millions lottery, here are the first 2 things -

YouTube YouTube Start of suggested clip End of suggested clip You have one year before your winning ticket expires. I also recommend that you contact an attorneyMoreYou have one year before your winning ticket expires. I also recommend that you contact an attorney because an attorney may help you a financial advisor. Definitely will help you.

How do I file a claim for the Florida Lottery?

Prizes of $1 million and above and all prizes with an annual payment option can be claimed in-person via walk-in or appointment at Lottery Headquarters. Prizes of $600 – $1,000,000 for games that do not offer an annual payment option can be claimed in-person via walk-in or appointment at any Lottery district office.

How do I get a Florida Lottery claim form?

There are several ways to obtain one of these forms: Download and print from one of the below links: Visit any Florida Lottery district office and ask for a Claim Form. Visit any authorized Florida Lottery retailer and ask for a Claim Form.

How much tax do you pay on a $5000 lottery ticket in Florida?

What percentage in taxes will the Lottery withhold from my prize? The Internal Revenue Service requires that the Florida Lottery withhold 24 percent federal withholding tax from prizes greater than $5,000 if the winner is a citizen or resident alien of the U.S. with a Social Security number.

How do I claim a winning lottery ticket in Florida?

To claim your prize by mail, simply mail the ticket(s), along with a Winner Claim Form (for prizes valued at $600 or more), and the documentation listed under the "Required Documentation" section. Tickets mailed to Florida Lottery Headquarters or district offices are processed in approximately 30 – 45 days*.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send FL DOL 173-2 for eSignature?

Once you are ready to share your FL DOL 173-2, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the FL DOL 173-2 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your FL DOL 173-2 in minutes.

Can I create an eSignature for the FL DOL 173-2 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your FL DOL 173-2 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is FL DOL 173-2?

FL DOL 173-2 is a form utilized by the Florida Department of Labor for the reporting of specific employment-related data, primarily in the context of unemployment compensation.

Who is required to file FL DOL 173-2?

Employers in Florida who are subject to state unemployment tax laws and have employees are required to file FL DOL 173-2.

How to fill out FL DOL 173-2?

To fill out FL DOL 173-2, employers must provide details such as their business information, employee counts, and any other requested financial information related to unemployment claims.

What is the purpose of FL DOL 173-2?

The purpose of FL DOL 173-2 is to collect data that helps the Florida Department of Labor administer unemployment compensation programs and to ensure compliance with state labor laws.

What information must be reported on FL DOL 173-2?

Information that must be reported on FL DOL 173-2 includes the employer's identification details, the number of employees, wages paid, and any claims for unemployment compensation.

Fill out your FL DOL 173-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DOL 173-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.